How To Invest in International Stocks

When considering investing in the stock market, many individual investors often forget about a critical asset class: international stocks. When incorporated correctly into your portfolio, international stocks from emerging markets or foreign markets can be a massive boon for your portfolio, enabling you to achieve a level of diversification that is impossible in more developed markets. Indeed, international investments are often critical to a well-balanced portfolio.

However, investing in international companies and overseas markets often presents fundamental challenges. Let us explore the pros and cons of international stocks and how you can invest in foreign markets.

What Are International Stocks?

International stocks refer to investing in stocks or companies physically located in foreign countries. This means that these companies are located in foreign countries and thus subjected to rules of the rules of these foreign governments.

That being said, don’t confuse international stocks with domestic ones with a global presence. In a world as interconnected as this one, it is challenging to imagine a domestic company that doesn’t have at least some international exposure. That doesn’t mean that the domestic stock is a foreign one. It just means they have an adequately broad range of investments in international markets.

Benefits of Investing in International Stocks and Mutual Funds

Investing in international stocks has many benefits, and in many cases, investing in these emerging markets can be an excellent addition to your investment strategy.

Sector Diversification

International markets allow you a chance to diversify your stock portfolio. While it is true that recessions tend to hit all aspects of the financial world, there is no question that specific recessions are industry-specific or hit some locations of the world harder than others.

The U.S. stock market may exhibit a high concentration of tech or tech-linked companies, as evidenced by the significant proportion that the ten largest stocks in the S&P 500 hold within the overall index.

A recession similar to the Dot-com burst could hit the U.S. markets more than foreign stocks. Yes, there are recession-proof sectors in the market, but if you are investing in index funds, they form a small portion of the index.

Country Diversification

The international investment allows you to diversify your portfolio and potentially mitigate the damage that any domestic-based recession can bring. International markets will enable you to engage in a diversification and asset allocation strategy that may mesh well with your overall portfolio needs.

For example, the Japanese market took over three decades to regain its all-time highs. If you had a home country bias and never invested internationally, could you plan to retire early with three decades of underperformance?

International stock markets often present individuals with a chance to gain international funds. By engaging in international investing, you position your portfolio to take advantage of both developed and emerging markets, depending on where you spend your money.

Investing in international stocks and mutual funds can also be done similarly to investing in the domestic stock market. In other words, you can invest in bonds, stocks, ETFs, mutual funds, and more like you would when investing in U.S. stocks.

Attractive Valuations

Disciples of the Ben Graham School of value investing would memorize every Warren Buffet quote and see opportunities in international investing because of their low valuations. On a Price to Earnings multiple basis, domestic securities often trade at a premium to their international counterparts.

Many investors prefer “cheap” book value based on the reversion-to-mean hypothesis. Unfortunately, the thesis hasn’t played out in the last few decades.

Potential Growth

International investing capitalizes on the growth potential of foreign economies, particularly in emerging markets. Companies are always looking for new customers to use their products.

Countries that open up their economies to global trade see an increase in their GDP, which flows back to the stock markets. At the turn of the last century, the U.S. was an emerging market and now commands the lion’s share of the global GDP.

Currency Hedge

With the rise of Modern Monetary Theory (MMT), many investors fear the loss of purchasing power of the U.S. dollar.

When you invest internationally, you gain global exposure to various currencies, which can help if there are changes in the exchange rates.

What Are the Risks of International Investing

Of course, investing in international stock markets does come with its share of risk. After all, investing involves risk, and putting your money into international holdings is no exception.

Currency Risk

Investing internationally comes with currency risks. While many foreign companies base their stock price on the dollar, many also use their domestic currency. International investments thus expose you to currency risk, meaning that you could lose money based on currency fluctuations.

Fluctuations in the exchange rate between a foreign currency and the U.S. dollar can impact the investment return in foreign stock. It is noteworthy that while a foreign investment may appreciate in its home market, changes in exchange rates can result in a lower valuation of that investment in U.S. dollars.

As such, owning international stocks or a piece of international stock funds means paying attention to the performance of international stock exchanges and the performance of a currency overseas.

Capital Controls

Certain countries might enforce foreign currency controls that limit or postpone the ability of investors or the invested company to transfer money out of a nation. Typically a balance of payment crisis triggers capital controls.

This could prove challenging as an investor if you cannot return the dollars to the U.S.

Financial Controls

One of the fundamental challenges with foreign countries is that they may need more financial controls to ensure that potential investors have all of the information they need before investing.

For example, in the United States and many other established nations, you have a robust set of disclosures and reports that can help ensure you can accurately judge a company’s performance.

That isn’t always the case in other countries, especially emerging markets. As such, you’ll need to check the performance of the foreign stock in question and judge the overall performance of the country’s regulatory body.

