I Bonds: Should You Sell Your Series I Savings Bonds?

Inflation is a silent killer. With the rapid rise in inflation over the last two years, I bonds became an attractive, safe investment.

With the government reporting lower CPI numbers, the earnings rate of I bonds is less attractive than when investors purchased them in the preceding two years.

Given the lower inflation rates, investors are now considering whether they should continue buying or selling existing Series I bonds.

This article will cover everything you need to know about I bonds, including benefits, risks, the timeline for purchase, maturity, redemption rates, tax implications, and how to buy an I bond.

And if you plan to sell your existing I bonds, which ones to sell, and what are the alternatives for investing your money?

Let’s dive in.

What Is An I Bond And Why Invest In Them?

I Bonds, or Series I Bonds, are non-marketable savings bonds issued by the U.S. Department of Treasury primarily for individuals to purchase and invest in. I Bonds earn a fixed interest rate for 30 years while having an inflation component that varies with inflation expectations each May and November.

I bonds are safe investments issued by the U.S. Treasury to protect your money from losing value due to inflation.

How I Bonds Work?

I Bonds work as variable interest rate Certificates of Deposit (CD) with a maturity of more than a year issued by the U.S. Treasury.

I Bonds are sold at face value. For example, if someone were to purchase a $100 I Bond, they would pay only $100 and receive the stated interest rate over the next 30 years. Interest rates on I bonds are adjusted regularly to keep pace with rising prices.

How Much Will I Earn If I Invest In I Bonds?

You earn money from two interest rates when you buy an I bond

- A fixed-rate that will never change for as long as you hold the bond.

- A separate inflation rate that varies every six months.

The fixed and inflation rates are added to give you the composite rate.

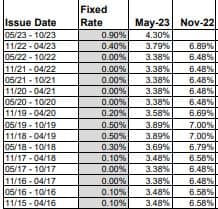

The current fixed rate for I bonds issued after Nov 2005 actually fell to 0.9% from 1.1% set in May.

The 1.3% fixed rate was a 17-year high and the last time it was this high was May 2007.

The U.S. Treasury has nudged up the popular Series I bond rate to 4.03%, a slight rise from the 3.98% offered through October. a far cry from the 9.62% for I Bonds issued 05/22 – 10/22.

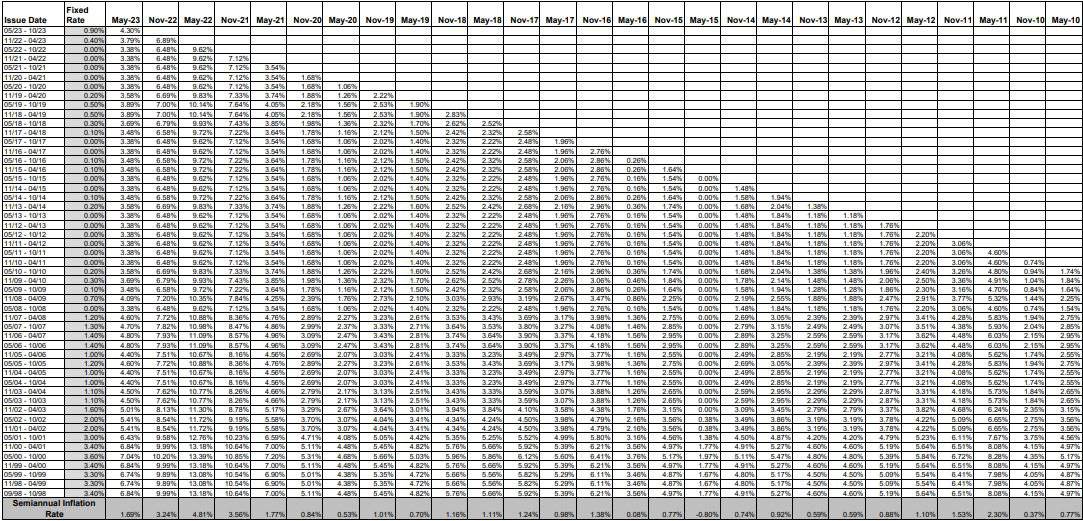

Treasury Direct has a chart showing the composite rates for all Series I savings bonds issued.

Why Invest In I Bonds

No risk

I Bonds have relatively low default risk, and I Bonds are also backed by the U.S. government, which is considered highly unlikely to default on I Bondholders.

Smaller lots

I Bonds can be bought with an initial investment of as little as $25. I Bonds come in various denominations up to $10,000.

Flexible redemption

You don’t have to redeem the whole amount. It’s okay to cash out a portion of the total purchase. For example, you can redeem $5,000 while the remaining amount continues to earn interest.

