Hedge Funds vs. Mutual Funds: Which is the Better Investment?

Investing can be a daunting task. You want to ensure that you learn how to invest your money in the best way possible, which can take time and effort.

Hedge funds and mutual funds are both popular investment options that offer managed portfolios for investors.

So which is right for you? Let’s take a closer look at the critical differences between hedge funds vs. mutual funds.

Hedge funds cater to high-net-worth individuals and often employ more aggressive and volatile trading strategies to generate positive client returns. In contrast, any investor can purchase a mutual fund, but these products are subject to greater regulation concerning what types of assets they can trade.

What Is a Mutual Fund

Many investors use mutual funds for their brokerage accounts and the retirement accounts like traditional 401k, Roth 401k, Individual Retirement Accounts (IRA), Health Savings Accounts (HSA), and other long-term accounts.

Mutual funds are strictly regulated by the SEC through two regulatory directives: The Securities Act of 1933 and the Investment Company Act of 1940. A mutual fund manager has to stick to these outlines in their prospectus.

Mutual funds can be open-end or closed-end funds.

Mutual funds are open-ended funds, which means they can issue unlimited new shares with the net asset value reestablished after the market closes. Closed-end funds offer a fixed number of shares, and no more are created. Close-end funds often trade above or below the value of the assets in the fund.

Mutual funds contain only certain income-producing assets, typically stocks and bonds. Mutual funds would not hold alternative investments.

A fund manager can actively manage mutual funds by making regular decisions on the assets in the funds and actively trading them. Or mutual funds can be passive such as an index fund.

Types of Mutual Funds

Investors have many choices when picking mutual funds. There are hundreds of different mutual funds to choose from, which makes it challenging.

Many investors use online screeners and enter their criteria to narrow their choices. Some investors stick with one or two mutual fund companies like Vanguard, Schwab, and Fidelity. Some of the different types of mutual funds to invest in include:

Stock mutual fund

Bond mutual fund

A combination of stocks and bonds

Stock mutual funds can be

- Style-focused such as growth or value investing, small-cap or large-cap.

- Geographic such as emerging, developed, or frontier markets.

- Real estate-focused funds such as REITs

- Sector-based mutual funds invest in one of the nine stock market sectors, like non-discretionary, energy, technology, health care, etc. My moonshot portfolio is a technology-focused fund.

- Environmental or green funds invest in green technology, wind, and solar power companies. Be aware that Socially Responsible Investments (SRIs) and ESG investments might have different criteria than expected.

- Funds that invest in dividend and interest-bearing stocks. Dividend Aristocrats are a great example of a dividend mutual fund.

Bond funds focus on fixed-income instruments such as corporate bonds, government bonds, TIPS, etc.

Retirement funds used for retirement investments are usually a combination of stocks and bonds. For example, if you plan to retire in 2040, a 2040 target date mutual fund could be an option. The manager will continue to allocate more to bonds when it gets closer to 2040. Target date mutual funds change the stock/bond allocation every year depending on your age

Index funds track a specific index, such as S&P 500, Dow Jones, etc.

On a related note, mutual funds are a lot like exchange-traded funds. Mutual funds change prices only at the end of the day. Exchange-traded funds change prices throughout the trading day. Both are regulated by the Securities and Exchange Commission (SEC).

Actively Managed Mutual Funds vs. Index Mutual Funds

An actively managed fund is run by a fund manager or managers whose job is to pick the correct stocks and beat the underlying benchmark index. Picking stocks yourself takes work. It is much easier for a fund manager to pick stocks and when to buy and sell them.

There is no question that a fund manager will be better at making the stock market decision than most individual investors. There are pros and cons to an actively managed fund.

Pros of Actively Managed Funds

There are several positives with funds that have an active manager, including:

- A chance to outperform the underlying index of the mutual fund

- There could be tax advantages because the fund manager will keep taxes in mind when buying and selling stocks in the fund.

- An active manager can move quickly in an ever-changing market and economic condition. After all, investing during a recession is more challenging than in bull markets.

Pros of Index Funds

An index fund invests in indices and will match that index. It shouldn’t do worse than the underlying index. Popular indexes include the Dow Jones Industrial Average, the S&P 500, the Nasdaq Composite, and many others.

- An index fund will have lower fees because the manager is just trying to mimic the underlying index.

- These funds have a buy-and-hold strategy, which can lead to tax advantages.

- It is easy to see if the fund stays the course and buys stocks within the index. And importantly, they are trying to avoid bumping their results by buying more high-flying stocks outside the index.

Cons of Actively Managed Funds

These funds have some negatives, but they are not terrible and still make a good investment for any portfolio.

- Since the manager is trying to outperform the market, they can make mistakes and buy the wrong stocks or time the stock market incorrectly and lose money.

