Accumulate Assets And Avoid Liabilities: Best Assets To Buy

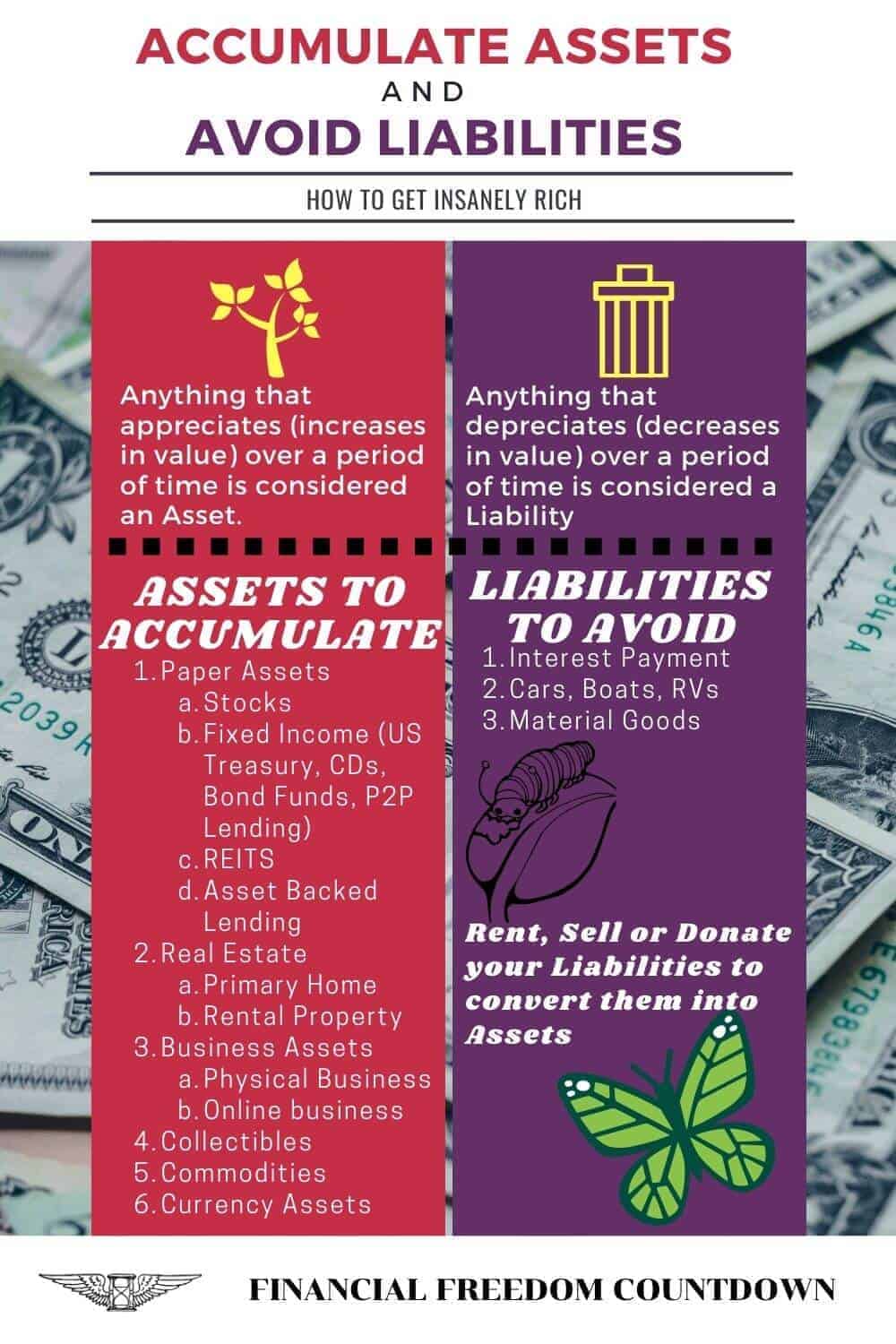

What Are Assets And What Are Liabilities?