Liquid

I Bonds are low-risk, liquid savings vehicles you can redeem anytime after one year. If redeemed before five years, you lose the last three months’ interest, but they are much more flexible than bank certificates of deposit (CD).

Inflation protection

I Bonds give investors a return plus inflation protection on their purchasing power. I Bonds are known for offering interest rates that provide higher returns than many other safe investments, such as bank savings accounts.

Tax advantage

While we should not let the tax strategies wag the returns dog, it is excellent to know that I Bonds are not subject to state or local taxes. You pay federal taxes; although you can defer federal income taxes until you redeem them, you pay zero taxes until they are sold.

Compounding

The interest portion of your I Bond balance is compounded semiannually and rolled into the principal balance, meaning you earn interest on the interest already earned. I am a massive fan of compounding.

Accessible

Anyone who has an SSN can buy I Bonds. Unlike real estate syndication or other investments, restricted based on accredited investor qualifications, I Bonds has no such restrictions.

How To Buy I Bonds?

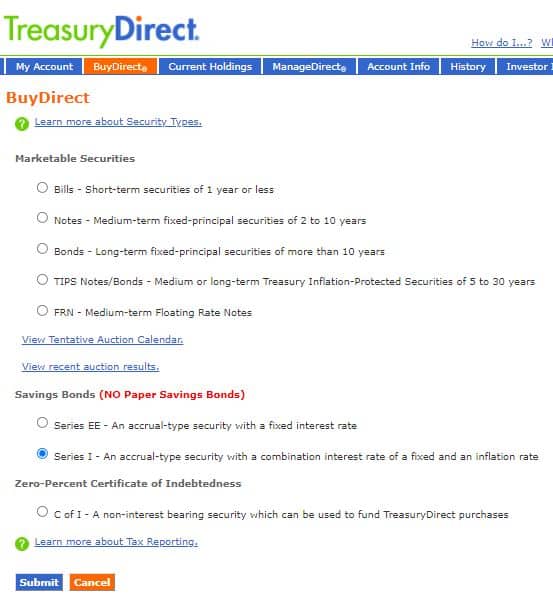

You can buy I Bonds by opening an account with Treasury Direct.

After logging in to your Treasury Direct account, go to the Buy Direct tab at the top of the page, then choose the Bonds ‘Series I’ option.

At the Treasury Direct website, you may purchase I bonds electronically up to a maximum of $10,000 per year per SSN.

You can also buy up to an additional $5,000 in the paper I Bonds if you have a tax refund due when you file your federal income tax return. You’d need to complete IRS Form 8888 and include it when you file your tax return. Some individuals make extra estimated tax payments during the year so they can claim a refund when filing taxes and get an additional allocation of $5,000 I Bonds.

Starting 1st January 2025, you will no longer be able to buy I Bonds with your tax refund.

You can establish a second Treasury Direct account for your firm with a different business name and EIN. It enables you to buy another $10,000 in I Bonds each calendar year using the same EIN.

You can purchase another $10,000 per year under the trust’s name if you have one. Residents of states like California usually create a revocable living trust to avoid probate. Your revocable living trust qualifies you to buy another $10,000 in I bonds.

If you do not already have a Trust consider creating one.

Trust & Will provides state-specific trusts for the protection and transfer of your most important financial assets. You can also nominate legal guardians for your children to make sure they are looked after by someone you know and trust, in case something happens to you.

When Do I Bonds Mature?

Series I Savings Bonds mature – meaning they stop earning interest – at 30 years. They carry a 20-year original maturity period immediately followed by a 10-year extended maturity period. After the first 20 years, I Bonds continue to earn interest for an additional 10 years unless cashed before that time.

When Can I Cash In I Bonds?

- I bonds can’t be cashed for a year after purchase. If a bond is redeemed anytime after one year and before 5 years, the prior three months of interest are lost (penalty).

- After 5 years you can cash the bonds without any interest penalty.

How to Cash in I Bonds?

The TreasuryDirect website allows you to exchange your electronic I bonds for cash. You can encash your paper bonds at any bank.

I bonds do not have a secondary market; you must redeem them only through the government.

How Are I Bonds Taxed?

The interest on I bonds is not subject to state or local income taxes. Only estate or inheritance taxes might be applicable. However, it is unlikely for you to have I bonds as part of your building generational wealth plan.

I bonds are subject to federal income taxes except when used to pay for qualified higher education expenses.

Owners can choose to pay federal taxes on the interest earned each year, at maturity, or when the Bond is redeemed. By default, taxes on I Bond interest earned are due only when you redeem them.

Differences between EE Bond and I Bond

Although the post is focused on I Bonds, I want to highlight the differences between another Treasury Direct product aimed at retail investors, known as the EE Bond.

