How To Invest Money: The 3-Step Process To Get Started

Figuring out how to invest money can be overwhelming, especially if you’re a beginner. Knowing where to start, what to invest in, and how much risk you’re comfortable taking on is challenging.

Today we will cover the basics of investing, different types of investment vehicles, and how to choose the right one for you. Plus, we’ll show you how to get started with just $100.

Step 1: Define Your Goals

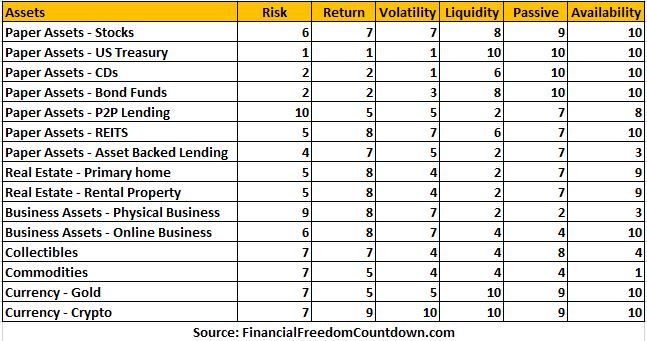

In investing money, several income-producing assets have different returns, risks, and volatility.

The stock market is a great place to grow your money, while others have made fortunes investing in real estate. Before you learn how to invest money, take a step back and ask yourself, “why”?

The purpose of defining your financial goals is twofold

1) Having a clear picture of why you are investing will make it easier to continue investing when the going gets tough

2) The goal will define your timeline and level of risk in your investing plan.

In the short term, stocks are volatile and hence not recommended if your goal is short-term.

For example, if you are saving up to buy a car in 6 months, the money may be better off on short-term investments such as secure government I-Bonds. While fixed income investments do not offer growth like stocks or real estate, they are an ideal place to save money until you have enough for your purchase.

Similarly, if you need a down payment to buy a house in a year, you are better off saving vs. investing the money.

On the other hand, if you are planning for retirement, then learning how to start investing in stocks makes sense, and you have an approximate timeline for investment based on your expected retirement date.

Similarly, if you want to fund your kids’ education by real estate investing, you know you need the money in the next fifteen years.

Break down your financial goals into short-term, medium-term (three to six years), and long-term (more than six years).

Step 2: How Much You Want To Invest

Carve out a portion of your monthly budget for investing. Treat it similarly to your other essential budget categories. If you follow the 50/30/20 budget rules, your 20% is earmarked for investing.

The advantage of setting up a monthly investing schedule is that you can dollar cost average your investment purchases, avoiding buying at the top.

Step 3: Define What Assets To Invest

When you consider investments, there are several assets to invest in. Each asset has some pros and cons. The best asset depends on your risk profile, time, knowledge, and unique circumstances.

Besides savings, the most common investments are bonds, stocks, and real estate.

Investing Money in Safe Investments

Safe investments do not offer a high rate of return and barely keep pace with inflation. However, most of them provide a high degree of certainty that your invested amount will be safe.

A savings account is an excellent place to keep your money for emergencies. Everyone should have an emergency fund set up before they start investing. An emergency fund should have enough money to pay for three to six months of living expenses and other emergencies. You should also pay off any high-interest debt you have. High-interest debt can hinder your financial goals.

You can put your money in a high-yield savings account when interest rates are high. With interest rates so low today, the best yield you can expect is about 1.6%. That is not very much, but high-yield savings accounts are an excellent place to keep money that you cannot afford to risk. One can find some of the best yields at online banks and brokers.

Another safe place is a money market account. Like a savings account, money market funds pay interest, usually the same interest as high-yield savings accounts. Many money market accounts act like checking accounts.

Certificates of deposit (CD) are another safe place to invest your money, but they are not as liquid as savings accounts or money markets. The money in a CD is generally held for a specific period.

