Should I Invest In Real Estate Vs. 401K: How To Actually Compare

A reader wrote to me recently asking, “What is a better investment than a 401k”? After a few emails back and forth, I realized that he was trying to decide if it is better to invest in property or mutual funds. Depending on what corner of the personal finance world you land in, there is always a fierce debate between investing in 401(k) or rental property. The die-hard real estate investors would tout the benefits of rental real estate. In contrast, the stock enthusiasts would prefer the 401(k). Before deciding if it is better to invest in 401(k) or rental property, let us evaluate the pros and cons.

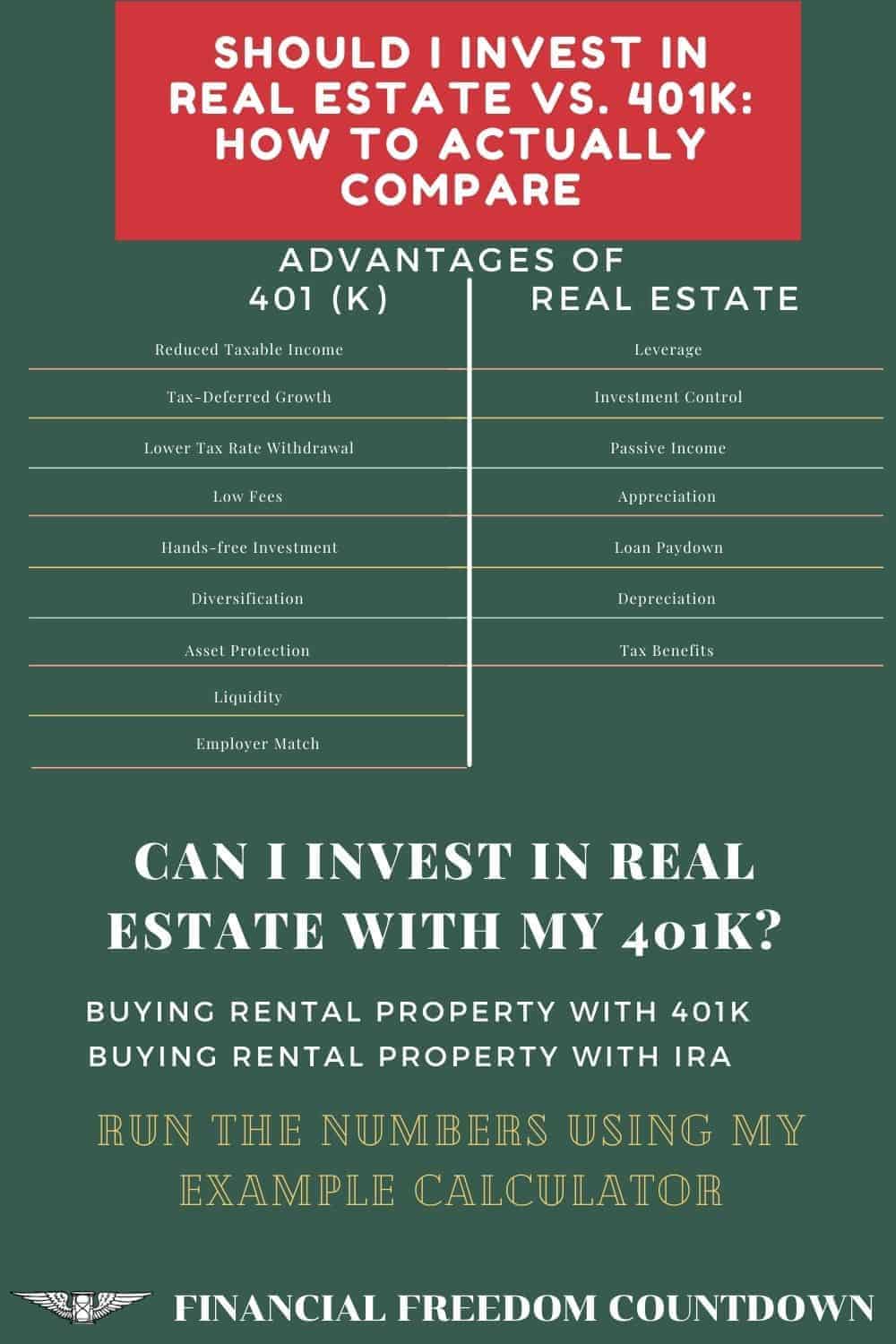

Benefits Of Maxing Out 401K Vs. Rental Property

Reduced Taxable Income

Besides housing, taxes are the most significant expense for an average household. Tax planning strategies should always be at the forefront of any decisions you make. The advantage of maxing out your 401(k) is that you reduce your taxable income. You save money by not paying taxes on your 401(k) contributions. And the reduced taxable income could also lower your effective tax rate. The U.S. has a progressive tax code. Based on the I.R.S. tax tables, moving from a 32% tax bracket to a 24% tax bracket provides additional savings.

Tax-Deferred Growth

The contributions in your 401(k) grow in a tax-deferred manner. The earnings on your 401(k) are not taxed till you withdraw.

