How To Get Rich and Grow Your Wealth

If you want to get rich, you must provide something of value to people who can pay and figure out a way to scale that effort.

Everyone has their definition of wealth. To get rich, you must first define what being rich signifies. Is it Elon Musk’s level of wealth or pursuing early retirement? Having clarity will help you understand the amount of effort required.

The desire to become rich is a common aspiration among many individuals, fueled by various motivations such as achieving a comfortable lifestyle, fulfilling dreams and ambitions, or ensuring a prosperous future for themselves and their loved ones. While getting rich is not easy, it is certainly attainable with the right mindset, strategies, and dedication.

Successful individuals who have accumulated wealth often emphasize the importance of setting clear goals, staying disciplined and focused, continuously expanding knowledge and skills, and embracing opportunities for personal and professional growth.

Building wealth also involves making wise financial decisions, such as investing intelligently, diversifying assets, and managing risks effectively.

Furthermore, cultivating a strong work ethic, persevering through challenges, and maintaining positive relationships with others can significantly contribute to achieving long-term financial success. Ultimately, becoming rich and wealthy requires discipline, intelligent choices, and a relentless pursuit of personal and financial excellence.

Set Financial Goals

Importance of Goal Setting

Setting financial goals is essential to achieving financial freedom and establishing a solid foundation for one’s future. Goals provide clarity and focus, enabling individuals to plan effectively, monitor their progress, and determine the amount of money they need to save or invest and the timeline within which they aim to achieve these goals.

Tips for Setting Realistic and Achievable Goals

Setting realistic and achievable financial goals to maintain motivation and avoid disappointment is essential. Tips for setting realistic goals include:

- Assessing one’s current financial situation.

- Identifying areas for improvement.

- Considering factors such as income, expenses, and debt.

Additionally, it is vital to break down larger goals into smaller, manageable milestones to ensure continuous progress. By setting specific and realistic financial goals, individuals can take control of their financial future and make informed decisions to reach their desired outcomes.

Build the Right Foundation

Understand the Basics of Financial Planning

A financial plan is imperative for individuals seeking to manage their finances efficiently. This entails comprehending the concepts of income, expenses, and assets and knowledge of various financial instruments such as loans and insurance policies.

Developing financial literacy is of utmost importance in today’s society, as it equips individuals with the knowledge and skills necessary to make informed decisions about their finances. Hiring financial advisors is an option, but it involves unnecessary expenses and leaves you constantly dependent on others for financial help.

Resources such as books, websites, online courses, and workshops provide detailed information and practical tips on managing money effectively. Additionally, you gain financial power by staying updated with reliable financial news sources and subscribing to educational websites offering valuable personal finance insights.

Identify Expenses and Create a Budget

After you have grasped the fundamentals, the next step is to identify areas where you spend money and create a budget. Tracking monthly expenditures lets you gain insight into your financial habits and priorities.

Creating a budget can be daunting, but it’s one of the best things you can do to save money.

If you do not already have a budget, sign up for a free account with Personal Capital. The Personal Capital Budget template automatically tracks your income and expenses. Entering all that data yourself can be annoying. You must keep receipts or log into your account to see what you spent that day.

Personal Capital solves this problem by asking you to provide all the login information for your various bank accounts, credit cards, and investment accounts and pull all the app transactions. Once you have linked your accounts, Personal Capital analyses your various transactions and automatically creates a budget based on your current spending patterns.

You can use that as a starting point and customize your budget numbers. From now on, Personal Capital will automatically send you alerts when you are exceeding your budget so you can cut back. Read my Personal Capital review on how I use the various free features.

By tracking your income and expenses, you can be intentional with spending. Plus, when you stick to your budget, you’ll be able to save more money for future investments. Whether funding your retirement, buying a house, or starting your own business, having that extra financial cushion can make a huge difference. So, take the time to create a budget today. You’ll thank yourself in the long run!

Learn the Difference Between Good and Bad Debt

Credit card debt is high-interest debt and is usually a bad debt. It is best to get rid of the interest payments immediately. It is OK to use credit cards as long as whatever you spend is part of your budget and you can pay the entire bill at the end of the month.

Student Loan debt can be a double-edged sword. While it’s not inherently wrong, it’s crucial to exercise caution. For example, student loans can be advantageous if the principal and interest rates are reasonable, enabling you to pursue a lucrative career by improving your high-income skills.

However, student loans can transition from being a boon to a bane if the figures don’t align in your favor. Undoubtedly, the system has been exploited, leading some students to amass significant debt for degrees with limited earning potential.