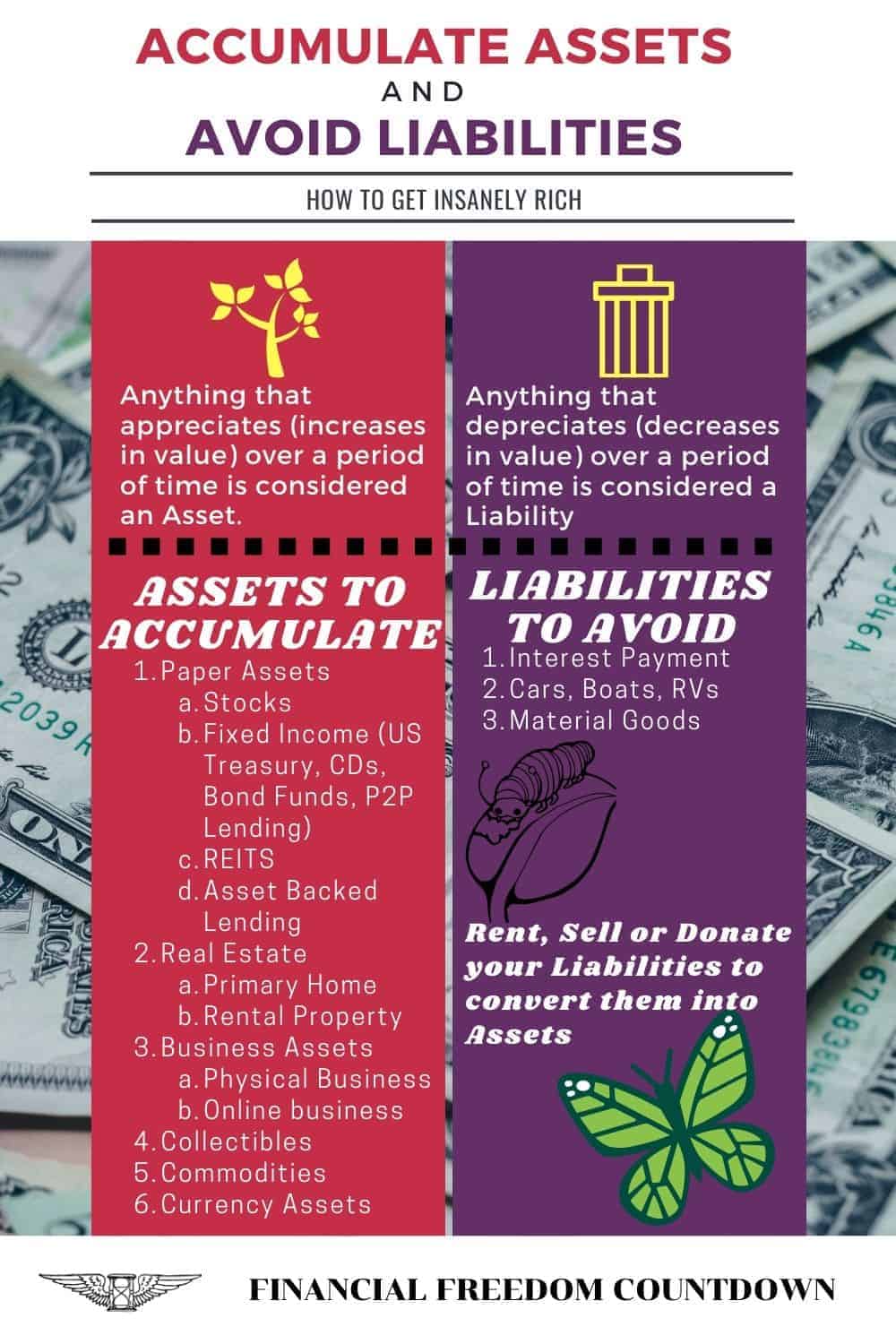

Anything that appreciates (value increases) over some time is considered an Asset.

Anything that depreciates (decreases in value) over some time is considered a Liability.

Why Accumulate Assets And Avoid Liabilities?

When you start and don’t have any money, I highly recommend improving human capital. Your human capital would be your best asset to leverage to achieve financial freedom.

