How to FI: Calculate Your Financial Independence Number and Achieve It

You want to retire, but it seems too far away. Most people can’t quit until they hit a specific number in their bank account. As an interim goal, have you considered Financial Independence (FI)?

Financial Independence is not about retiring on a beach with no worries. Learning how to FI will ensure you have enough money to live comfortably and do whatever makes you happy without worrying about money.

Let us dive in and figure out how to FI along with calculating your FI number and steps to achieve Financial Freedom.

Why You Should Be Financially Independent (FI)

Financial Independence gives you options – it opens up a world of possibilities for how you want to live your life.

When you don’t have to worry about money, you’re free to do what you love without restriction, which can be incredibly rewarding.

While many individuals do not want to pursue retirement, being financially independent will help you be selective about the stressful situations in your life.

It empowers you to say NO in your work environment. If your boss expects you to work on weekends, you can refuse without worrying about the loss of income from your job. If you want to take an extended leave of absence to visit your parents, you can request vacation time without fearing any repercussions.

FI is also a great way to ensure your retirement savings last as long as you do.

If you don’t have to rely on a fixed income during retirement, your savings can last 30-40 years!

What Is the Financial Independence Number?

The financial independence number, also known as the FI number, assesses your retirement preparedness based on your expenses and assets.

Often you read about “$1 million retirement goal” or “$10 million nest egg,” but are any of those numbers relevant to you? Calculating your financial independence number will help you answer the question: “How much money do you need to retire?”

Your calculated FI number can be used as a starting point when saving for retirement and can answer the financial aspect of the “when can I retire” question.

Although the Financial Independence number is a yardstick for retirement savings, many individuals modify it to fulfill their long-term goals better and address any unforeseen financial difficulties.

How Do I Calculate My Financial Independence Number?

You can use a few different formulas to calculate your FI number depending on the income-producing assets you are invested in. All of them are based on your estimated annual expenses.

Calculate Your Retirement Expenses

A good starting point for estimating retirement expenses for most people is to use their current annual costs.

Of course, this number will change as you get closer to retirement (and hopefully decrease as you pay off debt and other obligations).

But for now, using your current spending as a guide will give you a general idea of how much you’ll need to save. Your everyday spending should be easy to calculate depending on the budget templates. Please look at your entire monthly expenses and multiply them by 12.

If you do not already know your current expenses, I recommend linking all your accounts (credit cards, banks, brokerage accounts, etc.) to Personal Capital. I use it to track all my expenses for free, and it creates a budget for you based on your current spending. Check out my step-by-step Personal Capital review.

Stock Portfolio FI Number

Since most individuals invest in stocks, the most popular one is

FI Number = Retirement Expenses / Safe Withdrawal Rate

To use this formula, you’ll need to know two things:

1) How much money do you expect to spend each year in retirement and

2) What is a safe withdrawal rate from your stock portfolio.

Safe Withdrawal Rate (SWR)

We have already calculated our retirement expenses. The second part of the equation, the safe withdrawal rate (SWR), is more complicated.

This number is essentially the percentage of your savings you can withdraw each year without running out of money. The Safe withdrawal rate takes inflation into account.

For example, if you have a $1 million nest egg and a 3% safe withdrawal rate, you could theoretically withdraw up to $30,000 the first year of retirement. If inflation is 1%, in the second year, you will withdraw $30,300 without worrying about depleting your savings.

The safe withdrawal rate is a highly debated topic.

Many financial experts believe that a 4% safe withdrawal rate is a good starting point. The guideline is known as the Trinity Study after its authors at Trinity University conducted a study and published it in the Journal of the American Association of Individual Investors.

Although the 4% rule of thumb is used as the safe withdrawal rate based on historical data, it is safer to assume a lower number considering criticism of the 4 percent rule.

The safe withdrawal rate gives you a good chance of not running out of money even if we experience another prolonged period of low-interest rates and stock market returns.

Now that we have all the equation pieces let’s put it all together.

Using the FI formula, if you expect to spend $50,000 per year in retirement and have a 4% safe withdrawal rate, your FI number would be $50,000 divided by 0.04, which is $1.25 million.

You would need to have at least $1.25 million invested in a broad-based U.S. stock index fund before retiring full-time and not worrying about running out of money.

Of course, this is just a starting point.

You may want to adjust your FI number based on your circumstances and retirement goals.