Housing debt is tricky because people often spend a lot on their primary home. While investing in real estate is a great option, your primary residence is not an investment. It is usually better to consider a starter home and then upgrade to a forever home after accumulating a net worth of at least one million dollars.

Determine How Much To Save and Invest

Saving a portion of income is crucial for future security, meeting unforeseen expenses with an emergency fund. However, only saving money and not investing can be risky in the long run due to inflation.

Over time, investments typically result in 7 times more gain than having your money stuck in fixed-income investments.

Yes, a bank savings account or investing in bonds feels safer, but your money is not growing. I-Bonds and Treasury Bills barely keep pace with inflation.

Historically, investing in stocks has resulted in a 7% return. Your $100,000 investment over 30 years would be worth $761,226. Contrast that amount with putting the money in a savings account, yielding 0.1%, which would only give you $103,044.

Safe investments are required to store emergency funds or a down payment for an imminent home purchase. All other medium and long-term goals need to be considered as investment opportunities. Both saving and investing should be carefully researched and strategically incorporated into a well-rounded financial plan.

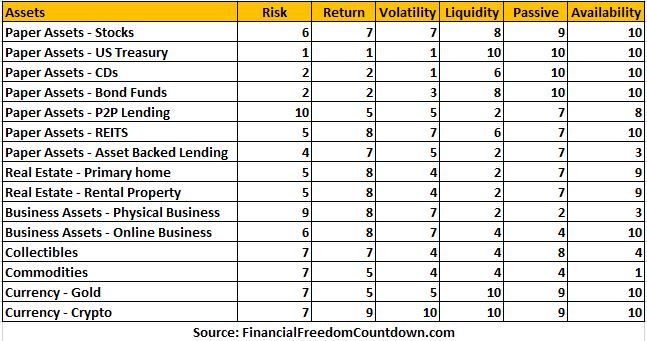

Understand Investment Options and Start Investing

When you consider starting investing, there are several income-producing assets to invest in. Each asset class has pros and cons; your job is to invest wisely. The best investment depends on your risk profile, time, knowledge, and unique circumstances.

Stocks or real estate are the most popular options when people consider how to invest their money.

Investing Money in the Stock Market

There is a difference between investing and trading to make money in the stock market. Trading is buying and selling stocks frequently for quicker profits. Investing is for more long-term investments to increase your wealth.

Picking individual stocks is more complicated than buying index funds, but a financial advisor can guide your investment strategy to help you grow your money. Investors also use online screening tools to find the best stocks to buy that fit their criteria. You can find screening tools on online brokers’ websites.

Beating the markets is challenging, and mutual funds have tons of fees. Many individual investors prefer to invest in the S&P 500 and other broad, diversified indexes to avoid chasing the next hottest sector. A diversified portfolio ensures you avoid placing all your eggs in one basket.

You can open an individual retirement account such as IRA, Roth IRA, or Sep IRA at many brokerage firms, including M1Finance.

Read my M1Finance review to see why I prefer the no-fee and automated investment approach compared to Vanguard, Fidelity, or Schwab.

Investing Money in Real Estate

There are several ways to invest in real estate, including real estate investments with little to no money.

Many of these involve sweat equity, such as fixing and flipping homes. Or wholesaling houses. But if the market cooled off too much, a house flipper could be left holding property with few buyers. Using the BRRRR method could protect against market downturns, but one must always be cautious of real estate investment risks.

A better way to invest in real estate is to become a landlord. Because of a small supply of available rental homes, rental prices are increasing. Understand the real estate metrics used to evaluate a rental property. Since one must maintain rental homes, it can take some hands-on work to be a landlord.

If you are not located in one of the best states for real estate investors, consider long-distance real estate investing or turnkey property.

Many investors who like real estate don’t want to be house flippers or a landlord but want to invest in real estate. Investors can buy real estate investment trusts (REITs) and funds that invest in real estate. Or use real estate note investing for actual passive real estate income.

Real estate crowdfunding or farmland investing are other options to invest in real estate passively.

If you want to invest passively in real estate, determine if you meet the accredited investor qualifications.

Streitwise is available for non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals. It is also open to foreign / non-USA investors. Minimum investment is $5,000.

EquityMultiple gives accredited investors direct access to individual commercial property with a minimum of only a $5,000 investment.

Build Multiple Income Streams

Increase Your Income From Work

The most effective way to get rich is to invest in yourself. Focus on improving your human capital and providing value to your employer. In my experience, many people focus on get-rich-quick schemes and ignore the easiest way to become a millionaire. I generated more profit for my employer, which enabled me to demand extra money from my employers.