However, as you start going down this path, you will hit a limit. Your time is finite. You do not want to get up in the morning, earn money for your needs, spend it, and then repeat the cycle the next day.

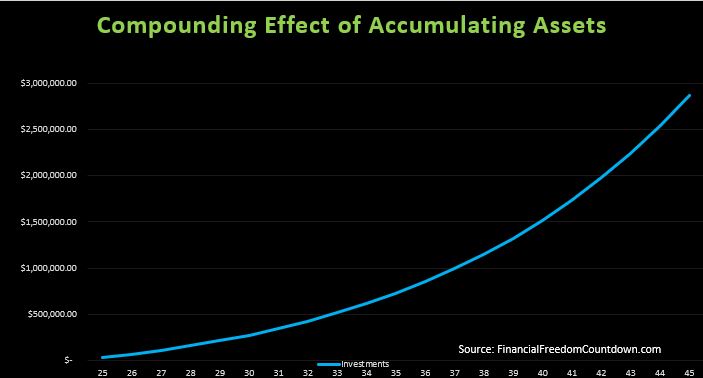

Since assets increase in value over time, they either appreciate or provide continuous cash flow. Invest the generated cash flow to buy more income generating assets. Due to the compounding effect, you will reach a point where your assets’ monthly cash flow takes care of your living expenses.

The best assets to buy depends on your risk profile, time, knowledge, and unique circumstances. Increasing your net worth should always be your primary focus. There are several free tools such as Personal Capital to track your net worth for free. Read my Personal Capital review and sign up.

Here is a graph indicating the exponential growth in net worth due to accumulating assets wisely.

Best Assets To Buy

When you consider investments, there are several assets to invest in. Each asset has some pros and cons. The best asset to buy depends on your risk profile, time, knowledge, and unique circumstances.

When you consider buying assets, there are six broad asset classes.

- Paper Assets

- Stocks

- Fixed Income (US Treasury, CDs, Bond Funds, P2P Lending)

- REITs

- Asset-backed Lending

- Real Estate

- Primary Home

- Rental Property

- Business Assets

- Physical Business

- Online Business

- Collectibles

- Commodities

- Currency Assets

Let us take a look at each of these in detail. It will help you decide the best assets to buy. Ideally, you should have a mix of different assets to generate multiple income streams.

#1 Paper Assets

1a. Stocks

A stock is a share in a company. The reason the stock prices go up over a period of time is because a company makes more money.

Companies provide goods and services that people want and are willing to pay for. Companies employ smart and hard working people whose job is to be better at what they do everyday.

When you add the employees’ efforts, companies continue to not only make money each year, but also make more than what they did last year.

There are 3 sources of returns when owing stocks of a company.

- When the company makes profit; you get a portion of that profit based on how many stocks you own in dividends. Dividend paying stocks provide steady cash flow.

- If a company does not issue dividends; it could also buy back the stocks from the market. Since buybacks reduce the available stocks in the market; the price of the stocks increases. From a U.S. taxation standpoint, buybacks are more efficient compared to dividend distribution.

- An increase in earnings leads to investors willing to pay a higher price for the stocks going forward. This is known as PE expansion or multiple expansion.

Individual stocks have high risks and high returns. Investors can build their own portfolio of moonshot stocks. Or invest based on themes like SPAC or ESG investing.

Risks of investing in individual stocks can be mitigated by investing in broad based index funds and exchange traded funds (ETFs).

Broad-based index ETFs avoid some of the volatility and risks associated with individual stock picking. To further reduce risk and volatility, it is best to invest regularly, whether the market is up or down. And automate that investing behavior. Stock investing is available to everyone with no restrictions, and it is easy to get started.

Although private equity investments are not publicly traded, these assets have similar sources of returns like stocks.

1b. Fixed Income (US Treasury, Certificates of Deposits, Bond Funds, Peer-to-Peer Lending)

Bonds, Certificates of Deposits (CDs), or Peer-to-Peer lending typically provide cash flow in the form of interest payment because you have lent the money and are considered as fixed income investments.

