Why Portfolio Diversification Is a Critical Component of Investing

One of the essential things you can do when it comes to investing is diversify your portfolio. By spreading your money out among different types of investments, you reduce your risk if one of those investments fails. Today, we will discuss the importance of portfolio diversification and how it can help you reach your financial goals!

What Is Diversification?

A diversified investment portfolio is one in which you have an array of different asset classes. Asset classes are income-producing investments that are of the same primary type. Stock mutual funds, ETFs, and equities are one asset class.

Fixed income investments such as Treasury bonds, T-bills, state and local government bonds, corporate bonds, bond funds, I-Bonds, and cash equivalents are another asset class. There are also short-term investments, such as money market accounts or certificates of deposit.

However, diversification among asset classes is not enough. It would help if you also diversified investments within those classes. It means that you are looking for an asset allocation that fits your investment goals, investment risk tolerance, and time horizon.

For example, there are equities or stocks. There are many types of stocks, including blue-chip, dividends, emerging markets mutual funds, foreign developed markets, and more. These asset types have different purposes, and investing experts may make various recommendations regarding the risk you should incur, given your preferences.

However, when it comes to diversification, you will want to ensure your investments are diversified within your asset class. It means that your stocks should be in numerous sectors, of different capitalizations, and be a mix of income-generating and growth potential.

Some investment classes are naturally diverse. It includes many types of mutual funds or exchange-traded funds. However, the level of diversification within a mutual fund or index fund ultimately depends on the fund’s goal and the investment options such funds offer.

Some mutual funds, index funds, or exchange-traded funds (ETF) are specifically geared to take advantage of one sector, international stocks, or stocks that are centralized around high-growth options. While there would be nothing wrong with investing in these stocks, they would not be considered part of a diverse portfolio, and if something happened to this individual stock sector, you could quickly lose money.

A single investment is never diverse: It is always best to have a broad array of stocks and avoid putting all your eggs in one basket.

There is no such thing as a perfectly diversified portfolio. Indeed, making an authoritative definition of asset classes can be challenging, and different brokerage firms may consider different financial instruments to be parts of different asset classes.

However, what is more important, is that you find a diversification strategy that fits your needs and aligns with your overall investment goals.

Why Is Diversification Important?

There are many reasons that diversification within and outside of various asset classes is essential.

First, as the old expression goes, you never want to put all your eggs in one basket. In other words, you never want to put all your money in one stock. If things go well, you can make a profit.

However, the risk here is too significant: If you invest all of your money in one stock or one class of assets, and that company goes bankrupt, or there is some event that damages all of these stocks, you can have significant problems. Investment portfolios with all of their eggs in one basket are uniquely exposed to market volatility. They can suffer considerable damage if something negative impacts the asset class they are invested in.

Related: The financial situation can change dramatically, and if you fail to diversify your portfolio, you can be exposed to the systemic risk that comes with changes in the financial sector, thus leaving you open to significant losses.

For example, rising interest rate changes can significantly impact bonds, bond funds, and other fixed-income investments. You may take a substantial hit if your portfolio is invested too heavily in these areas. You never want to put all your money in one asset class for this reason: You’ll be at a higher risk for losses, even if you put all your money in lower-risk funds.

Much of the conversation about diversifying your portfolio comes from avoiding investing too much in an individual stock or one investment, as you may lose money. If you fail to diversify your portfolio, you risk missing out on gains in other sectors that you may not otherwise have invested in, such as foreign stocks, treasury bills, or other high-risk investments.

Finally, remember this: The stock market is always cyclical. Indeed, the entire financial system is based on ebbs and flows. It will always go up, then always come back down. A balanced portfolio may not get “too” high when times are good, but it will also ensure that you don’t absorb significant losses when things go south.

A good fund manager understands this and can structure your portfolio so that you have different investments in different areas. They will also work with you to make sure you make informed decisions about where to put your money and to let you know when a specific investment may mean taking on more risk.

Taking on more risk is not necessarily bad, but you should always make sure you know when you risk altering the diversification of your portfolio. You also want to ensure that any investments are within your risk tolerance.

Example of a Diversified Portfolio

A well-diversified portfolio will hedge against risk and market volatility but is still positioned to take advantage of various income streams. This is why you need an investment strategy that balances market risk with the potential for real growth.