They can be invested for three months, six months, nine months, and a year or longer. If the money is withdrawn before the time is up, there can be a penalty. When interest rates are higher than the average dividend of the S&P 500, CDs can be a good and safe investment. The longer the time frame before the CD expires, the higher the interest paid.

If interest rates are rising and are expected to stay at higher levels, many investors will ladder their CDs. Laddering means buying several different CDs that expire at different times.

All of these investment options are good for everyone with a low-risk tolerance. Depending on the initial deposit, the interest rates on CDs will vary. More money and a long time to when they expire will usually pay a higher interest.

How To Invest Money in Safe Investments

Go to Treasury Direct to buy I-Bonds, Treasury Bonds, EE/E Savings Bonds, or TIPS.

One can set up Savings Accounts and CDs at any FDIC-insured bank. You can open several investment accounts, like one for an emergency fund, short-term investments, retirement, college savings, a down payment, or other financial goals.

Investing Money in Bonds

Bonds can be a very safe investment, or they can be risky. It depends on the type of bond. Bonds produce income in the form of interest payments. When interest rates are low, the interest on bonds will be low, especially for highly rated investment grade bonds.

The lower the rating on a bond, the riskier they are, and the higher the interest it will pay. When you buy a stock, you invest in a piece of a company. When you buy a bond, you are lending the company money. And for lending them money, you get paid interest.

You are lending the U.S. government money when you buy U.S. Treasury bonds. When you buy municipal bonds, known as munis, you lend the state, city, or other local entity money for their projects.

The safest bonds are those issued by the U.S. government and usually pay interest comparable to the current prime rate, which is relatively low. The bonds paying the highest amount of interest or yield are junk bonds. They are rated low by credit rating services because they are more at risk of default.

If you have a high-risk tolerance, you can invest a portion of your bond portfolio in junk bonds. Even if you have the risk tolerance for junk bonds, be aware that they can and have defaulted before.

For example, you buy a corporate bond that pays 5% interest annually (the yield) and matures in 10 years. You will get an interest payment every quarter. If you hold the bond until maturity, you will get your original $1,000 back at the time of maturity.

Bonds can be bought and sold. If interest rates start to fall, your 5% bond will look better than the bonds currently being issued. You can sell your bond for a profit. Putting your money, at least some of it, in bonds also diversifies your portfolio and minimizes risk in a bear market.

How To Invest Money in Bonds

Go to Treasury Direct to buy I-Bonds, Treasury Bonds, EE/E Savings Bonds, or TIPS.

For corporate bonds, you could buy individual company bonds or a bond fund like Vanguard Total Bond Market Index (BND) or Fidelity Total Bond ETF (FBND).

Bond funds can be purchased at a brokerage account either in person or use an online broker. I use M1Finance to buy bond ETFs with no fees. Read my M1Finance review for more details.

Investing Money in the Stock Market

The stock market is the most popular way most people invest money. There is a difference between investing and trading. Trading is buying and selling stocks frequently for quicker profits. Investing is for more long-term investments.

Picking individual stocks is not easy. You first need to define your goals. There are several categories of stocks like growth, value, and speculative stocks.

Speculative stocks are usually known as penny stocks and are considered risky investments. If your risk tolerance allows you to speculate on a couple of stocks, make it a small percentage of your overall portfolio.

Growth stocks are companies that are usually newer companies and up-and-coming companies. They are a business that is considered to have the potential to grow faster than competitors in the same field or industry.

Growth stocks usually do not pay a dividend. Instead, they might have a negative cash flow, and if they have cash left over, they invest it back into the business. Growth stocks are more volatile investments because their shares can rise and fall dramatically.

Value stocks are more established and older companies. These stocks are usually trading at a lower price relative to their fundamentals. A company’s fundamentals refer to earnings, sales, and dividends.

Investors see an excellent company temporarily trading below where they think it should be trading but could make for smart long-term investments. Many of Warren Buffet’s quotes on value investing highlight how he made his fortune buying value stocks.