US Treasury is the safest form of Fixed income in the world as long as you hold the individual security (not in a bond fund) to maturity. You can buy TIPS, Series EE and Series I Bonds directly from the US Treasury.

CDs are also a safe form of Fixed income as the principal is covered within FDIC limits, and the interest you receive is fixed.

Bond Funds are usually traded on the public market, so you have liquidity. Since a typical bond fund contains maturities of different duration, changes in interest rate impact it. The cost of this liquidity and diversification comes in the form of price fluctuations.

Since we have been in a declining interest-rate environment for over 20 years with benign inflation, the treasury bonds have provided excellent capital appreciation.

You might be surprised to know that bonds have beaten stocks over the last 20 years.

Of course, with the federal funds rate at a low level in the current interest rate environment; we cannot predict if we eventually get negative rates or the Fed decides on Yield Curve Control methods.

Peer-to-Peer lending is the riskiest form of Fixed Income. You are lending money in the hope someone would pay you back. Most P2P platforms offer no collateral. You have little recourse if that individual does not pay. I would personally avoid it.

In the fixed income market, the risks and returns are directly related. US Treasury is the safest form of investment and has the lowest return. Peer to Peer lending has higher returns but is the riskiest since you may not get back the money you lent.

1c. Real Estate Investment Trusts (REITs)

This is the most hand-free method of real estate investing. REITs make money by renting, leasing, or selling the properties they own.

Also, you have different REITs based on a specific sector. E.g., retail, shopping centers, office buildings, data centers, hotels, resorts, healthcare, and hospitals.

Real Estate Investment Trusts (REITs) are required to return a minimum of 90% of taxable income in the form of shareholder dividends each year. When you are in the asset accumulation phase, this could be tax-inefficient. And it is preferable to hold REITs in tax-advantaged accounts. However, in retirement, REITs are great for generating real estate passive income.

Vanguard, Schwab, Fidelity, etc., have created several REIT products that blend various sectors. You can buy REITs just like you buy other index ETFs. REITs are one of the best income-producing assets.

ACTION STEP: Paper Assets such as Stocks, ETFs, Bonds or REITs are the easiest to own and provide the most passive form of income. Consider buying in an Automated fashion. I personally use M1 Finance due to zero fees, very low minimums, automated investment with automatic rebalancing.

1d. Asset-backed Lending

Unlike Peer-to-peer (P2P) lending, asset-backed lending involves making loans against an asset. It would be best if you found out the value of the asset. And loan only up to a certain percentage of that asset. E.g., If the asset is worth $100K, determine if you would be comfortable lending only $50K or $80K.

The most common example is loaning against real estate. You could be the hard money lender on a fix and flip property. Or you could invest in an equity real estate deal. You could also do real estate note investing as a passive income strategy backed by real estate as collateral

This method is more active compared to buying a basket of REITs.

Real estate projects are very capital intensive; you can spread your investment dollars across many properties using crowdfunded real estate. Before allocating your money to any real estate project, make sure you read the 10 point checklist to evaluate real estate deals.

Real estate syndication is the easiest method to obtain all the benefits of real estate while having professionals manage it for you.

Besides real estate, you can also lend against other assets. Some of the most common ones are rare wine collections, artwork, farmland, etc.

ACTION STEP: PeerStreet, CrowdStreet and FarmTogether are best real estate syndication companies providing opportunities to compare and invest in residential, commercial real estate and farmland deals, respectively for accredited investors. Fundrise provides opportunities for non-accredited investors to invest passively in crowdfunded real estate deals.

#2 Real Estate

2a. Primary Home

Robert Kiyosaki of the Rich Dad, Poor Dad fame doesn’t consider the primary home an asset. While I agree that your primary residence doesn’t produce cash flow, you do need a place to live. Else you would be renting and making the landlord rich.

Your monthly housing payment is imputed rent. It is the rent you would be willing to pay to live in your own house. One of the many factors one needs to consider when asking “is now a good time to buy a house“?

Also, hardly anyone buys their Primary Home in cash. With low interest rates and tax deductions, it makes financial sense to take a loan and pay a small down payment on your primary home.