Example of the 4% Rule of Safe Withdrawal Rate

Say an investor has retired with a $1.5 million portfolio. Under the 4% rule, he should withdraw 4% of that portfolio or $80,000 ($1 million * 0.04) in his first year of retirement. For each subsequent year, she should adjust the withdrawal amount for inflation. For example, if inflation is 3%, he should increase the withdrawal by $1,200 ($40,000 x 0.03) to $41,200.

Real Estate FI Number

If you are investing in real estate, your calculation of FI number is more straightforward.

After subtracting all your operating expenses, including capital reserves, the income from the real estate should match your expected retirement spending. Since rents in real estate usually keep pace with inflation, rent increases would ideally protect your spending power in retirement.

Of course, evaluating a rental property and managing one is a full-time activity. Although IRS classifies rental property as passive income, any landlord can tell you it is far from passive.

Crowdfunded real estate investment is a popular option to avoid dealing with tenants and toilets in retirement. Real estate crowdfunding allows several investors to pool their money together and buy a professionally managed investment property with all the tax advantages of real estate. When investing. always use a checklist to evaluate real estate crowdfunding deals.

Streitwise lets you invest in passive real estate opportunities with a low minimum of only $2,500.

Stock and Real Estate Portfolio FI Number

Most individuals will have a complex portfolio of more than one asset class. Let us consider Kate, who has read our stocks vs real estate analysis and decided to build a real estate and stock portfolio.

Assume that she needs $53,000 annual expenses in retirement.

Real estate notes yielding 10% provide her a passive real estate income of $20,000 in retirement. She has only to figure out her FI number to generate a $33,000 annual income. Based on the FI number formula, she needs 1,100,000 in stocks with a 3% safe withdrawal rate.

Determine Years to Financial Independence

You’ll now need to determine how many years it will take you to reach financial independence based on your calculated FI Number.

Years to FI = (FI Number – Already Saved Money) / Annual Saving

It is only a rough estimate, but it’ll do for now.

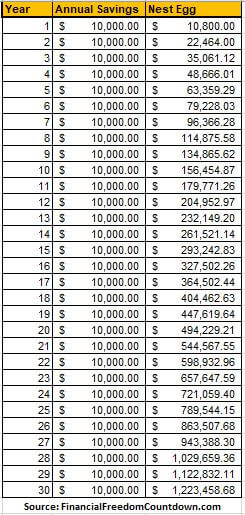

For example, if your FI number is $1,000,000 and you save $10,000 per year, it will take 100 years to accumulate the million you need. Of course, this is a very high-level simplification since it assumes that you aren’t earning any return on the money you’re saving. Ideally, you should invest the money to reach Financial Independence faster.

Assuming an 8% return on your savings, you can see how far you are from becoming financially independent by looking at this chart. With compounded growth, you achieve your goal in less than 30 years.

Although the chart assumes a linear 8% growth annually, you could have higher returns in one year and lower in the next such that your average annual return is 8%

Saving for Financial Independence

While there is no standard answer about your true savings goal, most experts agree on increasing your savings rate – Pay off debts, increase your income, reduce expenses, and invest wisely.

Focus on Debt

Avoid High-Interest Debt

Credit card debt is usually the highest interest debt, and it is best to avoid it. Although credit cards can be helpful tools if used correctly to accumulate travel rewards and cashback, they can also get us into a lot of trouble if we’re not careful. Credit cards often have high-interest rates, so it’s essential to pay off our balance in full each month. If we can’t afford to pay off our entire amount due, it’s best to avoid using our credit cards altogether.

Another thing to keep in mind is that the minimum payment on a credit card is often tiny. It can take years to pay off a big balance if we only make the minimum payment, so avoid carrying a large balance from month to month.

If we have trouble staying within our budget, it’s best to put our credit cards away and use cash for purchases instead. One way to quickly ruin your credit score is by not paying your bills on time or not paying the bills at all.

Refinance Expensive Loans

Besides credit card debt, you may also have student loans. Look at options like Credible for Student Loan Refinancing. Why pay higher interest rates when you could lower your payments by refinancing federal, private, and ParentPLUS loans? Checking rates won’t affect your credit score.

Credible also provides personal loans. If you have been paying higher interest on credit cards, car financing, etc., check out individual loan rates from 10 vetted lenders in 2 minutes on Credible.

Use the Personal Loan only to lower your higher interest rates and not take on additional debt.

Be Strategic With Debt

Don’t spend more than you earn, and keeping your debts to a bare minimum is the best route to manage your finances. Of course, most people need to take out loans from time to time, and at times there can be a benefit in going into debt, such as when it leads to the acquisition of a cash-flowing investment.