Treasury Direct has a page comparing Series EE and Series I Savings Bonds

I would avoid EE Bond for the following reasons

1) Unlike I Bonds, the interest rate of EE bonds is fixed and not indexed to inflation.

2) EE Bonds double in value after 20 years. Although this might seem like a great deal, it is not. Because if you encash your EE bonds before 20 years, you do not get the doubling in value. You only receive the fixed rate of interest, which is currently 0.1%

Imagine an asset with such a harsh lock-in when you could make more by investing in stocks. Or real estate investing.

Differences between TIPS and I Bond

A more complicated investment is the Treasury Inflation-Protected Securities (TIPS) program. Every month of the year, the Department of Treasury auctions TIPS, either new issues or reopenings. Investors can join in these auctions by putting noncompetitive bids (at $100) at TreasuryDirect, with no costs or commissions to pay.

Treasury Direct has a page comparing TIPS and Series I Savings Bonds

The Treasury establishes the coupon rate, which determines the interest paid twice yearly on the TIPS’ principal balance after the beginning auction. However, investors at the auction pay a premium above or below par value, resulting in an actual yield to maturity for the TIPS.

TIPS are complicated because once they are auctioned, they can also be traded on a secondary market. The market value of a TIPS shifts continuously, which implies the actual yield for new investors is also fluctuating.

You can also buy TIPS on the secondary market via brokerage firms. Many brokerage firms charge commissions when purchasing TIPS. You may also invest in TIPS via ETFs such as the TIP (iShares), SCHP(Schwab), or VTIP (Vanguard).

You can use a platform like M1Finance to purchase TIPS ETFs. Check my M1Finance Review on how I use the platform to buy ETFs commission-free in an automated fashion.

I would avoid TIPS since they have a lower fixed rate and come with taxes on phantom income with no tax deferral option. Instead, I would focus on I bonds and bank bonuses to get a higher yield on my risk-free portfolio.

Are I Bonds Good for Retirees?

I Bonds earn interest monthly. However the interest and principal are paid when you redeem the bond.

Individuals looking for investments that pay monthly income would need to divide the total allowable I bond annual purchase limit into monthly amounts. And build a ladder of I Bonds by purchasing them monthly so that they receive monthly redemption.

Are I Bonds A Good Investment?

To become rich, you should be investing in income-producing assets.

Stocks also work in an inflationary environment as long as you can withstand the volatility and do not keep questioning should I sell my stocks now. Remember that growth stocks with no profits will get hit in a rising rate environment, as discussed in our article on stocks vs. real estate.

We also covered more mainstream options lower in the risk curve backed by hard assets such as farmland investing, including farmland’s inflation protection benefits. And investment in real estate crowdfunding.

Moving further down the risk curve, we have fixed-income investments. While most fixed-income assets, such as I Bonds, do not offer inflation protection, there are a few risk-free ways to protect ourselves from inflation.

I bonds are a great place to store your emergency funds. Usually, the interest rate is generally low, but the I Bonds currently offer a significant rate due to rampant inflation.

I bonds are low-risk, and the best time to buy I bonds is when interest rates in the economy start rising. Investors should keep an eye on inflation and adjust their bond purchases accordingly.

I Bonds won’t help you get rich. But after you are rich, it can be a part of your asset allocation if you want to keep pace with inflation risk-free and can be a part of your bond portfolio.

Should You Sell Your Purchased I Bonds

The 0.9% fixed rate of the I Bond offered currently could make it a good choice for long-term investments since you will receive 0.9% above inflation for 30 years.

Also, the government has an annual purchase limit. If you want an extensive bond portfolio, holding on to your existing I bonds might make sense as you purchase more yearly.

But if you prefer to optimize your bond portfolio, what specific I bonds should you sell?

Consider the following factors

1. Age of Bonds: Have your I bonds matured for at least a year? You cannot redeem I bonds until they have been held for this minimum period.

2. Tax Implications: Are you prepared to manage the federal income tax on the earnings? While exempt from state and local taxes, federal income taxes are due on the interest unless used for eligible higher education expenses, which may allow for a tax exclusion. Detailed eligibility for this exclusion can be checked through IRS Form 8815 at irs.gov.

3. Investment Goals: Do you aim to increase your holdings of I bonds? Remember, the annual purchase limit per individual is $10,000. If you redeem old I bonds worth $10,000, you can still buy new ones up to this limit, plus an additional $5,000 in paper I bonds using a federal tax refund. But if you want to build an I Bond ladder then retaining older bonds and continuing to add to them might not be a bad idea.

4. Penalty for Early Redemption: Are the I bonds less than five years old? Redeeming them before five years results in a loss of the last three months of interest. Post five years, there are no penalties for cashing out.