Consider you buy a $100,000 with 5% down payment or $5,000. In 5 years, assume your primary home has appreciated to $120,000. Your down payment has tripled in value as a result of leverage.

Even if your house keeps pace with inflation, you will make money. And I do not include in this calculation Tier 1 city, which has had a monstrous run. Of course, you need to be willing to stay in your house for at least 7+ years to make it worth it.

Housing loans are the best form of leverage because, unlike stocks, you do not receive margin calls.

2b. Rental Property

Rental properties not only provide significant cash flow, but you also have the opportunity to force appreciation on the property. While I cannot control what Apple or Tesla does, I can employ various techniques to either increase the rent. Or I can carry out capital improvements to modify the cap rate of my property. Depending on your high-income skills, capital and time commitment you could get real estate exposure from owning multifamily rental properties or commercial real estate or single family rentals.

Short term rentals such as Airbnb or VRBO are options besides long term rentals.

Besides, rental properties have several tax advantages such as depreciation, expense write-offs, tax deferrals via Sec 1031, QBI, etc.

Rental properties are not very liquid. So consider various exit options before owning a rental property as an investment. Also make sure you understand how to evaluate a rental property before purchasing one.

In case you cannot afford a rental property, there are several ways to invest in real estate with little or no money. Of course, there are several real estate investment risks so one should have an appropriate risk mitigation plan in place.

Usually, it is not recommended to use debt to buy assets. Real estate investing is one of the few exceptions to the rules. Fixed rate mortgages provide benefits of leverage with minimal risk of margin calls.

ACTION STEP: Assess if you would like Real Estate to be part of your Net worth in the long term. Whether you decide to buy a Primary Home or Rental Property or both, make sure you run the numbers first.

#3 Business Assets

3a. Physical Business

Small businesses are the lifeblood of the U.S. economy and account for 44 percent of U.S. economic activity. They create two-thirds of net new jobs and drive U.S. innovation. Some of them could be as simple as a lawn mowing business, laundromat, car wash, or a restaurant. You can also explore franchises.

Physical Businesses do require startup capital. In addition to capital costs, they usually have an ongoing operating expense as well. Also, you do need specialized knowledge or partner with someone who does. If all the above criteria can be met, physical businesses do provide a lucrative avenue to turbocharge your net worth.

ACTION STEP: You may easily invest in small firms around the country by using a platform like Mainvest. It’s free to join, and there are no fees. Simply choose the businesses you’d like to invest in. You can begin investing with as little as $100,

3b. Online Business

Given the widespread usage of the internet, it is easier than ever to find your tribe. You can set up a website to talk about your primary job or hobbies. And develop your online business.

If you are a CPA at work, why not start a website sharing your tax expertise. Initially, you can monetize your website with ads or affiliate deals. Over time, you could become an authority in the space, garnering speaking engagements, additional clients, or even a book-writing deal. You could even create your products or courses.

If you do not want to talk about work, you can even write about your hobbies such as travel or gardening. There are successful money making websites in every niche. Explore online business as one of the best income generating side gigs.

Unlike physical business, it is effortless and cheap to create a website. For a low monthly fee of $3.95/month you can sign-up to get started. Check out my step by step guide for beginners on how to start a website.

ACTION STEP: At a minimum, consider setting up a website and brainstorming ideas for your online business.

#4 Collectibles

Art, vintage cars, rare coins, baseball cards, stamps, rugs, etc., are examples of collectibles. Unlike paper, real estate, or business assets, the increase in value comes solely from scarcity.

These assets generally not liquid. Also, with collectibles, there is no way to predict what could be the future price. Collectibles would be considered speculative investments and should ideally not form the bulk of your net worth. Collectibles are usually very expensive but now it is now possible to invest in art with fractionalized art investing.

ACTION STEPS: Consider collectibles only if you have specialized knowledge or edge in that area. While Collectibles can provide diversification benefits, it should be only a small portion of your portfolio.

#5 Commodities

Oil, Copper, Timber, etc., are primarily used for trading. Their price fluctuates based on supply and demand. Unless you are working on a commodity trading desk, there are no right instruments to trade these assets. Investing in Natural Gas counts as one of My 4 Worst Investments.

