How to Invest in Self-Storage Units for Maximum Profit

There are many options when it comes to where to invest your money. Your job is to find an investment possibility that is in high demand, has low expenses, and has a positive future. Sometimes, the answer to the best investment may be correct in front of you.

Very few investments act as inflation hedges and also provide growth. Real estate is one of the few income-producing assets. There are many ways to make money investing in real estate, but most people don’t think about storage units. Take a look at why you should consider investing in self-storage units!

Storage units are a great way to make money, and they are becoming increasingly popular as more and more people look for ways to store their belongings. We will discuss how to invest in self-storage units and provide tips on getting started.

What Is a Self-Storage Unit?

First, let’s answer the most obvious question: What is a self-storage unit? What sort of investment options do they come in? What is the best way for you to invest in these storage spaces?

As the name implies, self-storage facilities allow individuals to store goods they purchase or use. There are many types of self-storage facilities, each with its positives and negatives.

At their core, these storage facilities all have a variety of factors in common. They are warehouse-like structures with various storage units for individuals or businesses to use. These units usually come in different sizes and with additional options or potential amenities. Individuals can use a self-storage site to keep their stuff, then access it whenever possible.

Self-storage facilities are usually expected to provide on-demand access to a customer’s goods. It means that they must be 24/7 operations, and storage companies must be prepared to leave customers with automated access. Storage companies are usually expected to offer a variety of other amenities, including:

- Climate-controlled storage lets users know they can leave their goods in a place where they will not be exposed to outside elements and won’t overheat or freeze.

- Sophisticated technology systems that ensure someone can access their goods at a time of their choosing

- 24/7 security, protecting someone’s possessions from potential theft or vandalism.

- Insurance offerings, thus protecting users from accidental damage or theft if something does happen to the facility.

Storage facilities often offer a variety of other amenities, depending on the specific type of storage they offer. It includes:

- Drive-up storage: This storage allows individuals to drive up to their unit, open their trunk, and load their storage. It is a little different than many other storage facilities, which may have a loading dock and require individuals to march through winding hallways to reach their storage facilities.

- Business storage: Many businesses have specific storage needs. These often involve selling larger units that allow companies to store their things. Marketing, payment options, and other business specifics are usually skewed towards businesses.

- Specialty storage: Many specialty storage facilities are available, like boat storage. These facilities are usually constructed to allow for the loading of difficult-to-store or unload items.

- Climate-controlled storage: Investors who dabble in collectibles prefer climate-controlled storage for art investments. And here we are talking about physical collectibles and not NFTs.

Of course, this isn’t a comprehensive list of storage units that may be available for investment or creation.

For example, the shift to work-from-home environments has resulted in many businesses needing smaller spaces – often no bigger than a couple of closets – that can be used to store office equipment or client goods.

Amazon and UPS are getting in on this market, opening lockers in grocery stores and drug stores that allow for easy customer pick-up. Many businesses are also beginning to explore this model.

It creates entirely new spaces within the self-storage market, thus allowing for savvy and engaged investors to find new opportunities and ways to jump on this market. The self-storage market may not sound like a place where innovation can thrive, but making that assumption is likely to be a foolish one on your part. There are opportunities for passive investors who want to be engaged here.

Still, individuals who pay attention to industry trends and are willing to take chances on new and needed investments can potentially turn a serious profit by simply being aware of the current business climate. Like all other industries, the self-storage one is constantly changing. If you pay attention, you can profit.

What Is the Self-Storage Market Like?

Self-storage investments have become very popular as a direct result of the rise in the need for self storage. Think about it: Americans have never had more stuff. As the number of physical items Americans have expands, their need to find somewhere to put these things explodes. As a result, the self-storage industry is seeing significant expansions.

