Bobby Bonilla Hasn’t Played for Over 2 Decades. Why Do the Mets Still Pay Him?

On July 1st, Mets fans wish each other Happy Bobby Bonilla Day.

Why?

Because on July 1st, Bobby collects a check of $1.19 million every year from 2011 to 2035. And he has not played for the Mets since 1999.

Instead of receiving a one-time payment for $5.9 million, Bobby negotiated one of the best retirement packages in history. In case you are wondering how he got such a sweetheart deal. And what are the financial lessons for all of us? Read on.

Bobby Bonilla Day Explained

Why does Bobby get the $1.2M paycheck each year? Let us delve into the Bobby Bonilla Contract.

In 2000, Bobby and the management realized that they were not a great match. The Mets wanted to get substitute Bobby Bonilla. But they still owed him $5.9M on his contract. The Mets agreed to buy out the amount on his contract.

But the Mets also needed the money to bring a new player. So instead of paying Bobby the $5.9M in 2000, the Mets agreed to defer the payment to the future. They would make annual payments of nearly $1.2 million for 25 years starting July 1st, 2011, including a negotiated 8% interest.

The Mets were confident that this was a great deal for them since, at that time, they were investing with Bernie Madoff.

Even with a low 10% return from Bernie Madoff, they expected to end up ahead.

With the historical context around the Bobby Bonilla Contract what are the financial lessons we can take from Bobby Bonilla Day?

Have A Trusted and Knowledgeable Advisor

Based on what I have read, the fantastic deal was put together by Bonilla’s agent, Dennis Gilbert. He was an insurance agent at the time, so he was more uniquely prepared to understand deferred compensation type payouts than other agents.

Besides Bobby Bonilla, Gilbert also represented Barry Bonds, Ricky Henderson, Mike Piazza, George Brett, and Jose Canseco.

Financial details are complex and messy. All of us have a day job. Make sure you have someone on your team who understands the nuances. This is the reason why I use a CPA even though they make mistakes.

Opt for Annual Payments Instead of a Lumpsum

Taxes are calculated on annual income; If you make $1 Million in a year, then you will lose almost half of it to taxes. The IRS doesn’t care if you earn no money for the rest of your life.

One of the best tax planning strategies is to spread any income over several years. Instead of the $1 million, you would hardly pay any taxes if you opt for a $50,000 annual payment over 20 years. Also, it helps you in setting a default budget for a year instead of receiving a lump sum, spending it on a boat, and then living broke for the rest of your life.

Although we may not be baseball players, most employers have some form of the deferred compensation plan. The concept is similar to the Bobby Bonilla Day plan and one of the prime reasons why I also opted for it in my last job.

A considerable risk in deferred compensation plan deals is that the organization paying you should be solvent. Run the numbers but also be mindful of bankruptcy risks. After all, large corporations like Enron and Lehman suffered a worse fate.

Tax Planning Flexibility

Playing for the Mets, Bobby Bonilla lived in New York. From a taxation standpoint, as a California resident, I believe New York is worse because they have city taxes and state and local taxes.

If Bobby would have collected the $5.9M in 2000, he would also be paying New York state and city taxes. But by deferring the payment to the future, he got tax planning flexibility.

He is receiving the annual payments now living in Florida, a state with no income tax.

In my article comparing Roth 401(k) vs. traditional 401(k), tax planning flexibility was a key consideration. Often, jobs in high cost of living offer more money. If you can earn at the high rate but defer the earnings for the future; you essentially avoid paying local and state taxes provided you relocate to no tax state when receiving payments.

With the advent of remote work this possibility is now even more accessible to most professionals.

Guaranteed Returns

The deferment deal had a guaranteed 8% interest rate attached to it. Although you might get higher returns by investing in the stock market or investing in real estate syndication deals, Bobby Bonilla Plan is a guaranteed 8% return on an investment every year and without the volatility or risk present in other assets.

You and I can have a similar guaranteed return by opting to delay receiving social security benefits. The Social Security System pays retirees an extra 8% each year to wait to claim benefits up to age 70.

When you are running numbers using various Free Retirement Calculators, incorporate delaying Social Security in your calculations.