ACTION STEPS: Consider commodities only if you have specialized knowledge or edge in that area. Also, pay special attention to what instruments you use to buy or trade those commodities.

# 6 Currency Assets

I would categorize Cash, Gold, Silver, Bitcoin in this category. These are assets that you hold outside of the typical government and financial channels.

Quite useful if you need to leave everything behind at a moment’s notice and save your life. You should not rely on these assets for an increase in value. Instead, consider them as an ultimate form of insurance. I have shared my experiences with sectarian violence; and why I prefer some part of my net worth in a form that no government or financial institution can confiscate.

Of course, you could invest in cryptocurrency based on the value of DeFi, NFTs and Metaverse Crypto but till we obtain wider adoption these applications will be limited.

ACTION STEPS: Depending on where you live and what risks you perceive, decide if you would like to hold some part of your net worth in currency assets.

How To Buy Assets

Stocks, Bonds, REITS can be bought at any online brokerage platform. I prefer to use M1 Finance because I can select my asset allocation, use dollar-cost averaging to buy in an automated fashion at regular intervals, auto rebalance with no tax consequences. All with no fees.

US Treasury can be bought using I bonds at Treasury Direct.

Asset-backed lending is available through networking. For example, you could lend to someone in your local area to fix and flip.

Or you could use crowdfunded real estate platforms for deals. Besides real estate, the crowdfunded websites also have other assets such as art, wine, farmland, etc. Unfortunately, due to SEC regulations, asset-backed lending is generally only available to accredited investors.

If you do not qualify as an accredited investor based on financials, you can still meet the accredited investor qualifications based on knowledge.

Real estate assets in the form of a primary home or rental properties are available to everyone depending on your creditworthiness.

Running a physical business generally requires knowledge of that business. Such opportunities would be available within your business network. Franchises are another option if you want to pursue that route.

Online business is easy for anyone to set up and operate, even from foreign countries. During my vacation in Thailand, I met several online entrepreneurs who have a website selling ebooks on fitness, gardening, etc., to customers in USA and Europe.

Pick your hobby and setup your website using my Bluehost affiliate link. Even if your hobby is watching movies, you could leverage that into an online business of writing reviews and generate income. There is a limited downside with online business due to extremely low setup and operational cost. Worst case, you can shut your website if you don’t want to continue.

Sites like Flippa are also an option if you want to buy websites. However, it is always better to create your own website and get started. Even if you decide to later buy safe income producing websites; the knowledge you gain by creating your own website would be useful in evaluating the purchase and also operating the websites.

Buying collectibles would depend on the physical item purchased.

Commodities are widely traded on most exchanges. Do not fall into the trap of using underlying ETFs to buy commodities if you do not understand the ETF structure.

Bitcoin as a currency asset can be bought from the regulated exchanges such as Coinbase, BinanceUS and BlockFi. Make sure you store in a private wallet.

Gold, Silver can be purchased in physical form from your local store or US Mint.

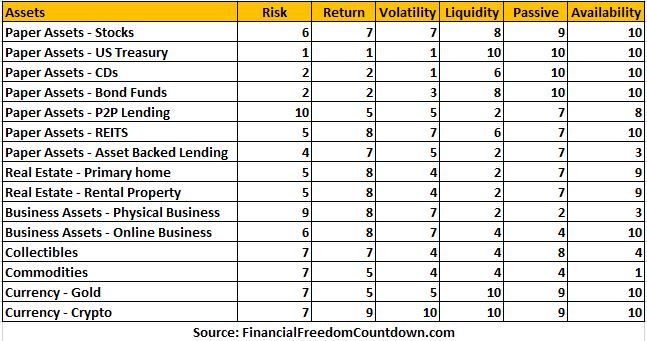

Ranking Best Passive Income Producing Assets

The best assets to buy depends on your risk profile, time, knowledge, and unique circumstances. Let us evaluate every asset depending on the anticipated risk and volatility, anticipated return, liquidity (how easy is it to sell and get our money back), passive nature and availability (can anyone buy it).