Accordingly, here is a helpful table of which I bonds you should consider redeeming and when you can do it. Since I Bonds can only be redeemed after a year and you loose the last 3 months of interest, here is how to maximize your redemption.

| Your I Bonds Issue Date | When Your I Bonds Start Earning 3.38% | Earliest Possible Redemption |

|---|---|---|

| Nov 2021 | May 2023 | Aug 2023 |

| Dec 2021 | Jun 2023 | Sep 2023 |

| Jan 2022 | Jul 2023 | Oct 2023 |

| Feb 2022 | Aug 2023 | Nov 2023 |

| Mar 2022 | Sep 2023 | Dec 2023 |

| Apr 2022 | Oct 2023 | Jan 2024 |

| May 2022 | May 2023 | Aug 2023 |

| Jun 2022 | Jun 2023 | Sep 2023 |

| Jul 2022 | Jul 2023 | Oct 2023 |

| Aug 2022 | Aug 2023 | Nov 2023 |

| Sep 2022 | Sep 2023 | Dec 2023 |

| Oct 2022 | Oct 2023 | Jan 2024 |

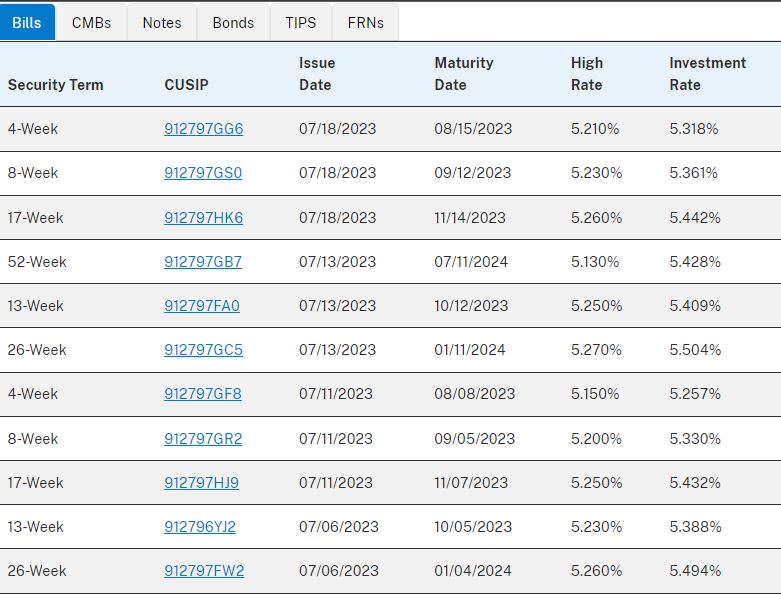

After selling the I bonds, consider Treasury Bills if you want to re-invest that money for higher rates in the short term.

Some T-Bills yield as high as 5.5% compared to the current composite I Bond rate of 4.3%. Follow this step-by-step guide on how to buy T-Bills.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

What address do I go to to buy bonds

The URL and the screenshot of the steps are in the section “How To Buy I Bonds” of the article. Let me know if you run into issues.

Can Series I Bonds be bought for others, like grandchildren? If so, how would one do this? Looking to hopefully by paper as a gift.

Treasury is moving everyone to electronic system and only few instances you can buy the paper bonds. Series I paper bonds can be bought as gifts when you request your refund from IRS. If you overpay your estimated taxes, when you file your IRS tax return, you can buy paper Series I savings bonds for yourself or others if you are owed a refund. https://www.treasurydirect.gov/indiv/planning/plan_gifts.htm

Just to clarify, the series I bond interest is reset every 6 months. So there is no way you can lock in the current high rate for the remainder of the 5 year period. Unless you want to be actively monitoring the rates announced every 6 months, you could consider custodial accounts for your grandkids. Stocks over a long period have historically yielded higher returns. M1Finance does offer a set it and forget portfolio with automatic rebalancing. Here is my M1Finance review.

Yes you can. The website has a place to buy gift bonds.

Yes. You can buy I bonds as gifts at https://www.treasurydirect.gov/indiv/planning/plan_gifts.htm

Note that the interest rate resets every 6 months, so it is entirely possible we do not get the current high rate for the full duration of the 5 years

Question. I reside in Puerto Rico, which is Federally tax exempt. Is P.R. considered as local o r state? If so it would have full exemption.

PR is not a state and considered as a U.S. territory. Did you move under Act 20/22?

I have the same question.

I born and live in Puerto Rico

Puerto Rico has tons of tax benefits so it is better to check with your local CPA. Either case, the I-Bonds rate for bonds purchased in May 2022 is higher than in the recent past. No other government bond offers this high rate of return. Personally I would invest just for the rate of return even if there are no tax benefits; but you are the best person to decide what makes sense for your financial goals.