What Is Dollar-Cost Averaging and 4 Reasons Not To Use It

Investing may be an excellent method to safeguard your financial future, but knowing where to start and how much money to put in is hard.

Many people are hesitant to invest because they don’t want to lose money. They think that if they wait until the “right time” or until they have more money saved up, they’ll be able to invest without taking on too much risk.

Dollar-cost averaging is an intelligent way to invest no matter how much money you have. Let us explore the dollar-cost averaging approach, its advantages and disadvantages, and when you should avoid it.

What Is Dollar-Cost Averaging?

Dollar-cost averaging (DCA) is a method for investing where an investor makes regular purchases of a target asset at set intervals, regardless of price, to lessen the impact of volatility.

Dollar-Cost Averaging aims to mitigate the risks of investing in the stock market. Investors commonly use it to buy shares slowly and steadily rather than risk losing money by purchasing all at once. When an investor dollar-cost averages, they buy more shares when prices are low and fewer shares when prices are high.

Dollar-Cost Averaging Example

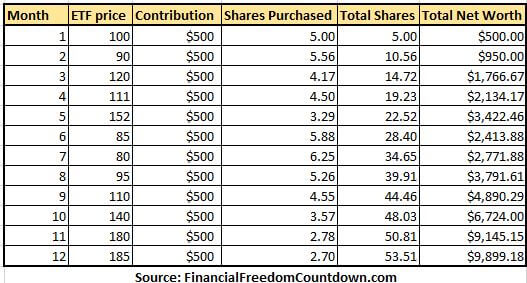

Investors buy more shares when the price per share drops below what they paid for them. When the price per share has increased above what they originally paid for them, investors buy fewer shares because they now have to spend more money on each share.

Dollar-cost averaging is a way to buy stocks at a fixed schedule but at different prices. It enables an investor to buy shares at an average price rather than a fixed price.

If you are contributing to your workplace retirement plan like a 401(k), you might already be dollar-cost averaging without even realizing it. When you opt-in to your 401(k) plan at work, you define how much of your paycheck is used for 401(k) investments. Payroll will deduct the contribution amount at regular intervals of every pay period, and your 401(k) provider will invest it based on your 401(k) investment options.

The DCA nature when purchases occur coupled with tax benefits makes it possible for individuals to accumulate large sums to retire early with 401(k).

How Dollar-Cost Averaging Works

Investors use dollar-cost averaging with stocks, exchange-traded funds (ETFs), and mutual funds. However, you can also use it with other income-producing assets like bonds and other financial instruments with high trading volume and lower price points.

While dollar-cost averaging is a great strategy, a few things to keep in mind as an investor.

First, dollar-cost averaging works only if you are willing to invest, whether the stock prices are low or high. If you prefer to buy at one price only, this strategy may not work.

Second, dollar-cost averaging works best if you invest at regular intervals. Trying to time the market is impossible even if we have all the financial information beforehand. Markets are made up of many players, including the central banks and the Treasury. We have seen how the fiscal and monetary policies prevented the last recession, and everyone who expected the markets to be lower was pleasantly surprised.

Third, dollar-cost averaging works best if you invest the same amount of money every time. It is essential to average out costs and reduce risk due to volatility.

Dollar-Cost Averaging Strategy in Various Market Conditions

To understand dollar-cost averaging, let’s take a look at the following three market scenarios:

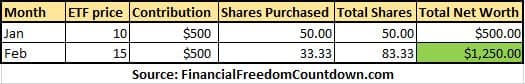

Rising Market

Here, an investor buys $500 of stock for $10 per share. After one month, the price has increased to $15. The investor decides to buy another $500 worth of stock for a total investment of $1000 and a lower average cost per share of $12.50. The total investment is worth $1,250 at the current price with a profit of $250.

If the market continues to rise, the investor will make a profit on the purchase made in the second month. Of course, dollar cost averaging will underperform lump sum investing in rising market conditions

Falling Market

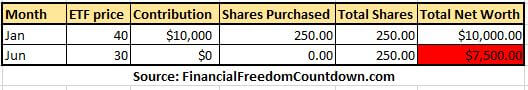

When the stock market falls, investors indulge in panic and selling. If you are unwilling to lose some percentage, you must be willing to dollar-cost average in declining markets.