Acquiring a mortgage to purchase a home could be such a case. Or you are buying a rental property. However, there are ways to invest in real estate with little and no money down, so debt should not be the first option.

Debts may sometimes be more economical than buying outright but be strategic and think of all possible scenarios to avoid debt as much as possible.

Cut Expenses

To achieve financial freedom, avoid unnecessary expenses. The advantage of reducing costs is twofold.

- You have more money to invest, accelerating your Financial Freedom journey.

- You need to accumulate a smaller nest egg with lower long-term retirement expenses.

FI Number = Retirement Expenses / Safe Withdrawal Rate

Cutting expenses lowers your FI Number

You don’t need to eliminate all luxuries, but there are ways to cut back on our spending. For many individuals, it is simpler to save money than earn more.

One way to start is by looking at our monthly expenses and seeing where we could cut. Do we need cable TV? Can we get by with a less expensive cell phone plan? These are the types of questions we should be asking ourselves.

To improve our finances, we must stay away from lifestyle inflation and make an effort to live within our means.

Increase Income

There is a limit to which you can cut debt and expenses, but the potential to maximize income is unlimited. Increasing income should also be on your radar.

Improve your Human Capital at work and earn more from your day job.

Side gigs in real estate could be one option to increase income and improve your knowledge. Look for deals in your neighborhood to flip a house profitably. or wholesaling.

Consider passive income ideas. You can establish a steady stream of income by investing some effort initially.

Make money from your hobby. Here is my Bluehost affiliate link to start a website for less than $4/month. My friend started a kitchen herb garden and now sells e-books on herb gardening from her website. Another friend is offering keto recipes on his website. With costs so low to start an online business, there is no reason not to start. Check out my guide on how to create a website in 10 minutes.

How To Invest for Financial Independence

Now that you’ve discovered your Financial Independence number, it’s time to begin!

The easiest way to save for retirement is to make regular contributions to a 401(k). It is possible to retire early using 401k(k). Most employers offer a 401(k) match which is free money that can help you reach your FI number even faster!

Even if your employer does not offer a match, try to contribute to the maximum limit for the year. Maxing out your 401(k) is one of the best tax-saving strategies.

Another great way to save for retirement is to automate your investments based on your risk tolerance.

You can set up a regular transfer from your checking account to a dedicated retirement account. You’ll be less likely to miss or forget about it by making investing automatic.

Another benefit of automatic investments is dollar-cost averaging, which means that you invest the same amount of money every month, regardless of the price.

I use M1 Finance to automate all my investing. Read my in-depth M1 Finance Review and why I prefer it to Vanguard, Schwab, Fidelity, Wealthfront, and Betterment.

Whatever method you choose, make sure you regularly contribute to your retirement savings and stay focused on your goal of FI!

Track your asset allocation and portfolio to ensure that you are on track. I use Personal Capital to track all my investments for free, which visualizes how my liquid net worth is growing over time.

Is It Possible To Personalize Your Financial Independence Number?

Yes, it is possible to personalize your Financial Independence number.

Your FI number will be different based on your age, income, and desired lifestyle in retirement. You can use the 4% rule as a starting point, but you may want to adjust it based on your specific situation.

Depending on the asset classes in your portfolio, volatility of the assets, your risk tolerance and expected life expectancy you can further tweak the numbers. The important thing is to come up with a Financial Independence number that you are comfortable with and that you think is achievable.

We covered a few ways to calculate your retirement easily and without using any fancy calculators. Of course, when you are truly deciding to retire check out several free retirement calculators.

Changing the safe withdrawal rate will modify your Financial Independence number, and make it seem that you could reach financial independence sooner. However, increasing the safe withdrawal rate is risky, especially since higher rates have the potential to run out of money sooner. A better option is to stick to the existing research on safe withdrawal rates and potentially create generational wealth for your loved ones.

Final Thoughts on How to FI

Reaching Financial Independence is a significant accomplishment and something to be proud of!

It takes hard work, dedication, and sometimes luck, but you can do it.

Whatever your FI number may be, keep working towards it, and don’t give up. Even if you can’t quit your job immediately, you may begin to enjoy some of the advantages of a financially independent lifestyle before you leave work altogether.

Imagine waking up each day and knowing that this is the day you get to do what you want – without having to answer to anybody else. That’s the security Financial Independence can bring. And it can happen for you sooner than you think.

Remember, it’s not a race, so take your time and enjoy the journey.

Readers, how would Financially Independence change your life? How far away are you from FI?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.