Next, you must ensure you are working with an experienced financial advisor. As noted, investments in a foreign market differ from those in a domestic one. To that end, you should work with an investment advisor with ample experience in foreign markets.

Liquidity Risks

Furthermore, foreign markets often have different levels of liquidity. You can instantly buy or sell a stock, mutual fund, or bond in the United States unless it trades on the pink sheets. That may not be the case for a foreign market, which may suffer from liquidity challenges. That’s not to say this is always the case, but you must monitor it when investing.

Geopolitical Risks

Different countries have different political, social, and economic institutions and pressures. Your challenge will be to monitor these pressures and determine how they will impact your investment.

This is particularly true for newer, emerging markets that may need more political stability than other countries. Of course, that’s not to say that more established markets always have ideal levels of political stability. We have seen recent examples where the entire Russian stock market is closed to foreign investors highlighting the political risks of international capital markets.

However, these countries have the structures and support to continue business. That may be different in other emerging markets.

Limited Legal Options

If U.S. investors encounter issues with their investments, they may face limitations in pursuing legal remedies through U.S. courts as private plaintiffs. Even in the event of a successful lawsuit in a U.S. court, enforcing a judgment against a non-U.S. company can be challenging. Consequently, they may need to rely on legal remedies available in the company’s home country.

The International Organization of Securities Commissions (IOSCO) provides a comprehensive list of foreign securities regulators who function similarly to the SEC in their respective countries. Additionally, IOSCO publishes investor alerts shared by its securities regulator members on the Investor Protection page.

Foreign Taxes

Foreign stocks typically generate dividends that are taxed in the foreign country. Of course, when filing taxes, you can ensure you are not taxed twice as long as these foreign stocks are in a taxable brokerage account.

However, if you invest in your 401(k) or other tax-advantaged accounts such as HSA, Roth, Roth 401(k), Deferred Compensation Plan, etc., you lose the ability to claim the tax credit.

One of the many reasons asset location is essential when deciding what income-producing assets should be in which specific accounts.

Transaction Costs

You may often lose more of your investment on international stocks’ transaction costs than domestic ones. This may be unavoidable, but it doesn’t mean you can’t reduce costs by searching for lower-cost transaction ETFs.

What Is the Best Way To Invest in International Stocks?

American Depositary Receipts (ADRs)

American Depositary Receipts (ADRs) are convenient for purchasing foreign stocks. Foreign companies employ ADRs to establish a U.S. market presence and raise capital. Infosys and Siemens AG are examples of ADRs from Indian and German companies.

Global Depository Receipts (GDRs)

A global depository receipt (GDR), also known as an International depository receipt, is an alternative form of depository receipt. A depository bank issues shares of foreign companies in international markets and makes them accessible to investors within and outside the U.S.

While ADRs are issued only in the U.S., GDRs are issued in more than one country.

Foreign Direct Investing

There are two methods for investors to purchase foreign stocks directly. One approach is establishing a global account with a reputable broker in your home country. Alternatively, you can open an account with a local broker in the target country.