Let’s assume that Panic Peter buys $10,000 worth of stock at $40 per share at the start of the year. The stock market begins to fall, and by June, the price per share has fallen to $30. Panic Peter decides to sell all of his shares, losing $2,500 on the stock price.

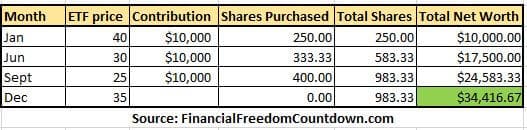

Instead of Panic Peter let us look at Steady Sam, who decides to dollar cost average in the same market. Steady Sam would have bought $10,000 worth of shares for $30 each in June.

In September, the stock falls to $25, and Steady Sam buys another $10,000 more.

By December, the stock climbs back to $35. Although the stock is still below the initial $40 Jan purchase, because of the dollar-cost averaging, Steady Sam has a profit of $4,416.67.

Flat or Rangebound Market

The stock price will remain relatively close to its previous levels in a rangebound market. In other words, there will be no drastic reductions or increases in the stock price. Let’s assume that the investor buys $10,000 worth of stock at a price per share of $40.

The stock market remains rangebound, and the price per share stays relatively stable. The investor will make no profit or loss on the stock.

In a flat market, dollar-cost averaging does not provide any benefits or downsides.

Is Dollar-Cost Averaging a Good Investment Strategy?

Dollar-Cost Averaging, one of the most popular financial investment techniques, is often praised by investors. Investing involves risk. DCA allows you to invest a fixed dollar amount at regular intervals to buy more shares when the market is down, known as a buy-low strategy. Some of the advantages of dollar-cost averaging are

Start Small

Whether you own a business or work at a job, people get paid periodically (monthly or every two weeks). Instead of saving all the money and deciding when to invest and how much to invest, the best course of action is investing as soon as you get paid and automating that behavior.

Dollar-cost averaging does not require a significant amount of money upfront.

Reduced Volatility

DCA minimizes the influence of short-term price fluctuations by averaging out costs over time. Individuals will not need to worry about purchasing a stock just as it is about to increase in price, only to watch it decrease.

On the other hand, investors will often sell a stock just before it increases in price. Investors that use dollar-cost averaging outperform investors that try and time the market.

Habit Formation

Dollar-cost averaging emphasizes investing as soon as you get paid. One of the best personal finance advice is to treat investing like a “pay yourself bill.”

It is easier to get folks to invest weekly with smaller amounts instead of expecting them to save and wait till they have a more significant quantity. It is hard to keep smaller amounts and resist the temptation to avoid spending it before it reaches that more substantial threshold.

With dollar-cost averaging, you invest what you have and build a habit of contributing to increasing your liquid net worth.

Auto Invest

The best results from investing come from putting money to work in the market regularly. It is hard to know what causes the markets to rise and fall daily. Investors do not control when the market rises or falls. Also, trying to time the market is a fool’s errand and will result in lower returns due to the cash drag. Typically cash performs worse than all other assets considering inflation. So rather than waiting in cash, you are auto-invested with dollar-cost averaging.

Investing a significant amount in one swoop will also lead most folks to second guess themselves. They will wonder if this is the right time to invest or should they wait for “lower” prices. The result of this analysis paralysis will result in them never getting started.

The auto investment part of dollar-cost averaging eliminates the analysis paralysis.

Tax-efficient Rebalancing

Portfolio balance is a significant factor in managing a diversified portfolio. After you have decided on your asset allocation, it is always a good practice to periodically rebalance your portfolio.

Consider a portfolio of 60% stocks and 40% bonds. If stocks increase in value, the portfolio now becomes 70% stocks and 30% bonds.

If you want to rebalance, you will eventually be forced to sell some of your stock holdings. Rebalancing restores asset classes to their target allocations by selling appreciated assets and buying those that have declined. It is, at its core, a risk-minimizing strategy and is also meant to increase returns due to the reversion to mean theory.

Selling stocks could be a taxable event, and our tax strategy is to minimize taxes.

Dollar-cost averaging is a great way to avoid the sale of specific investment holdings when their price goes up significantly. With dollar-cost averaging, your future contributions would buy more bonds and no stocks until your portfolio is rebalanced to the original 60/40 stock-bond ratio.