Lower Tax Rate Withdrawal

Both the contributions and earnings are taxed only when you withdraw. You can plan the withdrawal to occur when your income is low such as during retirement. As a result, you can pay lower taxes.

Low Fees

Funds within the 401(k)s are supposed to have low fees, but some funds charge an egregious amount. To ensure that you are invested in low-cost index funds, set up your free Personal Capital account and connect your 401(k) account. You can use the Investment Checkup module to search for any high fees, and you can eliminate them.

Hands-free Investment

You don’t need to manage your 401(k). In fact, after selecting your investments and automating the entire process, it is best not to tinker with it. You can better spend the time and mental energy saved on improving your human capital to earn more money.

Diversification

Index funds within a 401(k) provide a wide range of diversification across companies, sectors, and even countries.

Asset Protection

ERISA accounts such as the 401(k) offer one of the best asset protection benefits. If you file bankruptcy or get sued, it is not easy for your creditors to gain access to the funds in your 401(k).

Liquidity

You can sell stocks in your 401(k) at the click of a button. Most of the investments you find in a typical 401(k) are highly liquid and can be converted to cash in less than five days.

Employer Match

Most employers match your 401(k) contributions based on a certain percentage. The match is free money you are leaving on the table if you don’t contribute to your 401(k).

Advantages Of Investing In Rental Property Vs. 401K

Leverage

The best advantage of real estate investment is the use of leverage. When you buy real estate with a down payment and a fixed-rate mortgage, you are using leverage. The advantage of the fixed-rate mortgage is that even if the price of the real estate temporarily declines, you do not need to provide additional capital to the bank.

Investment Control

When you buy a rental property as an investment; YOU are directly responsible for the investment returns. Rental property investment returns depend on your skills to find a great deal, negotiate a deal. Or fix up the property, increasing the value. Or your photography and copywriting skills to attract a great tenant. Or your management skills in keeping a great tenant. Or all of the above.

Passive Income

Rental properties provide a steady cash flow as a real estate passive income stream. The cash flow is calculated after all maintenance and capital expenses.

Appreciation

In addition to your monthly cash flow, the rental property also appreciates. San Francisco, which is one of the best places for technology jobs, has seen a massive price appreciation. Even if you are not in tier-1 cities, the rental property typically appreciates at an annual rate of 2%. Or one can use value add real estate strategies to create additional income streams.

Loan Paydown

The tenants with their monthly rent payments are paying down the loan for you. If you hold the property as a long-term investment, your tenants would eventually pay down your loan. And you now have the property free and clear. After the loan-payoff, the monthly income in the form of cash flow increases substantially.

Tax Benefits

Rental property investment offers many unique tax advantages. The I.R.S. provides a mechanism for recovering your cost in an income-producing property using depreciation. When you sell the property, you can defer taxes as per the I.R.S. with section 1031 exchanges. The Tax and Jobs Cut Act also provided for Q.B.I. deductions for rental properties. All of these tax benefits combined make real estate more attractive.

Example Of Investing in 401K Vs. Real Estate

Consider a couple married filing jointly in California, each earning $100,000. In order to compare rental property investment vs 401(k) we will run two scenarios.

Scenario 1 – Max out 401(k) contribution and let it grow for 30 years.

Scenario 2 – Do not contribute to 401(k). Invest the additional take-home pay in a rental property for 30 years.

| Scenario 1 | Scenario 2 | |

|---|---|---|

| Federal Tax | $21,544 | $30,207 |

| FICA Tax | $11,437 | $11,437 |

| State Tax | $8,359 | $11,986 |

| Total Income Taxes | $41,340 | $53,630 |

| Income After Taxes | $158,660 | $146,370 |

| Retirement Contributions | $39,000 | $0 |

| Take-Home Pay | $119,660 | $146,370 |

Scenario 1 – Max out 401(k) contribution and let it grow for 30 years.

Assume an 8% return on the 401(k) for the couple in scenario 1. Due to the magic of compounding after 30 years they would have $392,445.30 in a pre-tax account.

In retirement, scenario 1 couple withdraws $40,000 from their 401(k) annually for a $34,988

Scenario 2 – Do not contribute to 401(k). Invest the additional take-home pay in a rental property for 30 years

The couple in scenario 2 has enormous take-home pay of $26,710 compared to scenario 1 couple. The couple in scenario 2 use the $25,000 as a down payment for a $100,000 rental property. The $1,710 is utilized as closing costs.

| Buy Price | $100,000 |

| Down payment | 25,000 |

| Loan amount | 75,000 |

| Monthly mortgage @3.5% for 30 years (principal and interest) | $337 |

| Operating expenses (taxes, insurance, maintainence) | $400 |

| Monthly rent | $1,000 |

| Monthly cash flow (after paying mortgage and expenses) | $263 |

| Annual cash flow | $3156 |

The couple invests the annual cash flow in stocks at the same 8% return as scenario 1.