Keep in mind that there is no set example of an ideally diversified portfolio, as different portfolios will have different levels of risks that an individual is willing to incur. An ideally diversified portfolio depends on your personal risk tolerance and investment goals.

One example of this is age and investment goals. For example, let’s say you were investing to save for retirement. In this scenario, you would be more willing to take risks if you were younger. In this example, someone would be more likely to take on a riskier diversification, with more stocks than saver investments, like treasury bills or bonds. In this scenario, the allocation of stocks could also be more treacherous, with an investor investing more in high-growth/high-risk stocks like moonshot stocks or even investing in cryptocurrency IRAs.

As the investor in this scenario aged, they would shift their allotment, moving more towards safer investments and shifting within each asset class, moving stocks away from growth and more into income and dividend-generating stocks.

Alternatively, consider the diversification that a retired couple would want. In this scenario, you’d be dealing with a couple no longer working. Since the couple cannot use their high-income skills to earn money, they would rely mainly on living off their retirement nest egg. The couple would want diversification to maintain their nest egg in this scenario. They may have a tiny percentage of their portfolio in equities, but that would be the riskiest of their investments. It would be just a hedge against inflation and make up a small percentage of their overall portfolio.

For this couple, they would likely have some investment in stocks that generated dividends. Given their need to preserve their nest egg, most of this portion of their investment portfolio would probably be in blue-chip stocks. They would likely scatter the rest of their money across cash equivalents, bonds, and other fixed-income securities, allowing them to generate income while ensuring that their principal was protected.

How Can I Start Diversifying Today?

Diversifying your portfolio is one of the most important things you can do regarding your investment strategy, and it is never too late to start diversifying your portfolio.

Suppose you are genuinely interested in diversifying your portfolio. In that case, you first need to understand better your financial goals and how you are saving your money. It would help if you also understood your timeframe and the level of risk you are willing to tolerate. This is important as it will determine your ultimate risk and how exactly you choose to diversify your portfolio. A longer time horizon means you can be riskier in the beginning. In comparison, a shorter time horizon means that you will want to be more conservative in your diversification choices, as you’ll have less time to make up for any losses in the event of a market loss.

You’ll also want to examine your entire portfolio and determine your ideal diversification strategy. Remember, diversification means among and within each asset class. You’ll have to question how diversified you are among equities, fixed income, cash equivalents, etc.

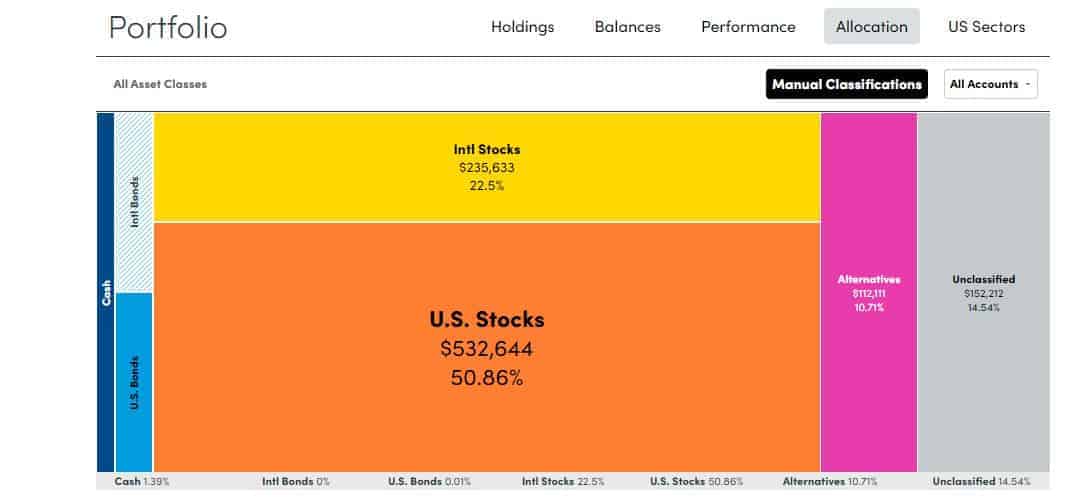

I use Personal Capital which provides a free tool to track your net worth, cash flow, and budget.

It also provides information regarding your investments, such as asset allocation, performance against benchmarks, and any hidden fees that eat away at your retirement savings.

You can also use it for retirement, savings, and checkup on your investments.