Therefore, if you use dollar-cost averaging, you take key advantage of the market conditions when they are down and buy more shares. It allows you to maintain a constant portfolio balance. Investors need to be disciplined and committed to their investment plan to perform this technique successfully.

By investing a portion of your money over time, you attempt to maintain a balanced portfolio by rebalancing your holdings periodically without selling.

Psychological Benefit

Investing takes discipline because many people feel that they can get more bang for their buck by investing in the stock before it goes up or selling before it drops in price.

We are all humans, and investor psychology is paramount. If someone diligently saves and invests a large sum, and the market drops suddenly, they will freak out and may shy away from any further investments. Psychology and behavior are essential for investing, so dollar-cost averaging helps individuals with low-risk tolerance.

Dollar-cost averaging can be a fantastic way to hold on to an investment when you don’t know whether the market will rise or fall. Dollar-cost averaging can help you preserve your investment and avoid panic selling.

Is Dollar-Cost Averaging Better Than Buying the Dip?

Dollar-cost averaging is one of the most famous investment strategies, but can it outperform a strategy known as buying the dip? Let’s take a look at how both of these strategies work.

The buy the dip strategy relies on market timing twice. You need to recognize the top and have perfect foresight to sell at the top. Then you need to have flawless luck to time the bottom of the market and buy the dip.

There are two problems with buying the dip strategy.

1) Market timing is challenging, even for professional investors, and for “buy the dip” to outperform, you have to be right at least twice.

2) The second reason “buy the dip” frequently fails is that market downturns are unusual and don’t occur as often as expected. If the dip you are waiting for never comes, then “buy the dip” is just a 100% cash strategy. So think carefully before waiting for one because your portfolio will likely miss out.

Typically cash performs worse than all other assets considering it loses its purchasing power against inflation and does not produce income. If you can’t time the top and the bottom perfectly or if there are no dips to purchase, staying in cash is a poor way to invest for the long term.

Dips of more than 15 percent are infrequent. However, while significant drops may provide more enormous rewards, predicting them ahead of time is nearly impossible. If market timing were so easy, we would all be rich. Even hedge fund managers cannot beat the market consistently over long periods. The Medallion fund by Renaissance Technology is one of the few outperformers, and even it uses algorithmic machine learning-based short-term trades.

Is Dollar-Cost Averaging Better Than Lumpsum Investing?

Lumpsum investing is when you quickly invest all of your available money at once.

Based on historical data, U.S. stock indices typically go higher over a long period since stock markets are loosely related to GDP. If markets are expected to be higher in the future, then the lump sum investment strategy will always result in a greater return than dollar-cost averaging.

Based on research, lumpsum investment beat dollar-cost averaging most of the time. However, lumpsum investing is a riskier strategy, and some investors prefer to use dollar-cost averaging to hedge against the volatility of the financial markets.

Dollar-cost averaging is an excellent way for investors to protect their investments from fluctuations in the market on a psychological basis. If someone invests a significant amount, and the market drops suddenly, they will freak out and panic sell, locking in the losses. They would also be afraid to reinvest. Instead, they may prefer to divide the large sum into equal dollar amounts and automate investing regularly.

Remember that if you use a dollar-cost investing strategy to invest a lump sum, it is good to have a specific time frame in mind before you start investing. So plan to dollar cost average the lumpsum investment in six months to two years. Otherwise, you might wait in cash for too long, struck by “analysis paralysis.”

Lumpsum investing can be an aggressive way to invest in the market based on the assumption that U.S. stock indexes have consistently trended higher over long periods. Of course, past performance is no guarantee of future performance, but if U.S. stock markets are doomed to crash for an extended period, we have more significant global issues.

What Are the Disadvantages of Dollar-Cost Averaging?

Dollar-cost averaging is an excellent way to invest in the market, but there are certain disadvantages that investors should be aware of.

No Downside Protection

Dollar-cost averaging is only beneficial if the asset’s value rises over time. The technique can not protect investors from the prospect of falling market prices.

Need Long Term

Another disadvantage is that the dollar-cost averaging strategy also requires a long-term outlook on your investments. So if you need the funds for short-term expenses, it is better to use I-Bonds.