After 30 years, scenario 2 couple has $386,123.56 in stocks and property worth $181,100 (assuming property appreciation at 2% annually).

In retirement, scenario 2 couple has no mortgage after 30 years but they still have operating expenses on a 30-year-old property. The monthly cash flow after the tenants pay down the mortgage is $600.

Assumptions In The 401K Vs. Real Estate Example

- We estimated operating expenses of 40% in Scenario 2. Your costs could be lower, but this is the standard value used in most real estate calculators.

- Monthly rent at 1% of the purchase price.

- We did not deduct taxes for the monthly rental income.

- We used any rent increases for the property to pay capital expenses on the property and hence not included in the cash flow.

- We did not include matching 401(k) contributions for scenario 1 couple.

In this example, the rental property couple did better than the 401(k) couple. Real estate investment risks do exist. The rental property couple did take on more risk as rental properties can’t be diversified. Also rental property is not passive, even if the I.R.S. treats income passively.

Can I Invest In Real Estate With My 401K

I am sure some of my astute readers must be wondering if there is a way to get the best of both worlds. If you are thinking, “can I buy real estate with 401(k) money,” the answer is yes, but it is complicated.

You can use your 401(k) to buy real estate. But there are some limitations to using this approach.

Buying Rental Property With 401K

You can take a loan from your 401(k) for the lesser of $50,000 or 50% of your 401(k) balance. The loan can be used as a down payment.

- You will be paying interest on your 401(k) loan. Not the best use of your 401(k) money.

- You need to repay the loan when you no longer work at the same company. In case of a sudden job loss the repayment of the 401(k) loan becomes a major issue since your income source is gone; and you need to also come up with the large repayment amount in a short timeframe.

Buying Rental Property With IRA

To buy a rental property with an IRA., you should maximize your 401(k) contributions at work. Once you have accumulated a substantial amount in your 401(k), find another employer and roll-over your 401(k) to a self-directed IRA. Use the funds in the self-directed IRA to buy a rental property.

- You can buy real estate with your IRA, but it needs to be a self-directed IRA.

- The real estate must be for investment purposes only. You or your family can’t live in it.

- The purchase generally must be all cash. So the best advantage of real estate in leveraging a loan might not be readily available. Any loan with a self-directed IRA is considered a non-recourse mortgage. There are very few lenders who provide loans to IRAs.

- If you manage to get a mortgage, the portion of your profits that results from using leverage (mortgage) might be taxable. Check with your CPA on UBIT (unrelated business income tax).

- You can’t take advantage of deductions such as property taxes, property-related expenses, depreciation, etc. On the bright side, any rental income generated by the property grows tax-free in the IRA.

- You can’t work on the property yourself. So absolutely zero sweat equity. Small fixes such as hammering a nail in the wall need to be contracted out and paid by the .RA.

- You can’t pay for anything relating to this property out of your pocket. If the property needs a considerable expense like a new roof and your self-directed IRA does not hold sufficient cash, then it is a challenge.

- You don’t have to pay capital gains tax to the I.R.S. when you sell the property. You do have to pay taxes when you withdraw money from the IRA account.

One approach I do not recommend is withdrawing money from your 401(k) or IRA to buy a rental property. You need to pay taxes on the amount you withdraw and face the early withdrawal penalty. Be wary of any real estate “gurus” who talk about this strategy.

Final Thoughts On 401K Or Real Estate

There are many ways to save for retirement.

Ideally, you should invest both in real estate and your 401(k) for maximum diversification. If money is a constraint, read how to bump up your saving rate so you can obtain the benefits of both income-producing assets.

If you have to choose one, I’d prefer maxing out my 401(k) since it involves no sweat equity. Many 401(k) plans include real estate investment trust (REIT) as one of the options. This way you can have your cake and eat it too. Of course, REITs are a slightly different beast than directly owning a rental property.

If you desire the benefits of real estate but lack the knowledge, time, or skills to invest directly, you could consider real estate crowdfunding.

However, no one, including me, can tell you which investment strategy is the best fit for your financial situation, risk tolerance, and long term goals. Those are decisions you need to make for yourself.

The example I have included should provide an excellent framework to guide you. I would encourage you to use my model and run the numbers yourself. The assumptions I made might not hold for you. It might be possible in your area to find a better cash-flowing property. Or your 401(k) options are horrible, and you found out that there are lots of fees hurting your returns.

You could also follow the hybrid approach of investing in real estate with the 401(k) or IRA.

There are indeed many more success stories with real estate. You do control your destiny with real estate. No such option exists with stocks that are passive by nature including investing in the S&P 500. Much of the real estate outperformance is a result of additional work put into real estate.

This article was focused on real estate vs 401(k). But 401(k) has an unfair tax advantage, and often you still have this question after maximizing your retirement accounts. Without considering retirement accounts, I performed a similar analysis if stocks vs. real estate is a better investment. The results including data from a Federal Reserve paper was surprising.

Readers, given a choice between investing in 401(k) or real estate, which would you pick? And why? Besides the options mentioned, are there other creative ways to buy real estate?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.