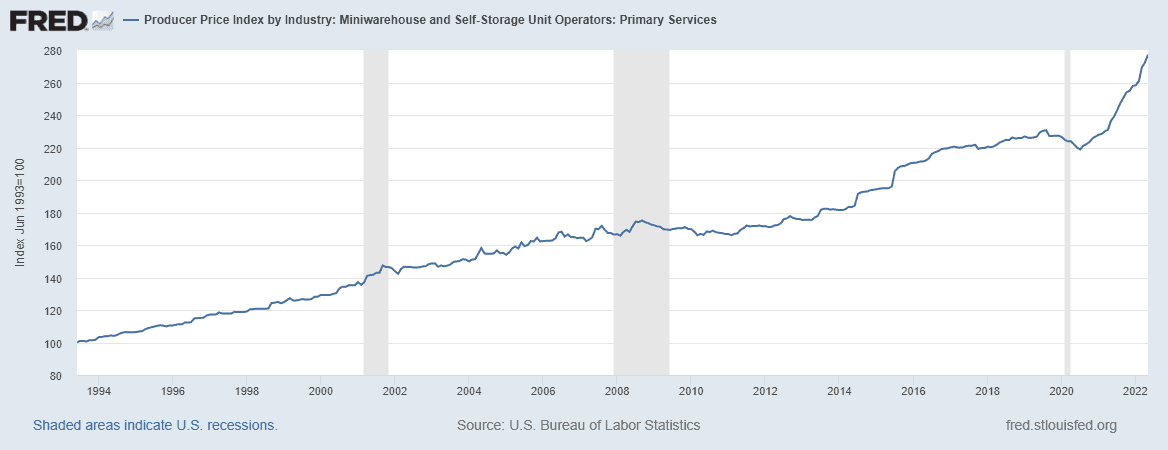

The St. Louis Federal Reserve tracks the PPI for Mini-warehouses and Self-Storage Unit Operators. The graph shows a steady increase in the self-storage asset class.

These statements are confirmed by various studies and reports about the self-storage asset class. Some valuations note that the self-storage market is currently valued at around $50 billion, with expected growth to hit 5.45% every year for the next five years.

It begs the question: Why is the market growing so much? And what does that mean for real estate investments?

First, the model is easily replicable. Everyone needs storage. Everyone has stuff. As a result of the increasing amount of things that people have, the storage business continues to expand.

The growth of the storage model is also primarily due to the pandemic. Think about the sheer number of people who moved, closed businesses, or were forced to reevaluate how they lived or did business as a result of the pandemic. The changes that the pandemic wreaked directly impacted where people put their things. Millions moved or closed businesses, and in many cases, these moves were exceptionally swift, meaning that people didn’t have time to dispose of their stuff correctly. As a result, they needed to store it somewhere, which helped boost the entire storage industry.

While the initial impacts of the pandemic may be over, the long-term consequences of remote work on real estate remain. It means that people have permanently left their offices and are now working from home – specifically, from a home that may not have the storage space needed to adjust to the post-office world. Again, this means that their stuff has to go somewhere and that “somewhere” is often a storage facility.

The lack of office space for many also means they don’t have anywhere to put their business stuff permanently. If this work-from-home atmosphere is genuinely there to stay, people will keep their things in storage more often as they look for a place to off-load them.

The churning real estate market has also driven a demand for these facilities. After all, the United States is currently undergoing a notable housing shortage. It means that people are looking to move but can’t yet. Accordingly, they may have homes that are partially packed, or they may simply have too many things to keep safe in their homes. The result? Self-storage.

Finally, consider this: Self-storage is an industry largely driven by individuals who don’t need much assistance with storing their things. There was a time in America when customers would have expected more service. Individuals would have expected others at a business to help them load and unload their things.

A crucial part of the self-storage industry is the word self. Americans are getting more and more used to self-service. We do self-service at restaurants, grocery stores, big-box stores, and much more.

As a result, people are more willing than ever to engage in tasks on their own that previously would not have even been considered. It unquestionably applies to the self-storage industry, in which people manage their own storage needs at a time and place of their choosing. All of this helps create a more economically viable market.

What Makes Self-Storage Facilities an Attractive Investment?

Although there are several real estate investment risks, the simple truth is that self-storage facilities are a desirable investment for various reasons.