Possibly Missing Gains

Dollar-cost averaging is a valuable tool for lowering risk—however, those who use this technique risk missing out on significantly higher earnings.

If the market rises while you are dollar-cost averaging, you may miss out on potential gains if you invest immediately with lumpsum investing.

Higher Trading Costs

If you are with a brokerage that charges fees for every trade, buying more frequently raises transaction costs. However, with several brokerages offering free trades for investing in stocks, you should open an account with no-fee investment firms. There is no need to pay more brokerage fees.

How Long Should You Dollar-Cost Average?

There is no fixed amount of time that you should dollar-cost average for. Many people will continue investing using this strategy throughout their careers or wealth accumulation phase.

You can stop dollar-cost averaging after you are ready to retire. If you are using retirement calculators to determine when can you retire, make sure to update the future retirement contributions to zero.

Does Dollar-Cost Averaging Work Better for Growth or Value Stocks

Dollar-cost average works for both growth and value stocks.

In his 1949 book The Intelligent Investor, Benjamin Graham first advocated dollar-cost averaging. The book is on every best beginner investing books list due to the ground breaking concepts explained in simple language. Graham is also widely recognized as the “father of value investing” and is the inspiration for several Warren Buffet quotes.

Value stocks typically pay dividends as these companies may have sizeable excess cash. The dividends issued by the companies are substantial enough to be used to buy stocks using the dollar-cost averaging method.

Before the advent of brokerage firms, public companies administered dividend reinvestment plans (DRIPs) for their stocks. A DRIP is a program that permits an investor to automatically reinvest dividends received into additional shares or fractional shares of the issuing stock.

Growth stocks typically do not pay dividends since they redeploy the excess capital into growing the business and capturing a larger market share. However, growth stocks experience massive volatility due to lumpy earnings and constantly changing business strategies.

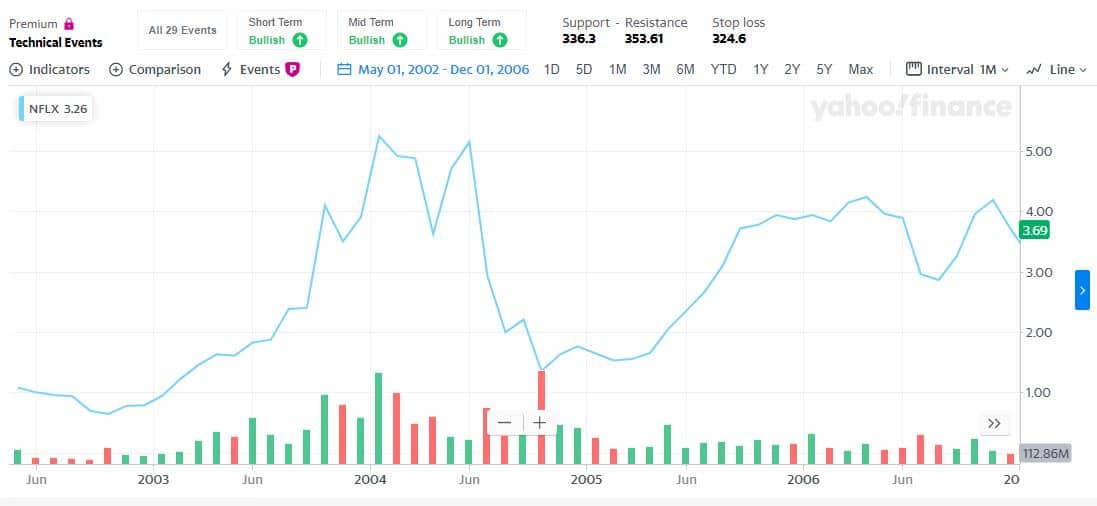

Let us take Netflix as an example. Initially, they started with mail-order DVDs. Then they moved into streaming. Now they are like a movie studio producing original content. Netflix had a monstrous decade, but you can see the price volatility even if we exclude that period.

Dollar-cost averaging helps with reducing the volatility of purchasing growth stocks.

Moonshot companies are growth stocks, and I use M1Finance to dollar cost average into them.

Does Dollar-Cost Averaging Work in a Bear Market?