Cut Your Losses

A huge reason for the deal is that the Mets were paying Bobby but could not utilize his high-income skills with the current team structure. The Mets decided to cut their losses and get their front-line starter. With the savings created by the deal, the Mets could trade for Houston Astros ace Mike Hampton.

The deal worked beautifully for the Mets. It was one of the franchise’s savviest and most successful transactions. It paid instant dividends, triggering moves that led to a World Series appearance in 2000. After Hampton left for the Colorado Rockies, the Mets could pick team legend David Wright.

Often we land up with losers in our portfolios. Trust me; I have made several mistakes. Here are my four worst investment mistakes. Sometimes when our investment thesis is no longer valid, it might be better to cut our losses and move to other winning strategies. Note that this is not the same as panicking every time the stock market falls and wondering should I sell my stocks now?

Cutting losses is more applicable in individual one-time investments. Dollar-cost averaging into index funds is a safer option.

Investment Returns Are Not Guaranteed

Another reason the Mets jumped on the deal because the Wilpons assumed that they could invest the $5.9 million with Bernie Madoff. In 2000 Madoff promised a conservative 10% annual return. If they could earn 10% and pay Bobby 8% in the future, they would still come out ahead. Of course, the Madoff returns weren’t realistic.

The applicable financial lesson is when anyone offers a guaranteed return, run!

Based on historical data, we know the average returns of each asset class. We can also build a diversified portfolio to avoid volatility and risk. Nothing is safe and guaranteed besides the Treasury bonds. Or FDIC insured accounts where I keep my emergency fund to get an 8% return.

Magic Of Compound Interest

Bobby Bonilla gave up $5.9 million in 2000 so he could enjoy a larger sum later in life. The $30 million he would receive seems a large amount at first glace, but it perfectly demonstrates the magic of compounding.

While you and I may not have such a large sum, we all have the same power of compounding in all our investments. By investing money in real estate or farmland investing we can expect an outsized payday in the future.

Life Is Unfair, Get Used To It

The biggest financial lesson which everyone overlooks is how Bobby Bonilla got to the MLB.

Bonilla grew up in NYPD’s 40th Precinct, notorious for its crime. He played sports for several hours a day and taught himself to switch-hit by pretending to be the Yankees’ Chris Chambliss from the left and the Mets’ Tommie Agee from the right side. That’s how he got out of his neighborhood.

Here is Bobby talking about his experiences

I mean, people talk about the pressure of playing in the big leagues, but where’s the pressure compared to growing up in a ghetto and looking for ways to get out? I’m talkin’ about houses burning and people starving, and I’m supposed to be tremblin’ playing the first-place Mets or [the] Dodgers? I’m having the most fun I’ve ever had. Sports has always been my release. I’d turn on the news as a kid and couldn’t wait for [sportscaster] Warner Wolf. How many murders can you put up within a day?

Bobby Bonilla

All of us will have some unfortunate situation holding us back. Instead of complaining about it, figure out a way to use it to overcome. I am sure Bobby must have overcome worse adversity by continuing to focus on improving his skills.

I’ve talked about improving my human capital, which is often our only asset. After you ramp up your hourly earnings, you could deploy the money in several income-producing assets.

Did Bobby Bonilla Get A Great Deal, Or Did The Mets?

Now for the $30M question, based on what we know, who got the better deal? Did Bobby Bonilla or the Mets reach the better part of the deal?

To me, the deal seems like a perfect win-win on both sides. On the surface, the $30M he would receive over a period of time seems like an massive amount compared to the $5.9M he was supposed to receive in 2000. But that is the beauty of compound interest. Applying compound interest can increase our net worth exponentially as well.

The Mets needed to cut their losses and get another player to help them win the World Series. The Bobby Bonilla Day deal enabled them.

Did Bobby Bonilla get more money in the long run with the deferred compensation payment compared to just receiving a lump sum of $5.9 million in 2000? Not really.