Low Expenses

First, expenses are low. Costs in creating a self-storage business can be higher: You need to acquire the land, make renovations to a building, ensure that the security and climate control systems are adequate, and make sure that you are complying with all relevant laws.

However, from there, expenses decline. In most businesses, the staff is the most significant expense. In a self-storage facility, that isn’t the case.

After all, they are called “self-storage” for a reason. The self-storage sector is known for its low staff costs. These facilities also typically have relatively low maintenance costs and a business model that most real estate investors already understand. It keeps expenses to a minimum and costs largely confined to improvements to your building.

Cash Flow

Second, self-storage facilities tend to have excellent cash flow and one of the few investments that pay monthly. When you examine the business model of the self-storage sector, you’ll find that this makes sense.

The typical self-storage facility has relatively predictable costs but also has solid revenue in the form of customers who pay monthly to use a self-storage facility to keep their stuff in a secured and climate-controlled space.

As a result, you get a solid income stream from owning your facility, leading to a high net operating income. Of course, there are various considerations to keep in mind, including the price of commercial real estate. If the local market supports a typical storage facility, you can absolutely do this.

Proven Model

Self-storage facilities are also a solid and relatable model. As noted above, the need for self-storage space continues to climb. As a result, self-storage financing for entrepreneurs is relatively easy to obtain. The real estate market is familiar with these businesses, understands their need, and has ample examples of well-performing storage units. As a result, individuals who want to open a new self-storage unit should be able to find them.

Storage facilities also make attractive investments among investors who want to invest in other asset classes that may be non-traditional. After all, as noted above, storage facilities are unique and an essential part of the current real estate market. There is also a constant demand for boat or vehicle storage that can fill desperately needed commercial niches. As such, mixed-use storage makes an attractive investment.

Recession-Proof

Self-storage facilities are also regarded as at least somewhat immune to a recession. For some industries, there are significant challenges when recessions hit, as people pull back on their spending and are less willing to engage in more discretionary expenditures.

It is not the case with self-storage units. After all, no matter what the economy is like, people will still have stuff. Indeed, if a recession is severe enough, the self-storage industry may improve, as people vacate their houses and still need to store their things.

You can use value add real estate strategies to create additional income streams.

Growing Demand

Finally, there is a need for more storage facilities. Operating businesses, individuals, and the wealthy have a constant need to store household goods, cars, and more. As far as real estate investment goes, storage spaces are fantastic and reliable investment methods, making them very attractive.

Many self-storage owners also find the benefits of owning a storage space, so they upgrade their storage options. It creates a built-in customer base that goes through regular churn within the self-storage world, and most self-storage facilities make it easy to upgrade and upsell their customers. It creates a built-in customer base that needs more, which helps the model’s overall viability.

Scalable

Furthermore, the franchise model and experience gained in operating self-storage units make it very easy to open multiple units. Commercial buildings are often easily converted into self-storage facilities, so there is a built-in creation method for turning businesses into self-storage units. With enough experience one can raise capital for real estate investments like building self-storage facilities using real estate syndication.

Passive

While there are several methods to invest in real estate, only a few like self storage can be considered as real estate passive income. Customers in your self storage investment are not complaining about toilets and plumbing in the middle of the night.

Long Distance

Long distance real estate investing is also easier with self-storage. Demands from customers is relatively less urgent compared to renters living in a property. Maintenance requests are infrequent since the netire model is based on self-service.

How Can I Invest in a Self-Storage Business?

When it comes to self-storage investment, you have many options. Indeed, if you want to invest in self-storage, you are not confined to traditional investment vehicles. A self-storage investor will have to take the time to determine how exactly they want to make a self-storage investment and what real estate investment fits their needs best.

Existing Facility

First, you can try to invest in an existing self-storage facility. An existing facility will have many advantages. The storage center in question will likely have established customers, a built facility, an understanding of how economic and physical occupancy laws work, and a solid record of success when it comes to storage centers.