- Fees, like the expense ratio, will be higher because it takes money to pay the manager to run the fund.

- Historically, actively managed funds, on average, have underperformed the underlying index. So it is essential to look at the manager’s experience and history and pick suitable funds.

Cons of Index Funds

Even though index funds are more straightforward and usually work well, there are some cons to index funds:

- An index fund’s manager will have constraints when which stocks to buy. Since they follow or mimic the underlying fund, they rarely outperform that index.

- There is no downside protection. If the overall underlying index falls, the index fund will decline. A classic example would be investors who focus on a country-specific index, and the country is plunged into turmoil.

- The fund manager will have little flexibility in buying stocks since the managers are just following the fund’s prospectus.

The best thing about mutual funds is that anyone can buy them with no or low initial requirements.

How To Buy Mutual Funds

The best way to buy mutual funds is via ETFs on M1 Finance. It is the perfect investment platform compared to Vanguard, Schwab, Fidelity, Wealthfront, and Betterment. M1 Finance has zero fees, very low minimums ($10), automated investment with automatic rebalancing, pre-built asset allocations, and fractional shares. You can read my M1 Finance review, including the comparison with other platforms.

What Is a Hedge Fund

Hedge funds are not for the average investor. Hedge funds are limited partnerships with private investors investing or limited partners that put their money into the hedge fund. Hedge funds are considered high-risk investments.

Professional money managers run hedge funds and are not constrained in their methods and what they can do, like mutual fund managers.

A hedge fund manager can use various trading techniques like leverage and trading methods to gain above-average earnings. Hedge funds rely on options, short selling, derivatives, and shorting the market to gain an advantage.

Hedge funds are riskier than mutual funds and usually cater to only sophisticated investors meeting the accredited investor qualifications with a high minimum initial investment or high net worth. Hedge funds are popular investment strategies with wealthy clients.

Hedge funds investors are high-net-worth investors, insurance companies, investment banking, pension funds, university endowments, brokerage firms, and trusts.

Hedge funds are actively managed, and there are no passive hedge funds or ones that follow an index. Hedge funds are looking for exceptionally gains each year, regardless of the overall market.

Although Berkshire is a conglomerate and operates like a hedge fund with leverage, one of Warren Buffet’s famous quotes is for individual investors to invest in the S&P 500.

Because very few hedge funds can beat a simple strategy such as picking a low-cost index fund, Jim Simmons and his legendary Medallion fund are an exception and one of the few hedge funds that have consistently outperformed.

How To Buy Hedge Funds

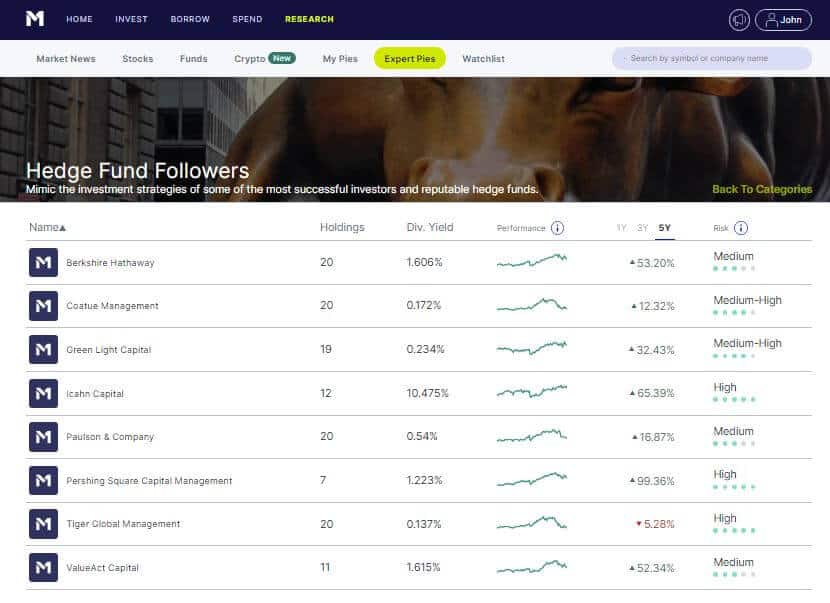

Hedge Fund managers file prospectus, and some platforms, including M1 Finance, attempt to recreate some popular hedge fund manager portfolios using Expert Pies.

Note that the trading information is available with a lag, so it is impossible to accurately recreate the performance of Ray Dalio‘s portfolio or David Swensen’s portfolio.

Also, some investments take more work for retail investors to access. Platforms like Yieldstreet provide investment options in art, structured notes, supply chain financing, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $2,500.

Hedge Funds vs. Mutual Funds

While mutual funds and hedge funds can seem similar, they are different.

Mutual funds have the following characteristics.

- All investors can buy mutual funds, often with an investment as low as $10. Investors do not have to be accredited investors to invest in mutual funds.

