Fat FIRE: Is the Sacrifice Worth It?

Many Americans are worried about having enough money to live comfortably. Can they retire early with only a 401k, especially now with both the bond and stock markets suffering losses? Will their pension fund or deferred compensation plan be enough to secure their financial future? Can healthcare expenses be sustained? Will they even have enough investments for monthly income to pay their bills?

For retirement planning, we need to make several assumptions on life expectancy, anticipated returns from our income-producing assets, future life events, and unexpected expenses.

When planning how to retire early, the timeframe over which these variables play out gets elongated. If everything works out exactly as planned, your average net worth would be enough to create generational wealth with a large enough nest egg. But if any assumption is unfavorably tilted against you, you have limited recourse with your retirement savings.

The Financial Independence Retire Early, aka FIRE methodology, has several flavors depending on your risk profile, desire to work low-stress retirement jobs, and flexibility to adapt. One such plan is fat FIRE which can help you become an early retiree with higher annual living expenses.

What Is Fat FIRE

Fat FIRE is the method to ensure you have a significant net worth at retirement and typically accumulate 33 times your annual expenses.

Fat FIRE can help many people not only retire early but also with a higher standard of living.

Is the goal to retain your current lifestyle after retirement, or will you reduce spending and live within your means? Even if your current lifestyle seems extravagant, you could somewhat reign in your current annual spending after retiring.

Discretionary spending is what you want to buy, not what you need to pay for. Discretionary spending can be anything outside the money you need for bills and daily living—fancy vacations, a new car, new items for your home, home improvement, and hobbies.

Following the 4% safe withdrawal rate rule would have limited room for luxuries. The Fat FIRE plan is one of the FIRE plans to be able to save without sacrificing the little extras you are used to. The Fat FIRE plan also gives peace of mind that you will have enough to live on while still being prepared for those life situations that come up once in a while.

How To Calculate Fat FIRE Number

The Fat FIRE number will be different for everyone based on their living standards and has to be calculated individually. The Fat FIRE calculation is similar to the regular FIRE number, but it will be higher due to the larger margin of safety.

Some financial independence proponents advocate an arbitrary number for fat FIRE annual spending. However, we know that cost of living is location-dependent. What is a fat FIRE in Cambodia could be Barista FIRE in San Francisco.

You can do the following calculation to get your Fat FIRE number.

First, you must know how much you want to spend each year in retirement.

The amount you will need to know includes all expenses, the discretionary amount you want to spend, and the amount for luxuries. If you have a budget template, pad the number based on your desires.

The annual expenses should be enough money for you to live without the need for budgeting or cutting coupons. Many people, no matter their net worth, still like cutting coupons and taking advantage of sales to save money. Mark Cuban’s net worth is $4.6 billion, but he still enjoys using coupons.

The Fat FIRE number is larger than the regular because you will add luxury spending to the yearly expenses. Luxury spending will include dining out, vacations, a more admirable car, fancier clothes, and items like that.

Suppose you do not already know your annual spending. In that case, you can use Personal Capital, free software that combines your cash flow, credit cards, bills, and bank account transactions in one place and automatically updates and classifies your financial data.

Unlike other budgeting apps, Personal Capital doesn’t need you to do the tedious task of setting up a budget. After you link all your accounts together, it looks at your current spending and creates a budget for your lifestyle. You can then modify it as needed. You can read my Personal Capital Review on how I use the various components and set up your free account.

The formula to get your Fat FIRE number is

Fat Fire number = 33 x (your desired yearly spending).

For example, if the comfortable yearly spending number after retirement is $100,000 per year, multiply it by 33.

For a $100,000 per year total spending level, your Fat FIRE number is $3.3 million.

It means that once a person has accumulated $3.3 million at retirement, they can comfortably spend approximately a 3% drawdown rate or withdraw $100,000 yearly.

There are more steps involved in calculating the personal Fat FIRE number. This calculation depends on two other figures:

- Current savings per year

- Current nest egg

Since we know how to estimate the yearly spending figure, we need to calculate a person’s saving rate, which is how much you invest every year.

If your current invested net worth is $1 million and your fat fire number is $3.3 million, you need to accumulate $2.3 million.

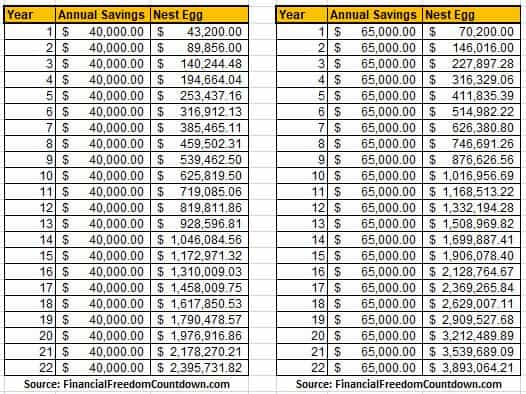

Assuming you save and invest $40,000 annually with an average 8% rate of return, you could accumulate the additional $2.3 million in 22 years.