You’ll have to do your homework before investing in such a facility. More to the point, you’ll need to ensure that the storage center requires an investment. Why would they want your money? What are they looking to do with it? Are they looking to make improvements to their facility? Buy other commercial spaces and expand? Spend money on marketing or hire more staff? Increase their total rental space? Remember, these are vitally important considerations, and you should ensure you fully understand why the center in question wants to get bigger.

Convert Facility

Of course, self-storage investing does not have to be confined to already existing businesses. You can always invest in a new storage facility by converting existing infrastructure to suit storage investing. In this instance, your investment would likely go to substantial business start-up costs, like making a down payment, buying commercial real estate space, purchasing the very sophisticated technology systems needed to run a modern self-storage facility, hiring staff, or much more. In this instance, your investment may be vitally important, mainly for something as fundamental as making a down payment or asset improvement.

Build New Facility

You can also create your own self storage facility. Of course, this is the most time-consuming of all investment methods, but if it goes right, it may be the most lucrative. In this instance, you have multiple potential options. You can create your self-storage facility with your name and marketing, or you can invest in any number of self-storage franchises on the market today.

Franchises have many advantages, including built-in systems, guidebooks on how to open, and access to the technology necessary to create your business. Of course, they also have serious drawbacks: You’ll have to make regular payments to the franchise in question, and if you have a conflict, you risk losing the entire business.

Do your homework and investigate what options work best for you. You may also want to consider relying on expert market analysis within the franchise space to determine if a self-storage investment is appropriate for you.

What Alternative Methods Exist for Self Storage Investing?

As you can now likely tell, there is a slew of options for investing in the self-storage industry. Fortunately for you, you can invest in the self-storage industry without ever having to have any advanced understanding of this industry or needing to create your own self-storage business. Indeed, for many self-storage investors, it is the potential breadth of opportunities that make this industry a truly attractive one.

Investing in Self-Storage Stocks

Many publicly traded investments allow individuals to invest in a self-storage facility. These companies are on the stock market and open for investment. They include CubeSmart, Public Storage, and Extra Space Storage. These companies – and many more – are on the stock market and performing relatively well of late. Given that the industry tends to do relatively well, it may make a very sound investment for your portfolio.

Investing in Storage REITs

Furthermore, remember, self-storage buildings are forms of real estate. It means that many Self Storage Real Estate Investment Trusts (REITs) may be open for investment. A REIT is a specific kind of stock that owns and operates real estate across a particular location, asset class, or more. REITs allow you to invest in storage facilities.

REITs are legally required to turn most of their profits back to stockholders as dividends. It means that you have a chance to invest in self-storage facilities and get a healthy cash flow from the dividends.

In this regard, a storage-focused real estate investment trust can be ideal: It can provide a solid and reliable dividend, even in a market where interest rates will continue to rise. As such, you may want to investigate finding a self-storage REIT which can fit your needs and match your overall portfolio objective.

Just remember: All self-storage REITs are not the same. Some focus on specific regions, while others may focus on specialty storage facilities, like boat storage or vehicle storage. Keep an eye on these specifics before investing in a self-storage site.

Since individual self-storage stocks and REITs are publicly traded on exchanges, one can purchase them using brokerage accounts.

M1Finance provides the ability to invest using dollar-cost averaging. You can read my M1Finance Review and why I prefer using them compared to the larger brokerages.

Crowdfunding

Furthermore, a REIT is not necessary when breaking into the self-storage business. Statistics show that as many as 70% of the self-storage units are “mom and pop” small businesses with no affiliation with national chains or franchises.

In many cases, these are ideal opportunities for investment: These individuals may have trouble accessing the traditional financial market and may need to rely on direct investment or peer-to-peer lending. These types of investment opportunities can be more challenging to find. As such, you will have to pay attention to local news, investor conferences, and the internet. It is an example of where being an active and engaged financial investor can pay off big time.