An easy job that pays well gives you time to focus on a side hustle.

Diversify Income Sources for Increased Financial Stability

Building multiple income streams has become a prudent strategy to grow your wealth in today’s uncertain economic climate. By diversifying income sources, individuals can mitigate potential risks and not solely rely on one source for their livelihood.

Unless you have a recession-proof job, you can always be laid off when recession strikes, even if you have been a fantastic employee. Exploring different options for additional income is therefore crucial.

This may involve starting a side business to build your wealth. When starting a side business, it is essential to thoroughly research the market and identify a niche that has high growth potential. It is also advisable to create a business plan, set realistic financial goals, and have a contingency plan to address any unexpected challenges.

Businesses require an infusion of capital, taking calculated risks, managing resources effectively, and consistently evaluating and adjusting strategies.

With everyone in the internet age, an online business is the best due to the risk/reward ratio.

- The low cost of starting an online business and the opportunity for passive income make it an ideal diversified income source.

- Besides, you can avail of several tax exemptions and live in a low-cost country/state to make it even more profitable.

- Given the digital economy, more and more of our world will move online. Automated tools make it easy to start a website in 10 minutes with zero computer programming skills.

Unlike physical business, it is effortless and cheap to create a website. You can start a website for a low monthly fee of $4.95/month.

My friend started a kitchen herb garden and now sells e-books on herb gardening from her website. Another friend is offering keto recipes on his website. There is no reason not to start an online business. Check out my guide on how to create a website in 10 minutes.

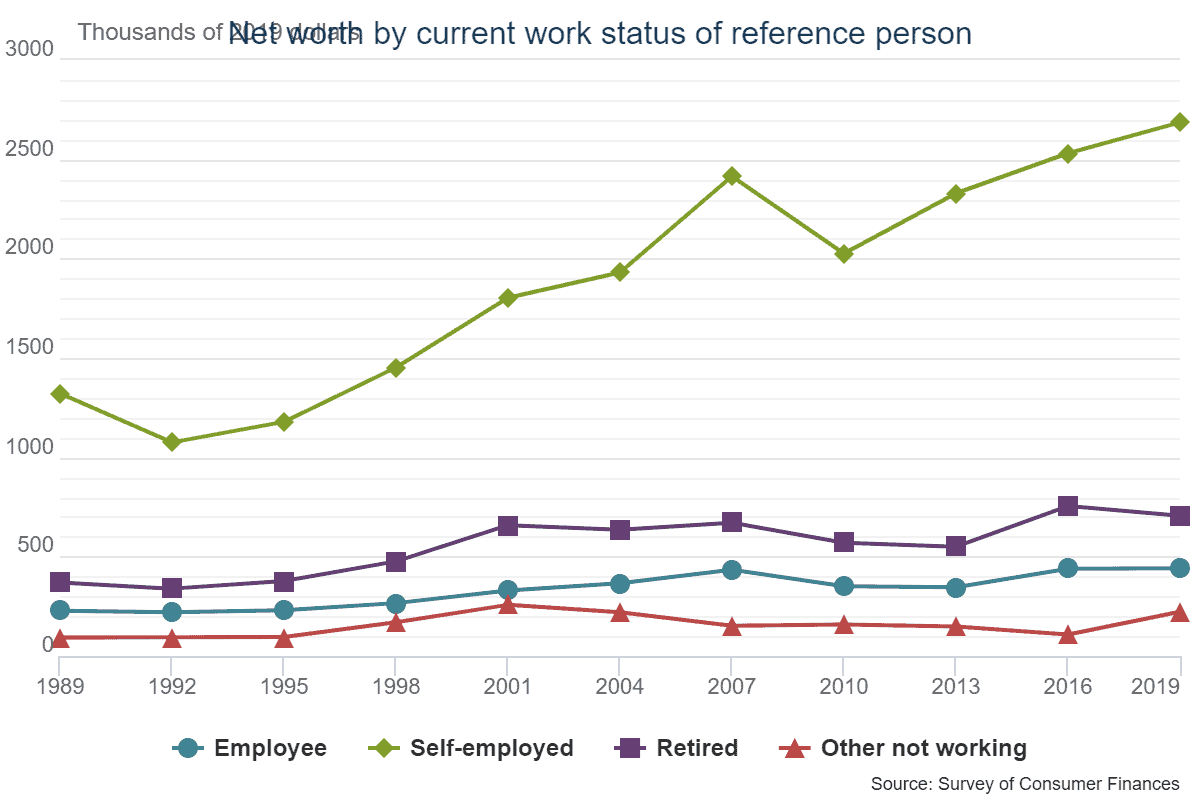

Data on the average net worth by age indicates that the USA is the land for entrepreneurs.