Bumping up savings to $65,000 annually shortens the journey to financial independence by five years.

Different Flavors of the Financial Independence Retire Early

The Financial Independence Retire Early movement has been around since the 1990s. The FIRE method of saving for retirement is growing and now includes several different FIRE calculations, with Fat FIRE being the hardest to achieve. The primary type of FIRE methods are listed below: easiest to hardest.

- The Coast FIRE method ensures you have invested enough to stop contributing and still reach FIRE when you retire.

- The Barista FIRE method could mean working part-time for supplemental income and needs like health insurance.

- Lean FIRE is a means of reaching FIRE with minimal investing and retiring with a tight budget. Some call the Lean Fire plan the vanilla FIRE or plain vanilla FIRE.

- Traditional FIRE is a method for you to retire early once you’ve accumulated 25 times your annual expenses based on the Trinity study.

- Fat FIRE is the method to ensure you have a significant net worth at retirement and typically accumulates 33 times your annual expenses.

For any version of financial independence to succeed, all your net worth must be invested in productive assets that generate income or increase value. You cannot include your primary home in the calculation since you always need a place to live. Of course, if you plan cash-out refinancing, you could add that amount to the analysis.

The Differences Between Lean Fire and Fat Fire

The main difference between Lean Fire and Fat Fire is how much money you need each year for early retirement. Becoming an early retiree will take work and sticking to any plan.

The difference between the two is they are the extremes of the FIRE methods. Lean FIRE is the barebones method for all the FIRE types. Fat FIRE was developed to achieve an early retirement or retire at retirement age with much more money, which gives you more wiggle room in your monthly budget.

The Lean FIRE method, once accomplished, should not require working after retirement, though retirees can work in a less stressful job if they want to supplement their income. The Lean Fire method figures your net worth at retirement and leaves you with the minimum to cover expenses for housing, transportation, and food after retirement.

Lean means living a lean lifestyle after retirement. If you’ve lived a frugal and lean lifestyle during your working years to achieve Lean Fire, you are already used to a frugal lifestyle. It is built assuming your spending and expenses will remain at or under the same annual spending levels after you have retired.

If living the Lean Fire lifestyle in retirement requires that retirees have an investment portfolio worth $1 million, Fat FIRE requires an investment portfolio of $2.5 million. Anyone pursuing the Fat FIRE goal could miss it when they decide to retire, but they could have easily accomplished the Lean Fire method.

Others describe the Lean FIRE method as the minimalist way to achieve FIRE, which means you retire with a lean budget. A quick way to describe the differences between Lean FIRE and Fat Fire are:

Lean FIRE:

- It is an easier way to achieve FIRE

- It means living on a strict budget after retirement

- It also means after reaching Lean FIRE; you have to live quite a frugal lifestyle

Fat FIRE:

- It is the most challenging path to achieve FIRE by retirement or early retirement.

- Lots of wiggle room in your budget after retirement for unforeseen events.

- It enables you to live a more luxurious lifestyle after retiring.

A Closer Look at the Other FIRE Methods Compared to Fat FIRE

Now that we have seen how Lean FIRE compares with Fat FIRE, let’s look at the other main FIRE methods as they compare to Fat FIRE.

Coast FIRE

When someone tries to achieve Coast FIRE, they must realize that the FIRE method eliminates the part about retiring early. It is about retiring with a sense of peace of mind, which is most important to many people.

With Coast FIRE, your goal is to reach a specific threshold of money where your accounts have enough money invested that you can let compound interest help you get the rest of the way to your personal Coast FIRE number.

Once you’ve hit your Coast FIRE, you can stop contributing to your retirement accounts, which frees up your monthly income. The money invested so far will compound to support your post-retirement lifestyle. You would retire at the normal retirement age defined by the Social Security Administration.

Barista FIRE

The name Barista is named after baristas at Starbucks, which recently announced that they would offer health insurance to all employees who average 20 hours per week.

Once you have reached your personal Barista FIRE number, and after retirement, you ease out of your previous intense and maybe stressful career, you can work at Starbucks or another job and get insurance and extra supplemental income. That allows you to live a quieter and more enjoyable life. You probably have friends who have retired early and decided to return to work because they want income and insurance.

That means that once you’ve hit your Barista FIRE number, you can work a part-time and low-stress job to get health insurance and some extra money to ease your annual spending expenses.

Many people aim to reach a Barista number without even knowing it. All they were trying to do was to accumulate enough wealth to live a more comfortable retirement and move out of corporate job culture and to a less stressful career.