A growth stock can turn into a value stock as they mature. Microsoft is an example of what was once a strong growth stock that today is considered a value stock. Finding the next Microsoft or Amazon on the stock market is difficult, but it can be done. Many brokers offer online screeners that help you find stocks and market data about each company.

Investors can choose stocks on their own or use an investment advisor. Investors who choose to select their stocks will use a couple of ways to analyze a company, fundamental analysis or charting.

Fundamental analysis is the method of understanding and measuring a company’s intrinsic value. Investors who use fundamental analysis believe that the market doesn’t always price all companies correctly.

A stock’s fundamentals include specific factors like cash flow, debt-to-equity ratio, and other factors that affect the company’s bottom line. Investors will also look at the competition, business models, and competitive advantages, if there are any.

Those who use charting techniques will look at the charts of a company. They believe that the stock market knows everything and can determine where its price is going by looking at the charts of where the stock has been.

Technical analysis relies on charting techniques like candle stick charts showing various signals of where the stock might be headed. They will look for reversals in a pattern of where a stock might head lower or higher to time the entry and exit points of a stock.

There are different sectors in the stock market. Investing in several sectors’ stocks is wise to diversify a portfolio. The various sectors of the stock market are as follows:

- Energy

- Materials

- Industrials

- Utilities

- Healthcare

- Financials

- Consumer Discretionary

- Consumer Staples

- Information Technology

- Communications

- Real Estate

When the economy starts to cool off or heads into recession, many investors will sell some of their stocks and invest in defensive stocks. Defensive stocks are companies that make products everyone needs to buy, whether in a recession or not. Consumer staples and healthcare are the defensive sectors for individuals investing during a recession.

Dividend stocks are one of the best investments for your money. Most will pay a quarterly dividend to their shareholders. Many investors will reinvest those dividends back into the stock and buy more shares.

Reinvesting dividends will continue to increase the number of shares an investor owns and increase the dividend they receive. Many brokerage services have dividend reinvestment plans (DRIP) that automatically reinvest your dividends. Investing over time is sometimes better than buying a stock in one lump sum.

Picking individual stocks is more complicated than buying index funds, but a financial advisor can give you sound financial advice to help get you started. Investors also use online screening tools to find the best stocks to buy that fit their criteria. You can find screening tools on online brokers’ websites. Beating the markets is not easy. Many individual investors prefer to invest in the S&P 500 and other broad, diversified indexes to avoid chasing the next hottest sector.

Mutual Funds

Mutual funds are a great way to invest and diversify a portfolio. A mutual fund is a basket of stocks that a fund manager picks for the fund portfolio. When you own a mutual fund, you will own shares of numerous companies. These types of mutual funds are known as actively managed funds.

Other types of mutual funds are called index funds. These funds track underlying indexes like the Dow Jones Industrial Average, the S&P 500, the Nasdaq Composite, the Wilshire 5000, and many other stock indexes. By following the index, an investor who owns an index fund will realize the gains or losses the underlying index makes. A fund that only tracks the performance of an index is known as a passive fund.

A mutual fund has an expense ratio, which pays for the manager and the running of the fund. Investors pay the expense ratio each year they own the fund. For example, if an investor has $10,000 in a fund with an expense ratio is 0.5%, they will pay $50 annually for the expense ratio.

A passive fund usually has an expense ratio from 0.03% to 0.25%. Actively managed funds have a higher expense ratio because they have a manager that actively manages the fund. A reasonable expense ratio for an actively managed fund is between 0.5% and 0.75%.

Some funds have sales commission fees known as sales load or the load. There are two kinds of loads, a front-end load and a back-end load. A front-end load is paid when an investor buys the fund, and the back-end fee is when the fund is sold.

Many funds do not charge these loads, known as no-load funds. Unless an investor wants a fund that charges a load commission, it is best to always look for no-load funds. Vanguard is one mutual fund company known for its no-load funds.

Some funds require a certain amount as an initial investment into the fund. Some funds might require an initial amount of $2,000 or so. It could be higher if the account is for different types of accounts, like an IRA account.