Dollar-cost averaging is an excellent strategy to employ when buying and holding in a bear market since it minimizes the effects of stock price drops. When stocks fall in value, your weekly or monthly purchases give you more of them, lowering your average cost.

Dollar-cost averaging can help you earn a profit when the market rebounds and equities rise in value. Your average cost will be lower when the market turns around, allowing you to make more money during a bear market. Dollar-cost averaging helps you avoid making significant losses by ensuring that you continue to invest as prices fall.

Also, dollar-cost averaging during a bear market eliminates the fear of investing, which plagues most investors who sit in cash, unable to decide when to invest.

Does Dollar-Cost Averaging Work in a Bull Market?

Dollar-cost averaging in a bull market may not be as beneficial. If the market as a whole rises steadily for some time, dollar-cost averaging will result in lower profits when compared to putting money down at the start of the bull run.

One of the reasons why lump sum investing is always recommended is if you have a long time horizon.

What Is the Best Way to Dollar-Cost Average?

1) Based on your budget template, decide how much you can allocate every month to invest.

2) Once you have the necessary amount decided, open an account on your investment platform based on the asset you want to dollar cost average. For stocks or index funds, I recommend M1Finance. For crypto Coinbase and real estate crowdfunding, it is Fundrise.

3) Decide the asset allocation on each of these platforms. So for index funds, you can pick different ETFs, or for Crypto, you can decide which coins to allocate your money to.

4) Automate the investment and forget about it. Please resist the urge to constantly check on your investment and tinker with it no matter the price.

5) If your investments pay a dividend, you can reinvest the dividends in the same assets.

6) If some of your assets increase drastically compared to others, your asset allocation may need to be brought back into balance. Generally, the platform you select can automatically rebalance your assets. If not, you might need to rebalance your investments periodically to your target allocation. Studies show that a six to twelve months rebalancing frequency provides the best results.

Once these investment decisions are made, dollar-cost averaging can be a breeze.

Dollar-Cost Averaging Stocks

It is easier than ever to dollar cost average into stocks with several investment platforms available. My personal favorite brokerage account is M1Finance, and you can read my M1Finance review for more details.

I prefer M1Finance because it has zero fees, a wide selection of ETFs, auto-investment, and auto-rebalance features. It also has pre-built asset allocations if you want to get started immediately and fractional shares purchases so you can buy expensive stocks or ETFs even if you do not have all the money.

Dollar-Cost Averaging Crypto

Although the article focused only on stocks, you can use the same approach for highly volatile assets like investing in crypto. Dollar-cost averaging may be an intelligent technique for long-term crypto investors and those who passively want to invest in cryptocurrencies, as the crypto market is notoriously unpredictable.

Based on historical data, dollar-cost averaging Bitcoin or Ethereum has proved to be a winning strategy. However, since there is no crypto ETF, it is best to stick to larger cap coins vs. venturing into smaller coins.

Coinbase allows individual retail investors to set up recurring investments so dollar-cost averaging can be automated.

Dollar-Cost Averaging Real Estate

Although real estate is one of the oldest asset classes, it has been hard to eliminate market volatility and manage risk. The housing crash starkly reminds us that market declines can wipe out attempts to build wealth.

Since it is expensive to buy houses, one does face risks in buying properties even after evaluating rental properties against specific investment criteria.

Due to the large sums involved, it would be great if there was an automatic trading plan for buying real estate.

The closest option to the dollar cost average in real estate is via REITs or real estate crowdfunding. Platforms like Fundrise, which allow you to buy real estate for a low minimum of $10, make it easy to dollar cost average.

Final Thoughts on Dollar-Cost Averaging

Investing is the foundation of personal finance, but it can be confusing and risky, especially if you don’t have much money.

You may have heard that you should never invest your money because it’s too risky. Or maybe you’ve been told that you need to have a lot of money saved up before investing.

Dollar-cost averaging is an intelligent way to invest no matter your budget and increase your average net worth. You use this investing technique by staggering your purchases over time to acquire more shares when prices are low and fewer shares when they’re high. It protects you from market fluctuations and helps you achieve your financial goals over time.

Dollar-cost averaging can be used in the stock market, real estate, and Crypto.

Do you prefer lumpsum investing or the psychological advantages of dollar-cost averaging? Besides stocks, have you tried to DCA into other asset classes?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.