Real estate crowdfunding platforms permit one to dabble in self storage investments by selecting the appropriate investment. However, since you are selecting a particular investment, such opportunities are only for individuals meeting the accredited investor qualifications. PeerStreet, EquityMultiple and CrowdStreet are some of the platforms one could sign-up and search for the self storage investing projects.

Your Garage or Driveway

Unused space in your garage or driveway can be turned into an asset. Unlike short term rentals or house hacking, you do not need to deal with people in your living space.

Sign up for Neighbor and get paid to store things. You can earn $100-$400 per month as passive income with unused space. You get to pick WHO, WHAT, and WHEN things are stored. And the platform comes with $1,000,000 host liability protection.

You list your space for free, review renter request (including what and when they want to store) and approve as per your criteria.

Garage, RV pad, closet, empty lot, shed, basement can all be listed as available rental space.

What Financial Metrics Should I Look For?

While there is unquestionably no shortage of possibilities for how to invest your money, that doesn’t mean that you can afford just to spend it wherever. Instead, it would help if you kept an eye on various financial metrics before investing.

Net Operating Income

First, make sure to inquire about the net operating income of any self-storage facility. It means how much money they make after all expenses are factored in. While the self-storage market is typically robust, that doesn’t mean that all self-storage units are doing the same in terms of their cash flow, expense ratio, and occupancy rates. Savvy self-storage investors know that net operating income is the most critical metric they can track.

Cash Flow

Cash flow is another vitally important metric. Suppose a self-storage facility has the right model. In that case, it will have a healthy cash flow that ensures they are constantly generating enough cash to invest its money in its business, pay expenses, and ensure that they are continually upgrading its facility to recruit new customers. Cash flow means that a company can keep the lights on, and you have to ensure that your storage investment has adequate cash flow.

Debt Ratio

You’ll also want to determine how much debt the facility in question carries. Is the debt level high? Is the cash being generated enough to service the standard debt load? Any business that is worth investment will open its books to you, giving you a chance you need to examine these questions and confirm that the investment you are about to make is a solid one. Furthermore, it is worth exploring the interest rates of the debt, particularly in an environment where these rates are likely to rise shortly.

Market Analysis

Specialty storage investment has become more and more valuable. This is vehicle storage, boat storage, industrial storage, and more. However, you need to do your homework before making this kind of investment. What does this mean? Find out if the market will support such an investment. For example, if people don’t have enough disposable income to own a boat, investing in a boat storage facility would be ridiculous. You’ll need to check local income levels and make sure that local customers will actually support the investment you are about to make.

Related to this point: You’ll need to conduct an extensive market analysis and ensure adequate demand for a storage facility you are about to start. While there is no question that self-storage is in demand, if there are already enough facilities in an area, a self-storage investment will fail. Doing this homework means engaging with marketing experts and confirming that the need exists. Furthermore, you’ll have to analyze the existing competition and ensure you won’t get crowded out of the market.

Business Plan

Finally, you will need to know how a business is doing and what they will do with any investment you make. What are they looking to do with your cash, and what sort of track record of business success do they have? Have they turned a profit over the past few years? What are their occupancy rates? Are they growing or shrinking? Are their expenses expected to hold even over the next few years? How long have they been in business, and what experience do they have in the current market? What is their long-term business plan for success?

Does this sound like a lot of information? It is. However, if you invest in an individual self-storage facility, these are questions you have to ask.

Final Thoughts on Investing in Self-Storage

You can invest directly in your own self storage facility.

Alternatively, you can buy stock in a company that is involved in this market, or invest in a REIT.

Or evaluate real estate crowdfunding deals related to self-storage on platforms like PeerStreet, EquityMultiple and CrowdStreet.

Or you can rent your spare garage space, shed or driveway using websites like Neighbor.

There is no question about it: The self-storage market is ripe and represents an excellent investment opportunity for savvy investors. It’s not for everyone, of course, but there are nearly countless ways to get engaged in this inventory and invest in a way that will help you turn a profit.

Do your research, ensure that any investment you make is aligned with your overall financial goals, and speak with a financial professional to confirm that the investment you are interested in making is sound.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.