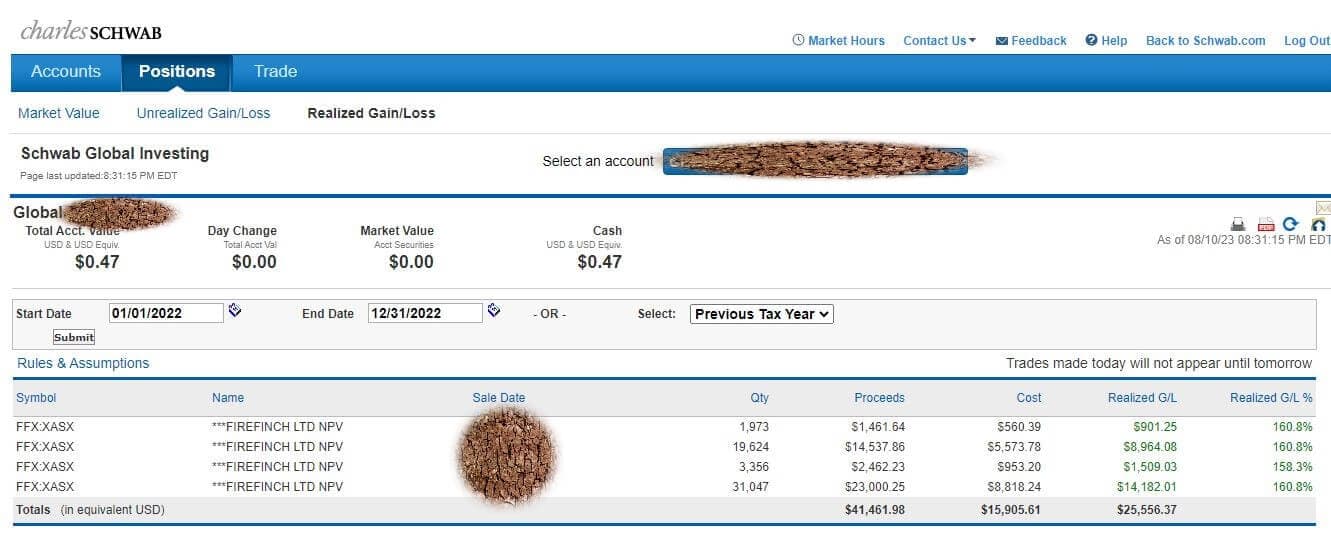

Although foreign direct investing may seem complex for large brokerages, opening a Global Account is relatively simple. Once I realized the Electric Vehicle boom was here to stay, I decided to invest directly in Lithium stocks by opening a global account with Schwab. Most mining companies trade on international exchanges such as Australia or Canada, although the mines may be located in Africa.

Directly investing was the best option since ESG investing could not capture the trade. Most ESG investing is focused on “greenwashing” companies versus the actual picks and shovels of the business.

Commodities trading using contracts is challenging, as shown in my experience of the four worst investments I made.

Example of my foreign direct investing in an international stock on the Australian Stock Exchange.

International Mutual Funds and ETFs

Investors looking to explore global markets with minimal hassle can consider investing in a mutual fund or Exchange Traded Funds (ETFs) specializing in international equities. Simplicity is among the many benefits offered by international ETFs.

U.S. Companies With Foreign Market Exposure

Investors who are hesitant to purchase foreign stocks directly, and even those who have reservations about ADRs or foreign ETFs, can buy domestic companies that generate a substantial portion of their sales from overseas markets.

Investing in the S&P 500 ensures enough exposure to multinational companies that profit from selling their goods in international markets.

Different Types of International Markets Based on Economic Development

When investing in international stocks, it is advantageous to have a comprehensive understanding of the distinctions between developed, emerging, and frontier markets. This knowledge facilitates a better grasp of international investment products’ risks, potential, liquidity, and stability.

Developed Markets

Comprise economically advanced countries. These nations possess highly developed capital markets, robust regulation, higher per capita income, and substantial market capitalization with greater liquidity. Examples include the United States, Canada, the United Kingdom, Germany, Australia, and Japan.

VEA and SCHF are developed markets ETFs created by Vanguard and Schwab.

Emerging Markets

Encompass countries undergoing rapid economic growth, increasing household incomes, and industrialization. Unlike developed markets, these countries typically exhibit lower household net worth, ongoing economic development and reform programs, less mature stock and bond markets with less regulated practices, lower liquidity, and undergoing structural changes such as infrastructure modernization or transitioning from agriculture to manufacturing.

Brazil, Russia, India, and China are prominent emerging markets. VWO and SCHE are emerging markets ETFs created by Vanguard and Schwab.

Frontier Markets

Represent a subset of international investing that may evolve into future emerging markets. These markets are generally less developed, have higher risk levels than emerging markets, limited market liquidity, and relatively underdeveloped market systems.

Examples of frontier markets include Kenya, Indonesia, Vietnam, and Mauritius.

The iShares MSCI Frontier 100 ETF (FM) is an example of a Frontier market ETF.

Are International Stocks a Good Investment

As you can see, there are pros and cons to adding international stocks to your investment portfolio. The diversification benefits of such a decision can be significant, as investing internationally exposes you to potential gains and allows you to improve your portfolio substantially.

At the same time, there is a real risk. Many countries do not have the same robust financial controls as the United States, and you have to judge what works best for your financial portfolio.

Lastly, it would help if you considered the region’s overall political and socio-economic environment. Like in the United States, foreign investments can be positively or negatively altered by the political climate, governmental actions, regulatory control, and more.

Generally speaking, investors prefer making investments in stable systems with robust governmental bodies that can act to protect assets, capital, and labor. To that end, when making a foreign investment, you need to check out the strength of the investment in question and monitor the country’s total environment.

M1 Finance is great for investing in international stocks due to zero fees, very low minimums, automated investment with automatic rebalancing. You can learn more in my M1 Finance Review.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

M1 Finance: John compared M1 Finance against Vanguard, Schwab, Fidelity, Wealthfront and Betterment to find the perfect investment platform. He uses it due to zero fees, very low minimums, automated investment with automatic rebalancing. The pre-built asset allocations and fractional shares helps one get started right away.

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Streitwise is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign/non-USA investor. Minimum investment is $5,000.

Platforms like Yieldstreet provide investment options in art, legal, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.