Regular FIRE

Compared to the traditional or regular FIRE, they are the same, except the numbers are much higher with Fat FIRE than with Regular FIRE. Fat FIRE allows retirees to have a lifestyle requiring higher monthly expenses. The more expenses you will need in retirement, the more cash you need, and the higher your personal FIRE number will be.

To achieve this higher standard of living in retirement, you will have to save harder and possibly work longer than you want.

The decision to retire early after achieving regular FIRE or continuing to work to pursue fat FIRE will be up to each individual. People will change how they feel when they reach this mark, or they could be so tired of their very stressful job that they either retire or find a less stressful job at a lower yearly income.

Disadvantages of Fat FIRE

Fat FIRE does have some disadvantages everyone should be aware of:

- Pursuing Fat FIRE means you might have to work longer than you want to achieve your Fat FIRE number.

- Or you need to hustle with side gigs and sacrifice your quality of life.

- You always wonder, “when can I retire” and delay the joys of retiring while you accumulate this large amount of money.

- Once someone finds they never needed that much money, they could have retired years earlier.

- The more you make, you feel you need more discretionary spending.

- Fat FIRE doesn’t rely on an actual budget or fully embrace frugality and live with less money, which means you could risk lifestyle creep or inflation. Lifestyle creep means you start living a more luxurious lifestyle than you should.

- You must ensure that the amount you plan to need in retirement is accurate.

- You accumulate generational wealth, set up a revocable living trust for your kids, and realize that your heirs do not embrace your values.

- If you have a naturally frugal personality, Fat FIRE is probably not the best FIRE method for you, and some other ways are better.

How Do You Achieve Fat FIRE

Financial independence early retirement is a lofty goal in itself. Seeking fat FIRE takes it to the next level due to the higher annual spending your nest egg must support. To achieve fat FIRE, we need the following two components to accumulate as much money as possible.

High Income

The Fat FIRE method requires a more significant nest egg than other financial independence approaches. The breakdown between saving vs. investing should tilt more towards investing.

Also, the traditional 50/30/20 budget will not work, and we must invest at least 50% of our net income. High-income professionals are best suited to bump up their savings rate in pursuit of fat FIRE.

- Improve your human capital so you can get paid more.

- Cultivate high-income skills so your job is always secure, even in an upcoming recession.

- Maximize all employee perks and tax saving strategies such as ESPP, 401(k), 403(b), from their Health Savings Accounts, FSA, dependent care, transit perks, etc.

If you have a high deductible health plan at work, consider moving funds to the free Lively HSA account, which has no hidden fees and helps you invest the HSA funds growing it faster. Also, Lively won’t charge you any fees to roll over or transfer your HSA to them. You can transfer your full or partial balance directly to Lively from your existing provider. Lively will contact your previous provider and handle the transfer on your behalf.

Develop a side gig that allows you to increase your income.

Online business is the best due to the risk/reward ratio. The low cost of starting an online business and the opportunity for passive income make it an ideal diversified income source. Besides, you can avail of several tax exemptions and live in a low-cost country/state to make it even more profitable.

Given the digital economy, more and more of our world will be moving online. Automated tools make it easy to start a website in 10 minutes with zero computer programing skills.

A website like the one you are currently reading generates income via affiliate sales and display ads. Read examples of how Edward and Betty started a website in 10 minutes and wrote about topics related to their day job and hobbies, generating monthly income.

Pick a niche you are interested in, and creating content should not be hard. Many websites generate money by reviewing TV shows, home improvement, or travel locations.

Click my Bluehost affiliate link to get started. It provides a one-click WordPress install and a free SSL certificate.

High Return Investment Income

One can obtain a large nest egg by periodically contributing to compound interest investments and getting over 7% on your investment. The money invested has to compound at a rate faster than safe investments.

Risk and reward are inversely co-related. Seeking the safety of fixed-income investments like I-Bonds can only keep pace with inflation and not provide growth.

Getting a 7% return on your investment portfolio each year is easier said than done. The 7% figure is used because it is the average return on investing in the S&P 500. Between 2010 and 2020, the S&P 500 has mainly been up, with just two out of the 11 years showing a negative return. It does mean there is no risk, but there has to be some risk if you need at least a 7% return.

In 2011, the S&P 500 index showed a 0% return. In 2016, the S&P 500 had a positive return of 9.5%. Even with the bad years, the S&P 500 showed a compound annual growth rate (CAGR) of 11.4% over the 11 years.

Unless the economy hits another financial crisis, like in 2008 and 2009, investing in stocks and bonds usually creates a positive return. We currently have negative returns in 2022 because investing during a recession is hard.

