Saving Rate: How To Calculate It And 3 Ways To Increase It

When trying to grow your wealth; several factors come into play. Investment environment, interest rates, asset selection, risk adjusted returns of various asset classes, taxes, asset location and saving rate. Most of these factors are outside your control, except a few such as Saving Rate.

What Is Saving Rate?

Saving Rate is the percentage of income a person sets aside every year. The money does not need to be held in cash and can be used to buy income producing assets. The important part is that it is not spent. It is saved or invested for spending in the future.

How To Calculate Saving Rate?

To calculate saving rate we need to determine disposable personal income which is Net Income.

Gross Income is income from all sources such as salary, dividends, rental income, business income, etc.

Net Income = Gross Income – Taxes

Savings = Net Income – Expenses

Saving Rate = Savings/Net Income

For example, if you earn $100,000 a year and pay $25,000 in taxes.

Your Net Income = $100,000-$25,000 = $75,000

If your annual expenses are $50,000 then

Your Saving Rate = $25,000/$75,000 = 33.33%

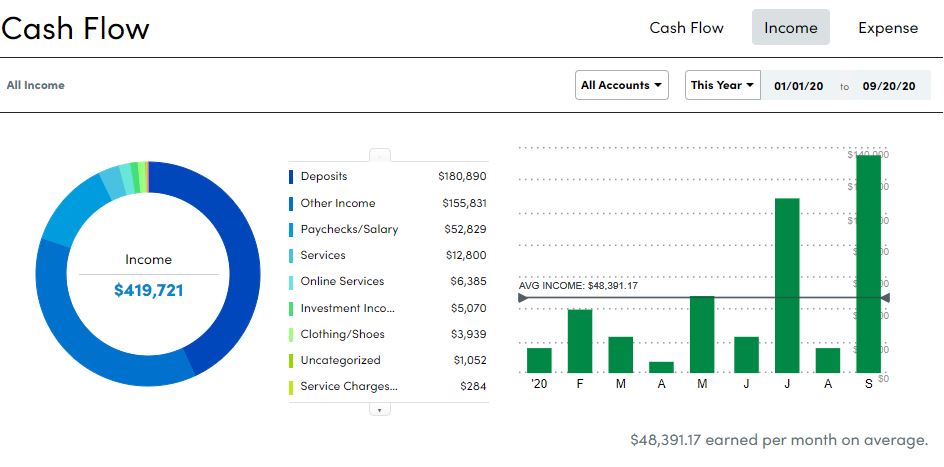

If you do not know your current saving rate, sign up for Personal Capital. This is a free tool I use to track my net worth on a regular basis and as a retirement planner. It also alerts me to hidden fees and has a budget tracker included. You can read my Personal Capital review on how I use it.

After you have linked all your accounts, click on Banking and then Cash Flow.

Switch the filter in the top right corner to this year. Click Income and you can see your average income for the year.

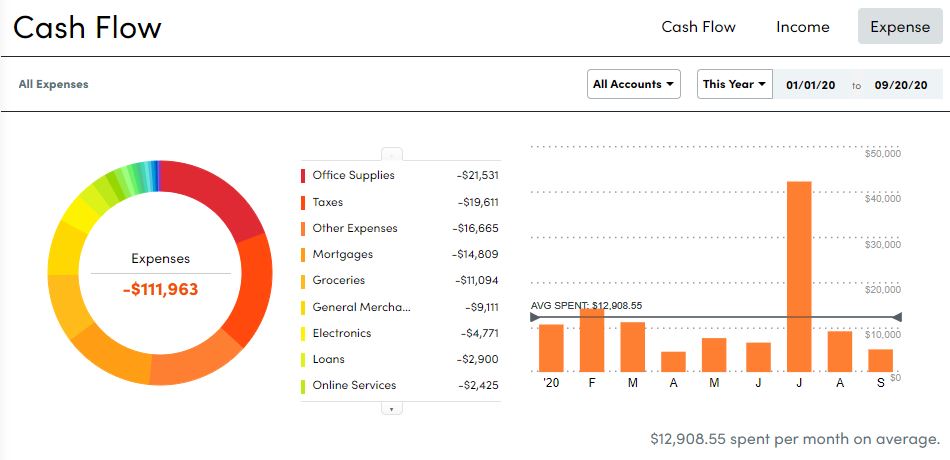

Click expenses and you can see your average expenses for the year.

In the example shown, the saving rate is a whopping 73%

Why Is Personal Saving Rate Important?

Low Expenses Compared To Income

The advantage of high Personal Saving Rate is that your expenses are low relative to income. I am not fan of generic frugality advice like skipping coffee if you enjoy it. But I am in favor of mindful spending.

Having a handle on your expenses will ensure that you do not need a large nest egg to retire. Based on the 25 times expenses rule of thumb, lower expenses will allow you to retire sooner on a smaller nest egg.