Nerdwallet was founded in 2009 as a credit card comparison website. The IPO 12 years later raised over $675 million.

Avoid the Temptation of Lifestyle Inflation and Reinvest

Picture this: You are living in a cozy apartment in a fantastic location, and now your additional income stream generates $500/month. Now, you’re contemplating moving to a fancy place. But stop and ask yourself, is it really necessary?

If you aspire to be a self-made millionaire, it’s time to resist the allure of lifestyle inflation. Instead of mindlessly spending more just because you can, why not channel that extra cash into your business or investments? Trust me, you’ll be amazed at how swiftly compound interest can help you achieve your retirement plan.

Elon Musk sold his first company, Zip2, and received approximately $22 million. He bought a new home, a Maclaren F1, and invested the rest into his next venture, which became PayPal. We all know what he again did with the profit from PayPal.

Learn the Best Ways To Become a Millionaire or Billionaire

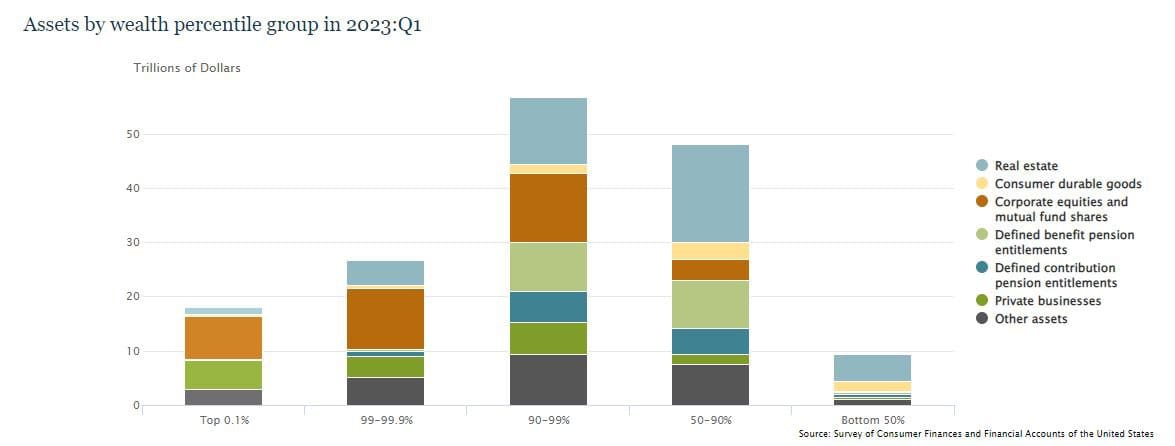

The latest data from the Federal Reserve shows real estate and businesses (private and corporate) hold the bulk of the wealth.

Yes, 7-figure salary jobs exist. But do you know anyone who became a billionaire working a 9-5?

Adopt a Growth Mindset

Developing a money mindset is essential for personal and professional growth. Successful individuals possess a unique perspective that enables them to overcome challenges and continuously learn and improve.

One such strategy is embracing the idea of lifelong learning and constantly seeking new knowledge and skills. Individuals can adopt a growth mindset by setting goals and creating a plan for acquiring new abilities.

Overcome Limiting Beliefs

Challenging and confronting limiting beliefs that may hinder personal development is crucial.

After all, it takes a unique mindset to take on all the car manufacturers and launch an electric car revolution. Or build a private rocket company with reusable rockets, which no government space agency has ever done.

And that is how Elon Musk launched Tesla and SpaceX.

Cultivating an abundance mindset, which involves believing in the abundant availability of resources and opportunities for all, necessitates a deliberate and concerted endeavor. The importance of this effort is amplified, particularly for individuals raised in circumstances characterized by limited resources and restricted access to wealth.

Take Calculated Risks

Be Open to New Opportunities

Embracing opportunities and stepping outside one’s comfort zone are essential to a growth mindset. You can unlock your full potential by actively seeking out new experiences and viewing setbacks as opportunities for growth.

Understand the Difference Between Calculated Risk and Recklessness

Calculated risk involves:

- Thoughtful analysis and informed decision-making.

- Taking into account various factors such as potential gains, possible losses, and available resources.

On the other hand, recklessness implies a lack of consideration for potential consequences, hastily plunging into ventures without a clear understanding of the probable outcomes.

The difference between a calculated and crazy risk is an extremely thin line. You’ll need to walk it if you want to strike it rich.