This year-to-year volatility shows why long-term gains are possible and why a buy-and-hold strategy is the best chance for investors to get a 7% return. Buying and trading stocks in and out only costs money, takes time, and is usually not a sound investing strategy.

Yes, you could lose money in any year investing in bonds or stocks. If you panic and wonder, “should I sell my stocks” during the downtimes, you lock in losses and never get the chance to benefit from the longer-term gains.

Some investors like to invest in dividend-paying stocks. Picking individual stocks and bonds yourself takes time and knowledge to get the right stocks. A better option could be to consider dividend aristocrats. Just be prepared for lower growth from dividend stocks and value investing compared to moonshot stocks.

Another good way investors can create passive income streams is to invest in real estate.

There are several ways to invest in real estate, including real estate investments with little to no money.

Many of these involve sweat equity, such as fixing and flipping homes. Or wholesaling houses. But if the market cooled off too much, a house flipper could be left holding property with few buyers. Using the BRRRR method could protect against market downturns, but one must always be cautious of real estate investment risks.

A better way to invest in real estate is to become a landlord. Because of a small supply of available rental homes, rental prices are increasing. Understand the real estate metrics used to evaluate a rental property. Since one must maintain rental homes, it can take some hands-on work to be a landlord.

If you are not located in one of the best states for real estate investors, consider long-distance real estate investing or turnkey property.

Many investors who like real estate don’t want to be house flippers or a landlord but want to invest in real estate. Investors can buy real estate investment trusts (REITs) and funds that invest in real estate. Or use real estate note investing for actual passive real estate income.

Real estate crowdfunding or farmland investing are other passive options for investing in real estate.

If you are good at raising capital for real estate investing, you can invest in apartment buildings, storage units, or mobile home parks.

Learning how to start property investing with beginner strategies will help you later when doing more significant real estate syndication deals.

If you want to invest passively in real estate, determine if you meet the accredited investor qualifications.

Fundrise has one of the lowest minimums (only $10 for the Fundrise Starter Portfolio and is available for accredited and non-accredited investors.

Streitwise is similar to Fundrise in offering a fund structure and is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals.

EquityMultiple gives accredited investors direct access to individual commercial property with a minimum of only a $5,000 investment.

PeerStreet has equity or debt investments on its platform. For debt deals, you provide hard money loans for others to buy the property. The advantage of PeerStreet is that you can filter debt deals by Loan To Value (LTV) and also stressed LTV. PeerStreet has a low $1,000 minimum and has an optional automated investing feature that automatically places you into investments that match your criteria.

You benefit from diversification across several properties with REITs for relatively smaller amounts. You can buy publicly-traded REITs like VNQ using no-fee platforms like M1 Finance for as low as $10.

Instead of pondering stocks or real estate, invest in both.

There are alternative investments to be considered based on your risk profile, but only after someone already has a well-diversified portfolio of stocks, bonds, and real estate.

Investing in cryptocurrency has been a hot topic recently. People made significant gains with specific cryptocurrencies, but lately, they have dropped in price.

But cryptocurrencies are very risky, and if you want to invest in them, they should be a small percentage of the entire portfolio. Although cryptocurrency IRAs are eligible for retirement accounts, investors with a low-risk tolerance should avoid investing as the chance of losing money is high.

Some investors invest in art, wine, and other types of collectibles.

Platforms like Yieldstreet provide investment options in art, structured notes, supply chain financing, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $2,500.

Paying Down Debt

An essential theme among all FIRE methods is becoming aggressive about paying down debt. When debt is paid off, you have much more free money to invest to reach whatever your FIRE number goal is.

Paying off all debt, especially credit card debt, will make your life much easier by the time you retire. Debt is a burden on your lifestyle and reaching investment goals. House and low-interest car payments are fine, but credit card debt can derail your saving and investment plans and make it much harder to get your FIRE number.

The average interest on credit card debt in the United States is now at 18.44% and climbing higher as the Federal Reserve raises rates even more. That 18.44% is money taken from you to service your debt. You could use the money to reach your FIRE number sooner and achieve financial independence.

Is Fat FIRE Right for You?

As the time towards retirement gets closer and you plug your numbers in retirement calculators, you worry if your liquid net worth will recover in time for retirement.

It might be time to consider when you can retire or if your how to FI plan needs to be reworked.

Many people are worried that they won’t have enough money at the time of retirement to live off and about their financial goals in general.

There is Social Security, and some have pensions, but with rising prices, there is no guarantee it will be enough to live a decent life after retiring.

Pursuing FatFIRE is a delicate balance between living a comfortable retired life and avoiding life’s hedonic treadmill of accumulating generational wealth.

Whichever FIRE strategy you decide on, you can enjoy the best life and live life to the fullest in retirement. Pick the method that is best for you and your personal finance.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.