- Fees are lower with mutual funds. Actively managed mutual funds have an average expense ratio of between 0.5% and 1.0%. Rarely will one have an expense ratio above 2%. Some mutual funds have a front-end load or a back-end load fee. It would be best if you avoided those. Passively run index funds have a much lower expense ratio than actively managed mutual funds and are also no-load funds.

- Although mutual fund managers charge fees, they do not take any share of the profit.

- Mutual funds are fully regulated by the SEC.

- Mutual funds buy and hold securities, like stocks and bonds, based on their strategy spelled out in their prospectus. There usually is no leverage or exotic investments unless explained beforehand in their prospectus. Typically, mutual funds cannot invest in a risky investment vehicle.

- You can buy and sell mutual funds any time of the day when the markets are open.

Hedge funds differ from mutual funds and will have the following characteristics.

- During bear markets, hedge funds could outperform the stock market and return positive returns because they can use a variety of esoteric investments and trading strategies like options, shorting, and derivatives.

- Only accredited investors can invest in a hedge fund.

- Hedge funds cannot be bought or sold when an investor wants to. They can only be purchased or sold during limited windows to invest or withdraw your money.

- They are structured as a limited partnership, and because of this, they are not as regulated as mutual funds by the U.S. Securities and Exchange Commission.

- Hedge funds fees are higher than mutual funds based on their performance and as assets under their management. They usually charge a management fee of 2% of assets being managed and also charge based on a percentage of profits. This charge can be around 20%, known as carried interest, and is a performance fee.

Hedge funds are permitted to invest in alternative assets like timber, farmland, currencies, commodities, cryptocurrencies, real estate investing,

| Mutual Funds | Hedge Funds | |

|---|---|---|

| Accessibility | All investors | Only accredited investors |

| Number of participants | More than thousands | Few |

| Minimum Investment | $10 | Over $10,000 |

| Regulations | Highly regulated | Loose regulations |

| Investment style | Not as aggressive | Aggressive |

| Assets | Stocks, bonds or futures contracts | Alternative assets including timber, real estate, currencies, commodities, contract financing, derivatives, etc. |

| Fees | Low expense ratios for index funds. Some mutual funds have front or back loaded fees | Management fees and Performance fees which include a portion of the profits |

| Liquidity | Easy to redeem | Usually have lock-in period and no secondary market |

Investing Choices for Investors: Hedge Funds vs. Mutual Funds

Investors have all kinds of choices for where to put their investment funds, like stocks, bonds, mutual funds, hedge funds, alternative investments, and many more options. What an investor invests in will likely be decided by their financial goals.

Short-Term Investments

A short-term investment is usually between 6-months within two years. The main reason is to build an emergency fund.

An emergency fund should have enough to cover three to six months of living expenses like rent or mortgage, food, utility bills, car repairs, and medical needs.

Long-Term Investments

Long-term investments are used for long-term financial goals like retirement funds, college education funds, and other reasons. Long-term investments are less safe than short-term investments, but they offer much better returns as long as they are held. Investment vehicles that investors use include mutual funds and hedge funds.

Anyone can invest in mutual funds, and most do invest in them. It usually only takes a minimum investment of $10. You can choose from thousands of mutual funds and invest in almost any market sector, or you can invest in mutual funds that mainly hold bonds. Mutual funds are publicly traded securities, while hedge funds are not publicly traded securities.

Only accredited investors can use hedge funds in their investment strategy.

You know what you’re getting with mutual funds since it is always spelled out in their prospectus. They are heavily regulated by the SEC, and fund managers cannot use exotic investments to boost their profits.

The SEC regulates hedge funds as limited partnerships, giving hedge fund managers far more leeway. Hedge fund fees are much higher than mutual funds, and the management fee can be much higher.

Mutual funds charge much lower fees, usually in the expense ratio. Actively managed funds have a higher expense ratio because of the mutual fund management fees, which should always be at most 1.5% to 2%.

Passive funds, like index funds, will have a low expense ratio. Stay away from mutual funds that have either a front-end or back-end load. They take more money from your investment and usually do not do better. Vanguard is a well-known fund company that sells no-load funds.

While both hedge funds and mutual funds hope to achieve profits, hedge fund managers are not constrained by the investment methods they can use to achieve those profits. Those methods can also come with more risks.

When it comes to hedge funds vs. mutual funds, mutual funds win because that is the investment where the vast majority of the average investors or retail investors can invest.

Of course, increasing your income or average net worth to meet the accredited investors’ guidelines is a great goal if you want to invest in hedge funds.

Increase your income by improving your human capital or developing high-income skills to make money from home. Even if you want to continue with vanilla mutual fund investing, having a greater liquid net worth or creating generational wealth is always a great stretch goal.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.