A mutual fund does not trade like a stock with its price fluctuating all day. The price will change at the end of the day when the net asset value (NAV) is calculated. Mutual funds will usually pay a quarterly dividend.

How to invest money in mutual funds is up to the individual investor. Some have their entire portfolio made up of mutual funds, while others just have one or two index funds as their core holdings. There are several types of mutual funds to invest in that include:

- Fixed income funds invest in investments that pay a fixed rate of return. They can be government bonds, short-term bond funds, and investment-grade corporate bonds. They can also invest in riskier high-yield bonds that will pay a higher dividend.

- Stock funds invest in a basket of stocks. Some funds might be specialized in growth funds, value funds, small capitalization, medium cap, and large-cap funds.

- Balanced funds invest in a mix of stocks and bonds, and the fund will specify its asset allocation. Aggressive funds will hold more stocks than bonds since stocks are riskier investments than bonds are. Investors will want their asset allocation more in bonds than stocks as they age.

- Index funds invest in stock market indexes like the Dow, S&P 500, Nasdaq, and other indexes.

- Specialty funds invest in specialized areas of investment. For example, a specialty fund might invest in green energy and hold stocks of solar companies, wind farms, and other green stocks. Other funds might invest in real estate stocks, precious metals, or commodities

- Fund of funds has their portfolio invested in other mutual funds.

Exchange-Traded Funds (ETFs)

ETFs are a lot like mutual funds. They hold a basket of stocks or bonds or some other investment options. Most ETFs are passively managed and track an underlying index.

ETFs will change price throughout the day as a stock does. Investors who buy a mutual fund will pay the closing price that day. When an investor buys an ETF, they pay the price it is at that moment of the trade.

Since ETFs trade like a stock does, there is no minimum initial investment. There are more investment options with an ETF, though some are riskier because they use leverage. In addition to the typical investing categories like stocks, bonds, and specialty funds, investors can find other investment options with ETFs like commodities or inverse funds.

Inverse ETFs allow investors to short the market without having to sell short. These are known as inverse ETFs and investors who buy these funds are betting the market or underlying index is going to drop in price.

For example, an inverse ETF that tracks the S&P 500 will rise in price when the S&P 500 falls. These inverse funds or short ETFs use derivatives like options or futures, which can decay as time passes and the underlying index is not falling.

Holding an inverse ETF for a long time can compound losses, primarily if they use high leverage. Some inverse ETFs are designed to move twice or three times as much as the underlying index. These are risky but can generate good profits if the markets fall. Some popular inverse ETFs include:

- ProShares UltraPro Short QQQ (SQQQ)

- ProShares Short UltraShort S&P500 (SDS)

- Direxion Daily Small Cap Bear 3X Shares (TZA)

Commodity ETFs are popular and allow investors to invest in commodities without trading the commodity futures markets. A few popular commodity ETFs include:

- SPDR Gold Trust (GLD)

- iShares S&P GSCI Commodity-Indexed Trust (GSG)

- iShares GSCI Commodity Dynamic Roll Strategy ETF (COMT)

- Energy Select Sector SPDR Fund (XLE)

- Vanguard Energy ETF (VDE)

Closed-End Funds

Closed-end funds have been around longer than mutual funds or ETFs but aren’t as well known. They are a favorite investment strategy for those interested in generating income because closed-end funds pay some of the best dividends of all investment vehicles. A good dividend is a perfect example of putting your money to work.

They differ from an ETF or a mutual fund because they have a net asset value but trade at their market price. A closed-end fund can trade at a premium or a discount to its NAV because shares can’t be redeemed before a specific period.

Many investors like to buy closed-end funds at a discount to their NAV and sell for around a 5% profit. This way, they gain dividends while they wait for the fund to climb above their NAV.

Many closed-end funds pay a dividend anywhere from 8% to 12%. Investors can diversify their portfolios with various closed-end funds with a mix of bond, stock, specialty, and asset allocation funds.