Consider these two examples: In 1999, Google founders Larry Page and Sergey Brin attempted to sell Google to Excite for $1 million. One of the world’s wealthiest and most successful companies once tried to sell its company to a now-defunct rival for the tiniest fraction of its current worth. And Excite said no! And they said no even after Google reduced the price further to $750,0000.

Another example from the mid-2000s was when Mark Zuckerberg almost sold Facebook to Yahoo! for a billion. He said no, despite opposition from some members of his board, who later said that if Yahoo! had increased the offer, they may have forced the sale. Turning down $1 billion for any tech product may seem like absolute madness, but considering Facebook’s net worth today, it was the correct business decision by Zuckerberg.

What is the lesson here? Zuckerberg took a calculated risk and got it right. Page and Brin took a safer bet and only got it right when Excite got it wrong.

Every business has critical pivot points that will make or break its success. You have to be prepared for these moments, and you have to get them right.

Embrace the Power of Networks and Connections

Leverage Professional and Social Networks

In today’s highly interconnected world, embracing the power of networks and connections is vital for achieving financial success. By leveraging professional and social networks, individuals can tap into a wide range of opportunities to further their careers and improve their financial standing.

In the professional realm, networking can help individuals access job opportunities, mentorships, and industry knowledge. Connecting with like-minded professionals expands one’s professional circle and opens doors to new business ventures and collaborations. Similarly, building and nurturing relationships can lead to various benefits in the social realm, including introductions to potential investors, clients, or partners.

Build Mutually Beneficial Relationships

To effectively network and build relationships, it is vital to approach them with a genuine and sincere mindset. Building mutually beneficial relationships requires a give-and-take mentality, where individuals provide value and support to their network connections while benefiting from their expertise and resources.

Additionally, active listening and effective communication are crucial. Individuals can build stronger connections by being attentive and investing time in understanding others’ needs and goals. It is also essential to maintain regular contact with network connections. Consistency demonstrates commitment and helps in cultivating trust and rapport.

Some valuable tips for effective networking and relationship-building include attending industry conferences and events, joining professional associations or groups, and actively participating in online forums or platforms. These avenues provide opportunities to meet new people, exchange ideas, and expand one’s network.

Furthermore, leveraging social media platforms such as LinkedIn, X, and Facebook can help individuals connect with professionals in their field and maintain a digital presence that enhances their credibility and visibility. Overall, embracing the power of networks and connections is essential in today’s competitive business environment, opening up a world of possibilities for financial success.

Avoid Get-Rich-Quick Schemes

Wealth-building takes time unless you win the lottery or come from a wealthy family.

With his successful value investing framework, even Warren Buffet became a billionaire only at 56.

MrBeast started posting on YouTube at 13. A decade later, he now generates millions monthly from YouTube.

Patience, perseverance, and resilience play vital roles in achieving wealth. The journey towards financial success is often plagued with obstacles and setbacks that can easily discourage even the most motivated individuals.

Patience is essential in this process as it allows for the necessary time frames to make sound decisions, understanding that wealth accumulation is a gradual process. Perseverance is equally crucial because it enables individuals to stay determined and committed to their financial goals despite difficulties. Maintaining focus during challenging times requires resilience, the ability to bounce back from failure or setbacks and continue progressing toward one’s objectives.

Breaking larger objectives into smaller, attainable milestones can make the journey more manageable and provide a sense of progress, which can serve as motivation. Seeking support and advice from mentors or like-minded individuals can also be beneficial, as inspiration can often be contagious.

Routine self-care practices like exercise, meditation, or hobbies can help reduce stress and maintain mental clarity. Overcoming setbacks and failures are inherent aspects of the journey towards wealth. Rather than dwelling on these setbacks, viewing them as opportunities for growth and learning is essential. Analyzing the reasons behind the failure, identifying the lessons learned, and making necessary adjustments are fundamental components of resilience. A growth mindset that embraces challenges and views failures as stepping stones toward success is crucial in overcoming setbacks and moving forward.

How To Get Rich if You Do Not Come From a Very Wealthy Family

Wealth, a concept often associated with financial abundance and luxury, is significant in our society. It provides a sense of security and freedom and opens up numerous opportunities for personal growth and the ability to positively impact others.

The financial advice for growing wealth is that you cannot get rich by renting your time. Time is finite. Own equity or part of a business and leverage your skills to build generational wealth.

Learn to create something of value or to sell. If you can do both, leverage the internet for distribution and let go of limiting beliefs. Generate multiple sources of income.

Getting rich or growing your nest egg is not a one-size-fits-all approach; individuals must tailor their strategies to their unique circumstances.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.