Greater Savings To Invest

A high Personal Saving Rate indicates that you are saving a greater percentage of what you earn. We know that accumulating assets is the secret to getting insanely rich. The more you save, the more you can invest in stocks, crowd funded real estate deals, etc.

The invested assets will either generate cash flow increasing your income. Or will appreciate in value increasing your net worth. Both are steps in a positive direction. If the increased cash flow is again reinvested into acquiring more assets, your net worth grows exponentially.

Average Saving Rate In USA

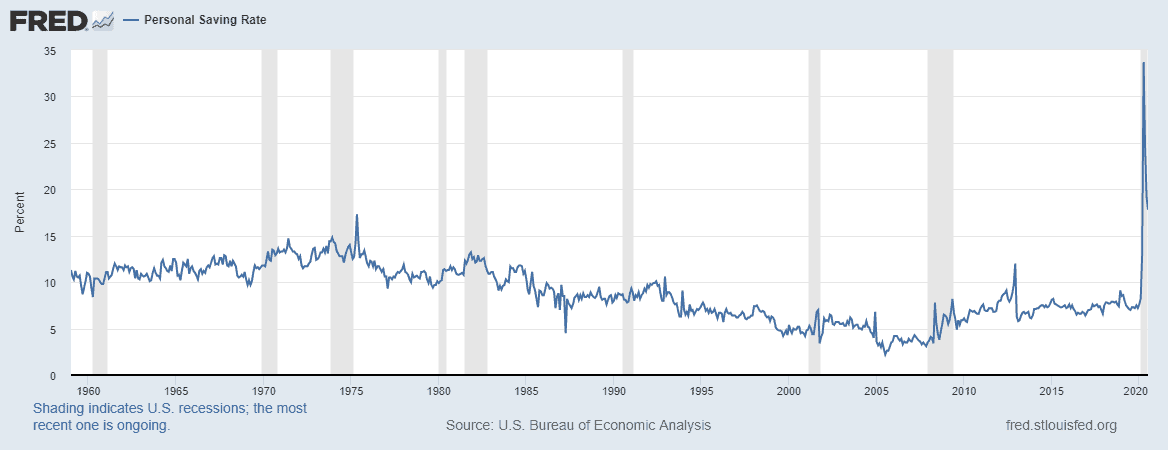

Just as Saving Rate is important for individuals to track for personal finance; it is also important for governments. Since the U.S. consumer accounts for more two-thirds of the economy; it is a valuable data point monitored by the Federal Reserve.

The Federal Reserve Bank of St Louis has Personal Saving Rate data from 1960s. The government uses it to learn about Americans’ financial health. And to predict consumer behavior and economic growth.

Saving Rate varies widely based on economic conditions. When there is a fear of recession, everyone becomes cautious and saves more.

But if the Saving Rate stays consistently high; it would indicate a more structural change in saving and spending habits. It tends to curb growth of the economy.

Personal Saving Rate in the United States averaged 8.91% from 1959 until 2020. It reached an all time high of 33.70% in April of 2020. The previous record saving rate was 17.3% in May 1975.

The pandemic made everyone cautious to stockpile cash. Due to the shelter-in-place orders most businesses were closed and individuals did not have avenues to spend the money. In this chart you can clearly see the all time high spike.

The lowest Personal Saving Rate of 2.20% was recorded in July 2005.

In a consumer driven economy, the government obviously wants you to have a LOW saving rate. But from your Financial Freedom standpoint; make sure you have a HIGH Saving Rate.

Saving Rate For Other Countries

OECD maintains data of Saving Rate as a percentage of GDP.

The calculation would be different from the Fed. But, the data does provide useful comparisons between various countries.

Look at China compared to the rest of the world. And Germany compared to other European countries.

Optimal Saving Rate

For a very long time, experts said running a mile in 4 minutes was impossible. In the 1940s, the record for running a mile was set at 4:01 minutes. For 9 years, this record stood until 1954 when Roger Bannister broke the four-minute mile record.

Barely after a year, another athlete ran a mile in less than 4 minutes. Then some more runners did. Today no one raises an eyebrow when you run a mile in less than 4 minutes..

Once Roger Bannister broke the record, everyone saw it is possible and could crush it. Similarly, now that we have seen saving rate of 33% is possible; why not have that as the minimum target saving rate!

To accelerate Financial Freedom Countdown you should ideally shoot for a saving rate of 50%.

With a 50% saving rate, you buy one year of freedom for every year you work. And this is before the money is invested in growing assets.