Get started by signing up and linking all your banking, investment, and retirement accounts for free. Your entire financial life at-a-glance is now visible in a simple, easy-to-use, actionable dashboard.

The Personal Capital dashboard will show how diversified you are across different asset classes.

One drawback of Personal Capital is that you need to manually add the value of your real estate investment properties. But it does include real estate paper assets such as real estate syndications or REITs.

Finally, keep in mind that there is no such thing as a static profile over time. Changes in the broader financial market will ensure that you will need to adjust your diversification strategy. For example, the fortunes of some industries – like tech and health – have now become more linked than ever. Future technological changes and changes in the world’s geopolitical systems may further press two other sectors together – or it may lever them apart. Regardless, it would help if you kept an eye on when a diversification strategy that worked once stopped working in the future.

Diversification Across Time

Although diversifying across asset classes is the most common definition of diversification, one should also consider diversification across time.

Markets rise and fall based on macro conditions, and prices of individual stocks also vary based on the economic cycles.

Investing during a recession might differ slightly from investing during a bull run.

The best way to diversify across time is via dollar-cost averaging. Contributions to HSA, Traditional 401(k) or Roth 401(k), and other accounts via payroll deductions are a form of time diversification.

Furthermore, a diversification strategy that works for someone in their 20s may not work for someone in their 50s. As time passes, you lose the ability to recoup losses and may need to shift towards a more conservative portfolio. As such, make sure you are regularly updated with your portfolio diversification strategy, working to ensure that your needs are being charged as your goals change.

Tax Diversification

One of the most critical tax optimization strategies involves diversification across accounts based on tax treatment. Asset location is a common strategy to ensure that individuals have the option to withdraw from different accounts impacting the MAGI (Modified Adjusted Gross Income) as needed.

For example, when planning how to retire early, one must have investments in either Roth or taxable accounts to withdraw penalty-free before the age of 59.5. Conversely, one must reduce the 401(k) and IRA balances before required minimum distributions (RMD) start affecting your Medicare premiums.

How Diversified Should a Portfolio Be?

The answer to this question ultimately depends on a variety of factors, including:

- Your personal preferences, knowledge of the stock market, and the systemic risk you are willing to tolerate in your portfolio.

- Your specific investment goals and how much risk you are willing to incur for the potential of a substantial gain.

- The particular stocks you have the most interest or knowledge in.

- Current market conditions, estimated future needs, and geopolitical considerations.

- Already existing individual investments.

- If you are trying to reduce your risk and seeking a lower-risk portfolio.

As you can see, this is a profoundly individualized question and one with no one set answer. However, there are some general principles you should adhere to.

- Invest your money in numerous asset classes that don’t move together in a positive or negative direction. This way, if one type falls, another asset class may still be able to make up the difference.

- Invest at least a portion of your funds in index funds, mutual funds, or other naturally diverse assets. This helps to build diversity into your portfolio while keeping management costs and fees minimum. Learning how to invest in the S&P 500 provides diversification and eliminates any expensive management fees charged by mutual funds.

- Set times where you reexamine your asset diversification strategy and adjust accordingly.

- Have set endpoints. Know when an asset is too low that you need to make a sale, take the loss, and move your money elsewhere.

- Make sure always to double-check the advice that others give you. Failing to do so may mean you get taken for a ride on expensive commissions or other fees, costing you valuable gains in your portfolio.

- Remember, there is nothing wrong with having a different diversification strategy for different investment goals.

Besides stocks and bonds, you can also invest in cryptocurrency, farmland investing, real estate investing, art investments, etc.

While some of these asset classes are restricted to investors meeting accredited investor requirements, there are also several non-accredited investments.

For example, if you cannot participate in real estate crowdfunding by PeerStreet, you can constantly evaluate investments for non-accredited investors such as Fundrise ($100 minimum). Unfortunately the SEC still relies on average net worth to determine accredited investor status.

Final Thoughts on Portfolio Diversification

Diversification is a key component to any investing strategy. By spreading your money across different asset classes, you can protect yourself from losses in any one particular area. While there is no one perfect way to diversify, following some simple principles can help you build a well-rounded and diversified portfolio.

Remember to regularly review your diversification strategy and make adjustments as needed to ensure that your portfolio continues to meet your needs. And finally, don’t forget to do your own research before deciding how to invest money – it’s the best way to safeguard your money.

With a little planning and diversification, you can reach all of your investment goals.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.