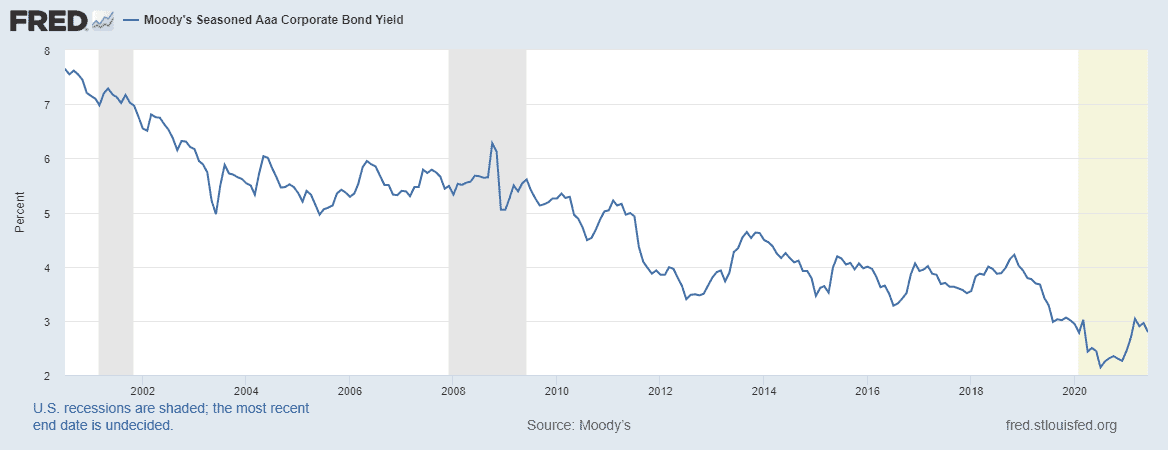

I looked at the data from the St Louis FRED for Moody’s Seasoned AAA Corporate Bond Yield.

The Yield is at 7.55%, which is close enough to the 8% Bobby Bonilla receives. Of course, relying on the Mets still being profitable enough to continue to pay is the risk Bobby took, which can be accounted for by the additional half percentage.

Lottery winners also have an option to opt for periodic payments instead of lumpsum. There are tiny but not zero risks of payment defaults. We have also seen how the government changes rules after the fact, such as the SECURE ACT on stretch IRAs. After the ProPublica piece on Peter Thiel’s Roth IRA, I anticipate some changes to Roth IRA as well.

Astute readers may ask if it was wiser for Bobby Bonilla to take the $5.9 million lumpsum in 2000 and invest in the stock market. After all, the stock market has had fantastic returns since 2000. But that would not be the correct comparison. Stocks are classified as medium to high for risk, return, volatility, and liquidity.

Of course, maybe taking a portion of the $5.9 million and investing in Moonshot stocks or Bitcoin a decade later could have worked out great. But we are then playing “Monday morning quarterback.” Is there a similar term in baseball?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

This is the most interesting take on Bobby Bonilla Day that I’ve ever read. I guess I’m just more used to reading about it on sports sites. This was vastly different. Now, I am not good with finances – while baseball is kinda my expertise. After reading your post I have another perspective and it seems like a fair deal for both sides to me! In theory, it should have worked but when you add in the name Bernie Madoff that’s where it kinda went sideways for the Mets. And while as noted, I don’t know a lot about interest, investing, taxes, or finances in general (which at my age I really should and should probably find some help to learn sooner than later! LOL! *face palm emoji*), I would have gone the same route as Bonilla. A million now isn’t really that much money but a yearly payment of a million Just knowing that you’re just gonna be getting a million+ a year for the next 30 years? You could pay me A LOT less yearly, and I’d still be stoked that it was there and reliable. And if I were Bobby Bonilla – I’d get that payment yearly on my birthday so that would work out well! LOL! Anyway, enjoyed the read very much! Thank you!

Thanks Jen. Feel free to ask any questions on interest, investing, taxes, or finances in general.

Hell Yes he got a great deal. Ive always loved how he gets a great income for years to come. Bernard Gilkey did the same thing with the Arizona Diamondbacks back when they first got the franchise. He deferred his salary of 20 million. 1 million dollars a year for 20 years.

It was a reasonable deal, but nothing special. It looks like a great deal only to those who don’t grasp the time value of money, which is almost everybody.

Agree. I was surprised at the press coverage. Ran the numbers and seemed fair to both parties.

Good article. NYC has much lower property taxes on average than the rest of NY. On the other hand, California has higher income taxes than NY on average for most people. NY does not tax social security or pensions of some types and offers pretty large deduction for others.

Yes, it is a balancing act between all the various taxes. New York and California are particularly aggressive in pursuit of former residents who’ve moved to places like Florida and Nevada.