Each asset is scored on all these individual areas in a range of 1 to 10 with 10 being the highest to determine the best income producing asset. So a rating of 10 for risk means that the asset is riskiest.

Stocks are classified as medium to high for risk, return, volatility and liquidity. They are also the most passive investment assets and available to anyone to buy.

US Treasury has the lowest risk, return, and volatility out of all the assets. And the highest liquidity, availability, and most passive.

Certificates of Deposits (CDs) are slightly riskier than US treasuries. Also they are not very liquid since most of them are locked for a fixed duration. Some CDs allow you to withdraw your money with a pre-payment penalty.

Bond Funds are more liquid than CDs since they are traded on a regular basis. They are more volatile compared to US Treasury or CDs.

P2P lending is the riskiest asset since you are lending money to strangers with no collateral. Also, it is not liquid since the money is locked up for the duration of the loan. I would avoid it.

REITs provide a high return and are relatively passive like stocks. REITs are a great source of passive income since by law, most of their profits are distributed every year.

Asset-Backed Lending has low risk since the assets back the loan, and you earn passive income. However, since most of these are restricted to accredited investors, the availability is low.

Real Estate in the form of a primary home or rental property has a great return to risk ratio since you can use leverage with fixed interest rate loans. Real estate is not totally passive. And it is not liquid either. All transactions take time, and if the real estate market is in a downturn; you could be waiting for a few years.

Physical Business has a high risk since you cannot diversify. Your laundromat or restaurant could run into trouble. Also, these businesses are hard to sell immediately in a recession. Require a lot of time and energy, so not passive. The physical location leads to high fixed costs. Also, the availability is low since you need specialized knowledge of the business. And not everyone would be qualified to run a physical business.

Online Business has a lower risk than a physical business since you can diversify income streams. For example, a website could make money from ads, affiliate sales, e-book sales. Operating costs are negligible. Barriers to entry are low since anyone can set up a website in an hour.

Collectibles generally are not liquid. Also, it is hard to predict what could be the future price.

Commodities are more liquid than stocks since they are traded on a global basis. However, the availability is low since you need deep subject matter expertise.

Currencies like gold and crypto are liquid since they are universally accepted. Also very passive since we are using it as a store of value. Cryptocurrencies are very volatile compared to other assets, including gold. But they have a high return potential since they represent an asymmetric bet on the future.

I have made several assumptions when ranking the best assets to buy. It should help you in forming your ranking to determine your current asset allocation. As your life circumstances change, continue to use this framework to make adjustments.

Best Physical Assets To Buy

My dad is pretty old school and considers only physical assets as the real assets. In that case, the list of physical assets to own is

- Real estate

- Physical Business

- Collectibles like art, vintage cars, rare coins, baseball cards, stamps, rugs, etc

- Currency assets like gold, silver, and cash

Given that we are moving to a digital world, there is no benefit in sticking to only physical assets. It might feel more comfortable, but you would not be sufficiently diversified without adding paper assets to the mix. For every best physical asset, there is a corresponding digital asset available. For example, art is now fractionalized and you can share in the investment growth of artists such as Banksy or Picasso by investing in the paintings via Yieldstreet.

People often wonder should I invest in 401k or real estate and my answer is “why not both?”. After all, there are several ways to invest in real estate with little or no money.

What Liabilities Should One Avoid?

While Assets increase your Net worth, liabilities are leeches draining your hard-earned money.

In an ideal world, we would only accumulate assets and avoid liabilities. However, that would be a miserable existence.

Let us take a look at the most common liabilities.

#1 Interest payment

Any interest you pay is the most significant liability on your net worth. Of course, one can’t avoid all loans, so let us look at what is acceptable.

Interest payment on credit cards, student loans, or personal loans is an absolute no-no.

The Federal Reserve has lowered interest rates across the board. Make sure you take advantage of it.

If you have been paying higher interest on credit cards, car financing, etc.; check out personal loan rates from up to 10 vetted lenders in 2 minutes on Credible.

When you complete the personal loan prequalification form, you can compare your prequalified rates from all the lenders without affecting your credit score. After you select one of the prequalified rates, you will be redirected to complete an application on the lender’s site, which will result in a hard credit inquiry.