Another reason closed-end funds are popular with income investors is that most pay monthly dividends. Investors get paid monthly, adding up to a nice monthly income.

How To Invest Money in Stocks

Before you invest your money in other investment vehicles, you should open an account for retirement savings and other financial goals. These accounts can be a traditional individual retirement account (IRA), Roth IRA, a 401(k), or a SEP IRA for self-employed people. Particular investments are best held in a taxable account, while other investments are better for a non-taxable account. Tax-advantaged accounts should form an essential part of your asset location strategy.

Even if you are already enrolled in an employer-sponsored retirement plan at work, you should still open an IRA if eligible. Depending on which type of IRA you open and invest your money in, there are essential differences in how they are taxed. A traditional IRA has the following characteristics:

- You make pre-tax or after-tax contributions. A traditional IRA is best suited for anyone who expects to be in the same or lower tax bracket when they retire.

- The money in the traditional IRA will grow tax-deferred and give you immediate tax benefits.

- When you start making withdrawals after age 59½, the money will be taxed as current income in the tax bracket you’re at when you make the withdrawals.

- It is mandatory that withdrawals start being taken at age 72.

A Roth IRA has the following tax benefits and characteristics:

- You will make after-tax contributions. The Roth IRA is best suited for those that think they will be in a higher tax bracket after retirement or when they start making withdrawals.

- Your contributions will grow tax-free, but you will not get a tax benefit for the current year you make the contributions.

- You can start making penalty-free withdrawals at age 59½, but you must have had a Roth IRA for five years.

- There is no age requirement for mandatory withdrawals.

You can only put a certain amount of money into each IRA per year. For 2022, the limit is $6,000 if you’re under 50 and 7,000 if you are 50 or older.

If you have a high deductible health plan at work, consider opening a Health Savings Account (HSA), which is triple tax-advantaged. Lively HSA is free and has no hidden fees. Also, Lively won’t charge you any fees to roll over or transfer your HSA to them. You can transfer your full or partial balance directly to Lively from your existing provider. Lively will contact your previous provider and handle the transfer on your behalf.

After maxing out your 401(k) at work, you should open an IRA or Roth IRA if eligible. Open a taxable account if your income is above the IRS limits to open an IRA or Roth IRA.

You can open IRA, Roth IRA, or Sep IRA at many brokerage firms, including M1Finance. Read my M1Finance review to see why I prefer the no-fee and automated investment approach compared to Vanguard, Fidelity, or Schwab.

Investing Money in Real Estate

Real estate has been one of the hottest investments recently. Comparing stocks vs. real estate investments gives real estate investments a slight edge.

There are several ways to invest in real estate, including real estate investments with little to no money.

Many of these involve sweat equity, such as fixing and flipping homes. Or wholesaling houses. But if the market cooled off too much, a house flipper could be left holding property with few buyers. Using the BRRRR method could protect against market downturns, but one must always be cautious of real estate investment risks.

A better way to invest in real estate is to become a landlord. Because of a small supply of available rental homes, rental prices are increasing. Understand the real estate metrics used to evaluate a rental property. Since one must maintain rental homes, it can take some hands-on work to be a landlord.

If you are not located in one of the best states for real estate investors, consider long-distance real estate investing or turnkey property.

Many investors who like real estate don’t want to be house flippers or a landlord but want to invest in real estate. Investors can buy real estate investment trusts (REITs) and funds that invest in real estate. Or use real estate note investing for actual passive real estate income.

Real estate crowdfunding or farmland investing are other options to invest in real estate passively.

If you are good at raising capital for real estate investing, you can invest in apartment buildings, storage units, or mobile home parks.

Learning how to start property investing with beginner strategies will help you later when doing more significant real estate syndication deals.

How To Invest Money in Real Estate

If you want to invest passively in real estate, determine if you meet the accredited investor qualifications.

Streitwise is offering a fund structure and is available for accredited and non-accredited investors. They have one of the lowest fees and high “skin in the game,” with over $5M of capital invested by founders in the deals.