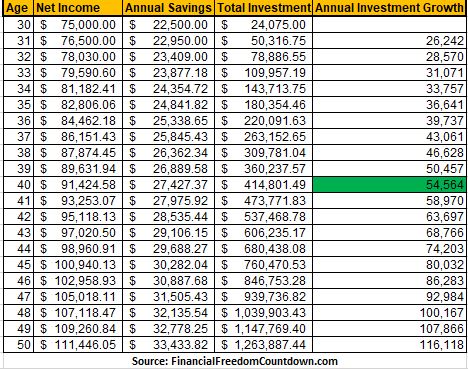

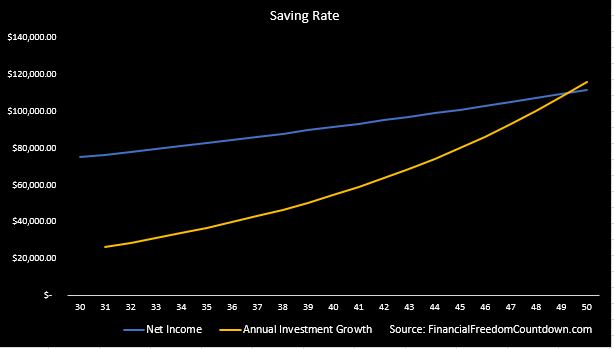

Let us look at an example of Randy earning $75,000 with a 30% saving rate and annual expenses of $52,500. Assume a modest 7% investment return with income increasing 2% annually.

The graph shows in 20 years, Randy’s year on year investment growth is more than his income. Actually, in 10 years something even more amazing happens. The investment growth is equal to his annual living expense.

How To Increase Saving Rate

There are only 3 levers to increasing saving rate

- Reduce Taxes

- Reduce Expenses

- Increase Income

Reduce Taxes

Look at every possible means to reduce taxes. Planning for taxes should be an ongoing activity. If you wait till April when you file your taxes; you have already missed many opportunities. Check out my tax planning strategies

Maximize your tax advantaged accounts. Fund 401k, IRA, HSA to the maximum extent possible. Look into Deferred Compensation Plan if you are a high earning W2 employee.

Reduce Expenses

Look at your expenses in the Personal Capital dashboard.

There will be some expenses you can eliminate without lowering your quality of life. Eg: A magazine you subscribed but no longer read.

There are other recurring expenses which are needed but you are paying too much for them. If you have Cable TV, Wireless Phone, Satellite TV, Internet Access, Satellite Radio or Home Security sign up for BillShark. They negotiate lower prices on your monthly bills saving you time and hassle. You give up some savings by having them do the work for you. But it is better to have professionals negotiate on your behalf versus you doing nothing and paying full price.

Interest payment on credit cards, cars, student loans, etc. is the worst kind of expense. You get ZERO enjoyment from it. In fact, before buying your next car, consider the cost of car ownership. Make sure you evaluate all your car and credit options if you absolutely need to buy a car.

If you already have a car loan, student loan or credit card debt; you should strongly consider refinancing to lower your interest payments.

The Federal Reserve has lowered interest rates across the board. Take advantage of it and check out personal loan rates in 2 minutes from up to 10 vetted lenders on Credible. You should be able to find options to reduce your interest payments.

When you complete the personal loan prequalifcation form, you can compare your prequalified rates from all the lenders without affecting your credit score. After you select one of the prequalified rates, you will be redirected to complete an application on the lender’s site, which will result in a hard credit inquiry.

Use the Personal Loan only to lower your interest rates and not to take on additional debt.

Similarly, if you have Student Loan debt, check Credible to refinance federal, private and ParentPLUS loans. Compare prequalified rates from multiple, vetted lenders in 2 minutes. Checking rates won’t affect your credit score.

Increase Income

There is a limit to which taxes and expenses can be cut. Increasing income should also be on your radar.

Improve your Human Capital at work and earn more from your day job.

Look for deals in your neighborhood to flip a house profitably. or wholesaling. I’ve listed a number of ways to make money in real estate with little or no money down using your sweat equity.

If you are artistically incline, you could even have an art side hustle leveraging these drawing ideas.

Make money from your hobby. Here is my Bluehost affiliate link to start a website for less than $4/month. My friend started a kitchen herb garden and now sells e-books on herb gardening from her website. Another friend is offering keto recipes on his website. With costs so low to start an online business; there is no reason to not get started. Check out my guide on how to start a website in 10 minutes.

Final Thoughts On Saving Rate

Personal Saving Rate provides an important benchmark on how you are handling your financial life.

Measure your current saving rate and target to reach at least 30%.

Readers, leave a comment below on what worked and what did not work in your efforts to boost your saving rate.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

Fascinating to see the saving rate compared to the the other countries

In my opinion, it is far better to calculate savings rate as a percentage of gross income as this forces you to directly confront the impact of taxes.

I wholeheartedly agree that taxes need to be minimized to the maximum extent possible.

Unfortunately, the saving rate definition is set by the Bureau of Economic Analysis “it’s the percentage of people’s incomes left after they pay taxes and spend money.”

Hence the caveat that we should personally strive for a higher rate even if the government prefers a lower rate.