Use the Personal Loan only to lower your interest rates and not to take on additional debt.

Similarly, if you have Student Loan debt, check Credible to refinance federal, private and ParentPLUS loans. Compare prequalified rates from multiple, vetted lenders in 2 minutes. Checking rates won’t affect your credit score.

Remember that all interest payment is not bad. Interest used on loans to buy property is worth it. Your down payment is leveraged, and if there is an appreciation, you can exit anytime.

Interest payment for business deals is also ok. You should have included the cost of the loan when calculating the ROI of your business.

#2 Cars

Since cars are an integral part of our lives, it is perfectly fine to own a car. And as long as you are in a great financial situation, you can even buy a new car. Just make sure it is a conscious choice, and you have run the numbers.

Besides cars, we can also use this category to include other forms of transportation such as boats, RVs, etc. Personally, it is hard to justify buying these; unless you use it every weekend for several years.

#3 Material Goods And Subscriptions

Any material possession you own comes into this category – everything from clothes to TVs to couches. One cannot avoid buying material goods. But when buying, it is always good to gut-check if there are better alternatives.

Most companies drain our money by asking us to sign up for subscription services. We often pay for several subscription services and don’t even use them. Trim is an excellent service that looks at all your current subscription saves money by eliminating unnecessary money leeches. Also, instead of paying full price, sign up and see if Trim can do the work negotiating your cable, phone, and internet bills lower.

How To Turn Liabilities Into Assets?

Now that you know to avoid liabilities, what can you do with all your accumulated liabilities?

Fortunately, the Sharing Economy now offers you multiple options to at least recoup some of your losses.

If you bought a house larger than you need, go ahead and list that spare bedroom on AirBnB.

The average family’s RV will sit unused for approximately 90% of the year. List your RV on RVShare. It is free to join, and you could earn up to $40,000 in additional income per year from your RV when you aren’t using it. You are in control of your rental, which means you set your rental price and how many nights a renter can take your RV.

If you bought an expensive car, list it on Turo and make some extra money.

Other items in your house which you now regret buying; can be sold or rented out. You can sell clothes on Poshmark or Mercari. Clothes or other household items which you can’t sell; can be donated to charities for a tax write-off.

While the above options are not a panacea; at least you can reduce the bleeding.

And now you have learned to be more thoughtful to avoid liabilities.

ACTION STEP: Make a list of all your liabilities you own. Consider if you can rent, sell, or donate some or all of them to obtain some value.

Final Thoughts On Buying Assets

When it comes to increasing your wealth, make conscious decisions every day to accumulate assets and avoid liabilities. Figuring out the best assets to buy depends on your risk profile, time, knowledge, and unique circumstances.

To convert your liabilities into assets, consider if you can rent, sell, or donate to recoup some cost.

Readers, do you agree with the classification of various assets and liabilities based on their risk, return, liquidity and availability to invest?

How many different income generating assets do you own?

What are some of your biggest liabilities you regret buying?

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.

A very detailed look at assets and avoiding liabilities. I especially like your point about how you can make money even from your depreciating assets (Like using Turo and you car).

Great article as I am still beginning to learn about investing and basic financial terms, etc. – soaking up information like a sponge!

You stated that the US Treasury is the safest form of Fixed income in the world. Would you please clarify if you are referring to bills, notes, bonds, or “other Treasury securities?” I clicked the link you provided that went to treasurydirect.gov and felt overwhelmed with the options.

Thank you!

Yes, all of those are issued by the Treasury and each have their pros and cons. Given that inflation is around 2% and most of these instruments now yield lower than that; the return is not great. I do like Series I Savings Bonds personally. But I’d personally invest in it at these rates only after I paid off all my debt and have excess reserves after investing in other asset classes.

Yes, it is crucial to always keep the eye on the prize – Financial Freedom!

Very informative article. Thank you. I liked how you emphasized that we can still generate a profit from liabilities by selling or donating them. That did not cross my mind.

Yes it is important to recover and move forward. Have to keep the end goal of Financial Freedom Countdown in mind.