EquityMultiple gives accredited investors direct access to the individual commercial property with a minimum of only a $5,000 investment.

You benefit from diversification across several properties with REITs for relatively smaller amounts. You can buy publicly-traded REITs like VNQ using no-fee platforms like M1 Finance for as low as $10.

Investing Money in Gold

Gold is another way to invest your money to diversify your portfolio. You can invest in gold and other precious metals through funds, stocks, or own the precious metal itself.

If you buy gold coins or bars, you will need a place to store them. Gold funds that track the price of gold are an excellent way to invest in the price movement of gold. Investing in real gold and silver coins and bars is one way to stay ahead of inflation.

Unfortunately, gold does not have an excellent track record of outperformance, and it would not be advisable to invest a large portion of your portfolio in gold.

Investing Money in Other Investments

There are alternative investments to be considered, but only after someone already has a well-diversified portfolio of stocks, bonds, and real estate. Investing in cryptocurrency has been a hot topic recently. People made significant gains with specific cryptocurrencies, but lately, they have dropped in price.

But cryptocurrencies are very risky, and if you want to invest in them, it should be a small percentage of the entire portfolio. Although cryptocurrency IRAs are eligible for retirement accounts, investors with a low-risk tolerance should avoid investing as the chance of losing money is high.

Some investors invest in art, wine, and other types of collectibles. But it takes a lot of knowledge about the investment, so unless an investor is a student of the arts, they should think twice about investing in art. Whatever collectible investors choose to invest in, they should be knowledgeable about it before investing money.

How Not To Invest Your Money

Before we wrap up all the different ways you can invest your money, we should discuss how not to invest. One of the written rules of investing is never to put all your eggs in one basket.

For example, if you work for a company that gives out their company’s stock, don’t rely on that as your only investment. There are some infamous stories of employees working for Enron and WorldCom that had all of their investments in the company stock. When the company filed for bankruptcy, the employees lost everything. Successful investing is about diversifying a portfolio.

Don’t risk much of your investing money on risky stocks or hot tips from a friend and other risky investments. If you want to take a chance because you believe in it, invest only a tiny percentage of your investing money. If you take a chance on a penny stock, you can consider it lost money.

Don’t try to time the market precisely. The stock markets will fool you every time. Invest for the long term and don’t trade in and out of stocks frequently. With proper research, investors pick companies they think will do well for them over a long time.

Summary on How To Invest Money

The sooner you can start investing, the better. Once someone has emergency savings and retirement accounts, they can start investing in other areas. You can have different investment accounts. You can keep retirement funds in one financial institution and a stock portfolio in another.

Investing in stocks and funds for growth and income is best for a diversified portfolio. Making smart money moves is not always easy, and using advisory or brokerage services to help make the right financial decisions is a good idea.

Diversifying the portfolio is easier if there is a mix of stocks, funds, ETFs, and bond funds. Index funds are a diversified investment in one fund since they cover a broad range of stocks.

Investing in stocks that pay dividends, such as dividend aristocrats, is having your money work for you. Not only are you gaining the dividend payments, but the stock also has the potential to grow. You can reinvest the dividends and expand the number of shares you own, which increases the dividend payments.

When you invest money, you should know exactly what you are investing in. Choosing individual stocks is not easy. It is easier to buy stock funds or an index fund that holds many stocks. That also spreads the risk around.

There are all kinds of investment strategies to use. Sometimes it is best to stick to a simple plan to reach financial freedom. A simple technique is also easier to stick with. Learning about wealth management and how to handle your money will help you develop good investing habits and build generational wealth.

The more investing knowledge you have, the better investment decisions you make. And don’t be afraid to ask for investment advice. Whichever investments you want to invest in, always keep your asset protection in mind.

Besides investing in financial assets, do not neglect to invest in yourself. Continue to develop high-income skills that one can leverage to earn passive income and increase your average net worth.

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.